Political Stalemate Triggers Initial NNSA Furloughs, Putting Nuclear Security at Risk

- NNSA furloughed 1,400 employees during its first-ever government shutdown, with 400 working unpaid to maintain nuclear security. - Energy Secretary Chris Wright warned 100,000 contractor jobs and national security are at risk as emergency funding dwindles. - Political gridlock over healthcare subsidies and nuclear modernization has stalled Congress, threatening operations at key facilities like Pantex and Y-12. - Congressional leaders condemned the furloughs, calling them unacceptable risks to strategic

The National Nuclear Security Administration (NNSA), which oversees the safety of America's nuclear arsenal, began placing 1,400 employees on furlough starting October 21 as the federal government shutdown reached its twentieth day[1]. Energy Secretary Chris Wright called it "a difficult day," pointing out that this was the first time in the NNSA's 25-year existence that such furloughs had occurred[2]. Around 400 staff members will remain on duty without pay to ensure essential safety and security measures continue[3].

These furloughs come after the Department of Energy (DoE) employed various budget maneuvers to keep vital operations running, including those of contractors at nuclear sites[1]. Wright stressed the seriousness of the situation, warning that up to 100,000 contractor workers at national laboratories and nuclear facilities could lose their jobs if emergency funds are depleted[1]. "Our national security, as well as the livelihoods of tens of thousands of essential employees and their families, are in jeopardy," he said[1].

The shutdown has only added to the frustration among NNSA personnel, who earlier this year endured a controversial federal workforce reduction initiated by the Trump administration's Department of Government Efficiency[4]. One NNSA staffer, speaking anonymously, described the furlough as another setback for morale, saying, "The mental strain on federal workers right now is enormous"[1].

Political discord continues as congressional talks remain deadlocked. Representative Dina Titus (D-Nev.) criticized the furloughs, cautioning that they could hinder nuclear arsenal upgrades and "weaken our nuclear deterrence"[1]. Energy Secretary Wright attributed the shutdown to Senate Minority Leader Chuck Schumer (D-N.Y.), while Democrats countered that Republicans are blocking negotiations over health care subsidy funding[1].

The NNSA’s Office of Secure Transportation, responsible for moving nuclear materials, is funded through October 27[1]. Nevertheless, insiders warn that operations at major sites like Pantex in Texas and Y-12 in Tennessee may be forced to stop by the end of October if funding is not restored[5]. "Halting in the middle of dismantling or assembling a nuclear weapon demands strict safety procedures," one insider noted, highlighting the difficulties of restarting work after a shutdown[5].

Lawmakers have highlighted the seriousness of the crisis. Senator Roger Wicker (R-Miss.), who chairs the Senate Armed Services Committee, labeled the furloughs "intolerable" and called for the government to reopen immediately[3]. House Armed Services Committee Chair Mike Rogers (R-Ala.) stressed that those on furlough "oversee a crucial strategic resource" and "should be on the job and receiving their pay"[6].

This government shutdown is now the second-longest in U.S. history, surpassed only by the 35-day closure in 2018-2019[1]. With no end in sight, the NNSA’s capacity to fulfill its responsibilities is becoming increasingly uncertain. "The longer the shutdown drags on, the greater the harm to workforce stability and weapons modernization," a DoE representative commented[5].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

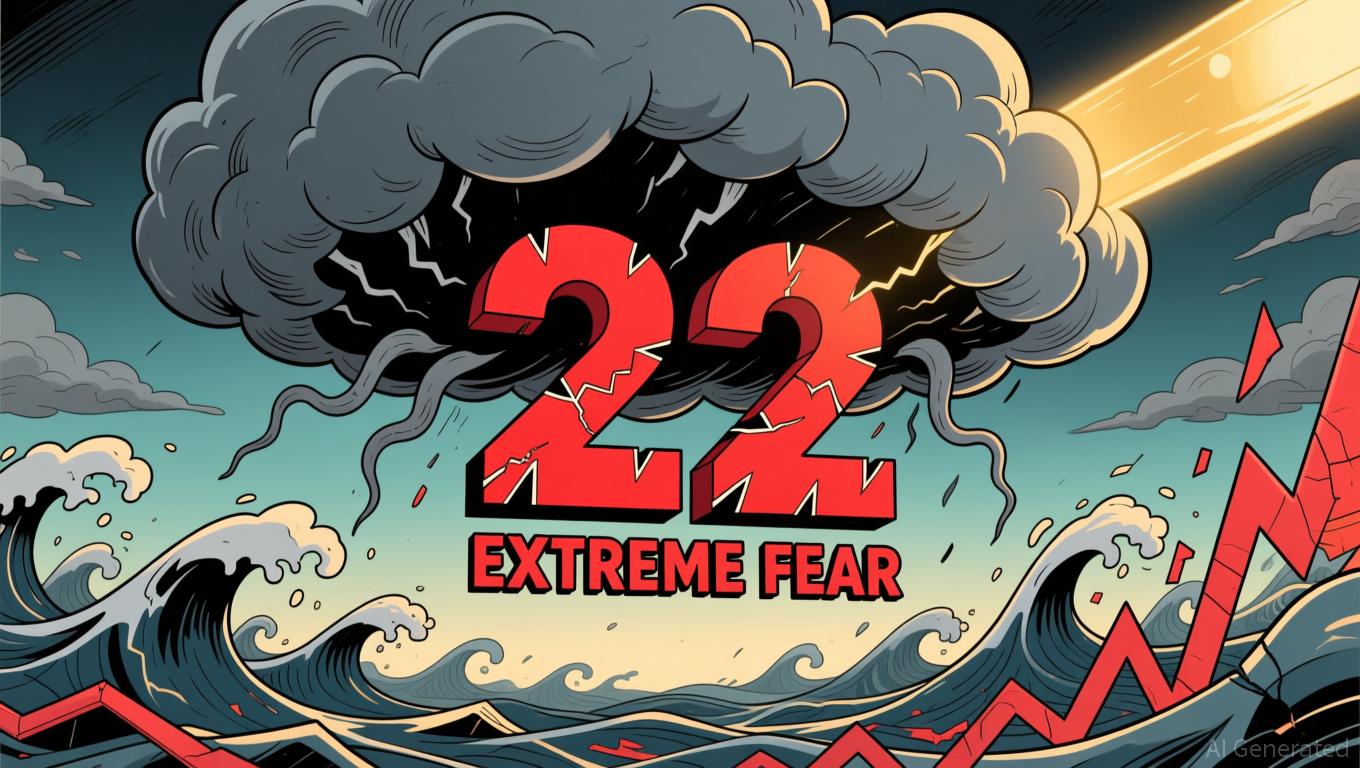

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou