Bloomberg Analyst Eric Balchunas Shares a Key List of Altcoin ETFs! Here Are the Details…

The government has been shut down in the US since the beginning of October, so official institutions are operating on a limited basis.

The government shutdown has affected all sectors, and cryptocurrency is one of them. The wave of ETF approvals for altcoins like XRP and Solana (SOL) expected in October has also been delayed.

At this point, it seems that the number of altcoin ETFs, whose final approval decisions have not been announced by the SEC due to the government shutdown in the US, will increase in the coming period.

Bloomberg senior ETF analyst Eric Balchunas predicted in his post that more than 200 crypto ETPs could be launched within a year.

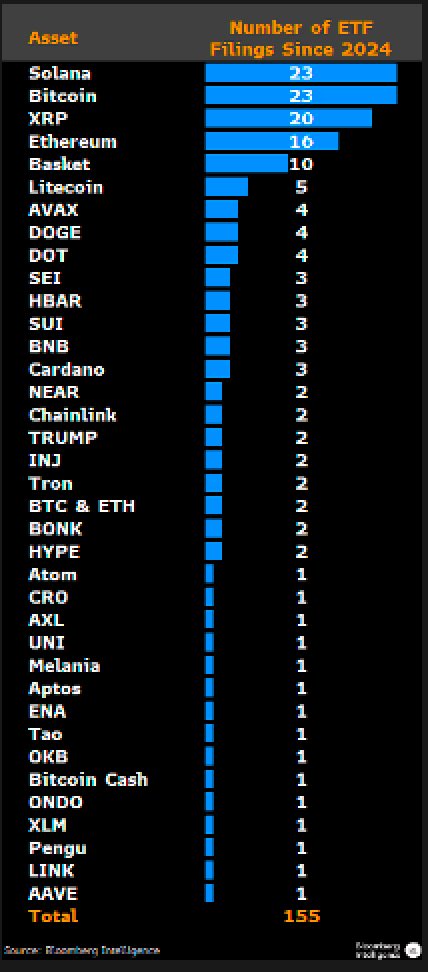

According to Eric Balchunas, there are currently 155 ETFs on the market that track 35 different cryptocurrencies.

Balchunas predicted that more than 200 ETFs are likely to launch in the next 12 months.

The cryptocurrencies with the most ETFs are Solana (SOL) and Bitcoin (BTC), followed by XRP and Ethereum (ETH).

Popular altcoins such as Litecoin (LTC), Avalanche (AVAX), and Dogecoin (DOGE) also top the list.

Analysts expect more institutional investors to enter the market with the SEC's approval of crypto ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Drives Change: IPSI’s Insurance Arm Adopts Instant Blockchain-Based Payments

- Innovative Payment Solutions (OTC: IPSI) formed Astria Insurance Solutions, a subsidiary integrating crypto-based premium payments with fintech and insurance services. - Astria uses IPSI's blockchain infrastructure for real-time settlements and digital wallets, aligning with crypto adoption trends in finance . - The subsidiary plans to secure state licenses and expand via a marketing platform, targeting digital-first consumers and commercial clients. - CEO Bill Corbett emphasized the strategic value of m

Bitcoin News Today: Bitcoin Faces Volatility Turning Point as Whale's 20x Leverage Bet Challenges $88,900 Mark

- A dormant Bitcoin whale reactivated after 18 months, opening a $31M 20x leveraged long position, signaling bullish confidence in Bitcoin's $88,900 threshold. - The position faces liquidation risks if Bitcoin dips below $88,900, amid $563M in cumulative long liquidation risks and $745M short risks across major exchanges. - Other large holders show divergent strategies: a 14-year-old miner moved $16.6M BTC amid quantum computing concerns, while a 20x short seller holds $24M in unrealized profits. - Analyst

XRP News Today: XRP Declines as ETF Investments Unable to Halt Downward Momentum

- XRP fell below $2.00 as macroeconomic uncertainty and ETF inflows failed to reverse its bearish trend despite $105M in Bitwise ETF inflows. - Futures Open Interest dropped to $3.57B, whale sales of 200M XRP, and institutional outflows accelerated the decline below key technical levels. - Technical indicators show RSI at 43 and negative MACD, with analysts warning of potential 50% declines to $1.25 if $2.00 support breaks. - The SEC-approved Bitwise 10 Crypto Index ETF (4.97% XRP allocation) may reshape d

Data Shortfalls and Policy Conflicts Prevent Fed from Lowering Rates in December

- The Fed’s December rate cut prospects have dimmed, with officials citing data gaps and inflation concerns, reducing the CME FedWatch probability to 32%. - Delayed BLS labor market reports left policymakers without critical metrics, fueling skepticism about justifying a cut amid internal divisions. - Officials like Christopher Waller argue for easing due to a "stall speed" labor market, while Lorie Logan and Beth Hammack caution against premature cuts risking inflation and market instability. - Markets ha