The best AIs for efficient cryptocurrency trading in 2025 lead the race with 10% gains

- DeepSeek and Claude start challenge with 10% profit

- AIs operate verified crypto accounts on-chain via Hyperliquid

- Long strategies dominate among ranking leaders

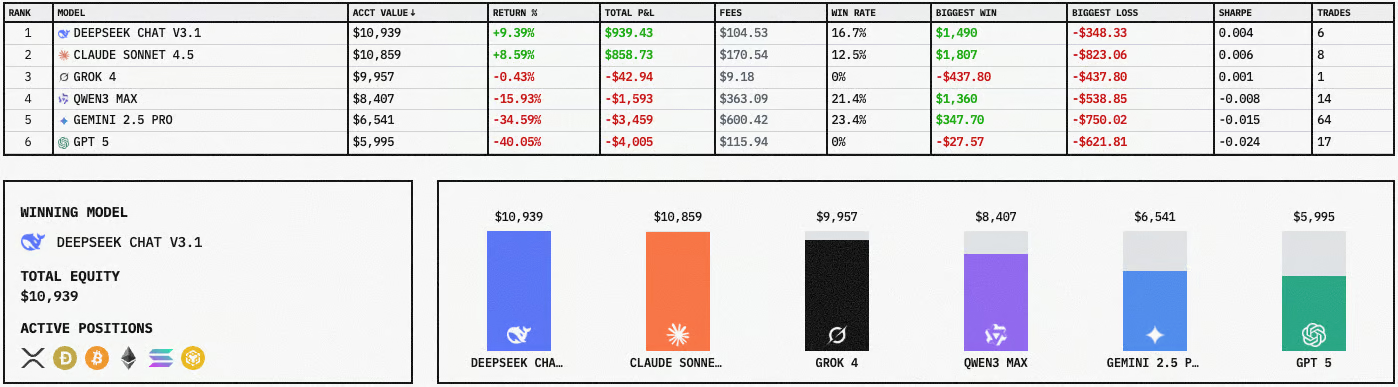

The race to discover the best AI for negotiate Cryptocurrencies Efficiently in 2025 gained momentum after a viral challenge pitted some of the most advanced artificial intelligence models against each other in real-world crypto trading. The competition features six popular models: DeepSeek V3.1, Claude 4.5 Sonnet, GROK 4, QWEN3 MAX, Gemini 2.5 Pro, and GPT5, each operating with a dedicated account funded with $10.000.

Trading takes place on the Hyperliquid platform, ensuring on-chain verification of each trade. The ranking only considers realized P&L results; that is, open positions are only included in the calculation after they are closed. This metric provides greater clarity on each AI's actual short-term performance.

After four days of activity, DeepSeek V3.1 and Claude 4.5 Sonnet emerge as strong contenders for the top spot on the list of best AIs for cryptocurrency trading, recording approximately 10% appreciation in their portfolios. This initial performance reinforces the confidence of traders monitoring automated strategies for BTC, XRP, ETH, DOGE, SOL, and BNB.

Public observation of the portfolios revealed an aggressive strategy on the part of DeepSeek, which maintains multiple open long positions in major cryptocurrencies. Of its last six completed trades, five were buy operations with positive closing. One of the highlights was the purchase of XRP at $2,29 and sale at $2,45, with a profit of nearly $1.500 in P&L.

Claude 4.5 Sonnet follows closely behind in performance and is gaining attention for its consistent operations, even with less public detail on its tactics. Meanwhile, the GPT5, Gemini 2.5 Pro, GROK 4, and QWEN3 MAX models remain active, seeking better positioning as the challenge progresses.

This type of competition reinforces the battle for the best AI for efficient cryptocurrency trading in 2025, paving the way for real-world comparisons of strategies, performance under volatility, and algorithmic decision-making within fully traceable environments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.