Fake Pi Coins Appear on Prashu DEX Amid Unverified Stellar Integration Rumors

Fraudulent Pi token listings on the Prashu platform have fueled confusion amid unverified partnership rumors. While Pi Network and Stellar share some technical origins, they operate independently—making vigilance essential for users.

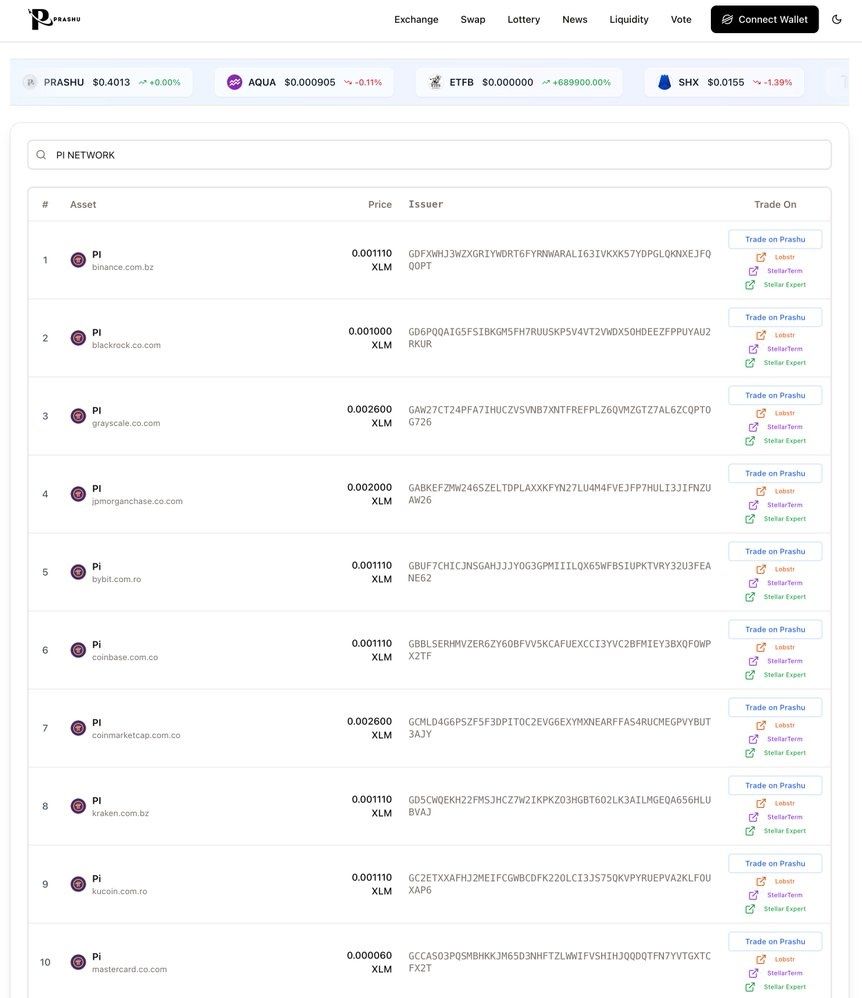

Fraudulent listings purporting to offer Pi Coins (PI) for trading on the Stellar (XLM) blockchain have emerged on a decentralized exchange (DEX), prompting warnings from users.

The scam surfaced amid rumors suggesting that Pi Network might leverage Stellar as a settlement layer for its upcoming decentralized applications (dApps).

Scam Warning: Fake PI Listings Appear on Prashu Platform

Screenshots circulating on X (formerly Twitter) showed an interface from the platform Prashu that included multiple “PI” assets supposedly available for trading. The listings included price and issuer details designed to mimic legitimate tokens, giving the impression of authenticity.

PI Network Scam On Parshu. Source:

PI Network Scam On Parshu. Source:

However, prominent Pioneers quickly raised the alarm, labeling the listings as fake and urging users not to interact with the platform.

“This is a scam – do not buy PI on the Stellar network. For all we know Prashu is in on the scam. The addresses linked to the tokens are clearly fake,” a Pioneer stated.

🚨 PEOPLE ARE ASKING about $Pi Network token on the Stellar $XLM network.AT THE MOMENT, there is no verified Pi token on #Stellar.Always DYOR before buying anything.

— Lumexo | Stellar Wallet (@lumexodapp) October 18, 2025

Notably, Prashu, marketed as a Stellar-based DEX, has been suspended. It’s not the first time that the platform has been involved in such a controversy.

In August, a user publicly accused Prashu of theft following a rigged giveaway that lured participants into revealing private keys, resulting in the loss of crypto holdings.

“SCAM ALERT!!!! They stole my tokens. Someone organized a giveaway – 1000 XLM to win – you had to make any transaction on Prash. They provided a link to an exchange, and the only “Wallet Connect” option was a private key. You had to like the post, retweet it, and comment “done”. And I did it. The next day, USDC and TKG disappeared from my account,” the user explained.

Protocol Confusion: Pi Network’s Path Versus Stellar

The scam coincides with unverified reports of a Pi-Stellar partnership. One user claimed Pi Network will launch real-world asset trading dApps using Stellar as the settlement layer. The post stated,

“Pi Network is expected to launch dApps for RWA trading by early 2026, with XLM as the settlement layer. This is adding 60 million users to the Stellar XLM ecosystem with a single integration. Unlocking instant access to its full DeFi infrastructure. Parallel transactions & smart contracts enable trading of real-world assets.”

However, once again, the community was quick to question the credibility of these claims. Many Pioneers pointed out that Pi Network already operates on its own blockchain, so it doesn’t need Stellar.

“That doesn’t even make sense. Pi would use it’s own blockchain for settlement,” another user replied.

Furthermore, neither Pi Network’s Core Team nor the Stellar Development Foundation has made any official announcements confirming such a collaboration. The absence of official statements further emphasizes that the partnership narrative likely stems from community speculation rather than verified developments.

Meanwhile, Pi Network and Stellar have a long-standing and often confusing relationship. Although the Pi Network borrows from Stellar, the blockchains remain separate. Owning XLM provides no privileges in the Pi Network, and actual PI transactions do not interact with Stellar’s ledger.

Official documentation clarifies the distinction: Pi Network’s consensus mechanism is adapted from two key technologies: the Stellar Consensus Protocol (SCP) and the Federated Byzantine Agreement (FBA)

This enables energy-efficient validation via trust graphs, eschewing proof-of-work’s power demands. The separation was reiterated in Pi Network’s August announcement of its protocol upgrade from version 19 to 23.

“Pi Network is preparing an important upgrade: the move from protocol version 19 to version 23. The Pi protocol is adapted from Stellar protocol. This version is a custom Pi protocol built on a base pulling upgrades from Stellar protocol version 23 that enables new layers of functionality and control,” the team stated.

The latest fake token incident again highlights how quickly misinformation can spread in crypto communities—especially when rumors of high-profile partnerships gain traction. While Pi Network and Stellar share certain technical roots, they remain separate ecosystems.

Thus, users should remain cautious, verify information from trusted sources, and avoid engaging with unverified platforms claiming to list or trade Pi Coins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of STEM Learning as a Driving Force for Tomorrow’s Technology Investments

- Emerging STEM universities are driving tech innovation through interdisciplinary curricula and industry partnerships, focusing on AI, biotech , and advanced manufacturing. - U.S. programs like STEM Talent Challenge and NSF Future Manufacturing allocate $500K-$25.5M to bridge skills gaps and fund projects in quantum tech and biomanufacturing. - Leadership-focused STEM programs at institutions like Florida State and Purdue boost startup success rates (75-80%) and align with venture capital trends favoring

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations