Key Market Information Discrepancy on October 23rd, a Must-See! | Alpha Morning Report

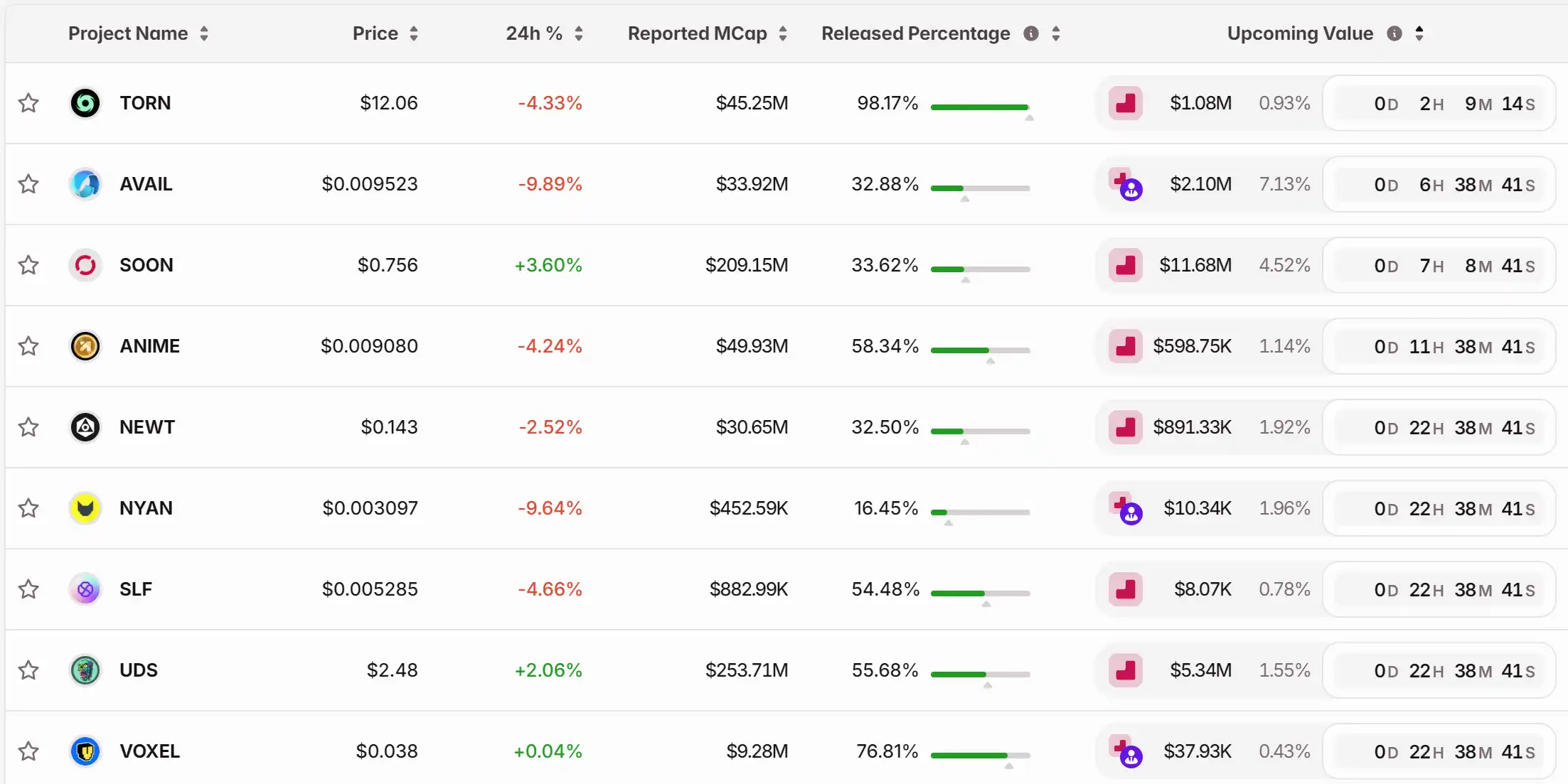

1. Top News: Polymarket Plans to Seek Funding at a Valuation of $12-15 Billion 2. Token Unlock: $TORN, $AVAIL, $SOON, $ANIME, $NEWT, $NYAN, $SLF, $UDS, $VOXEL

Top News

1. Polymarket Plans to Raise Funds at a Valuation of $12-15 Billion

2. Crypto Giants Gather at Capitol Hill, Market Structure Regulation Takes Center Stage

4. ENA Sees Brief 10% Price Plunge, Liquidates Associated Address on Hyperliquid Linked to Andrew Kang

5. Kraken Reports $648 Million in Q3 Revenue, a 114% Year-over-Year Growth

Articles & Threads

1. "120,000 Bitcoins Seized? In-Depth Analysis of the Regulatory Dilemma Behind the 'Prince Group' Case"

Amid tightening global cryptocurrency regulations, a cross-border "online pursuit" spanning Cambodia and the US/UK has captured everyone's attention. In October 2025, the US Department of the Treasury and the Department of Justice joined forces to launch the largest-ever cryptocurrency enforcement operation against the Cambodian Prince Group, freezing up to 120,000 bitcoins.

2. "From Liquidation Storms to Cloud Outages: Cryptocurrency Infrastructure's Crisis Moments"

Amazon Web Services (AWS) faced another major outage, severely impacting cryptocurrency infrastructure. The AWS issue in the US East Region (Northern Virginia data center) resulted in outages for Coinbase and dozens of other major crypto platforms including Robinhood, Infura, Base, and Solana. AWS has acknowledged "increased error rates" affecting Amazon DynamoDB and EC2, core databases and computing services relied upon by thousands of companies. This outage provides immediate and stark validation for this article's central argument: cryptocurrency infrastructure's reliance on centralized cloud service providers has created systemic vulnerabilities that repeatedly manifest under stress.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar (ASTR) Price Fluctuations and Institutional Engagement During Network Enhancements

- Astar (ASTR) launched Tokenomics 3.0 in late 2025, capping supply at 10.5B tokens and introducing a Burndrop mechanism to reduce circulating supply. - Institutional investors like Galaxy Digital and partnerships with Sony/Toyota boosted ASTR's utility in logistics and enterprise blockchain solutions. - Despite $29M buybacks and deflationary mechanisms, ASTR faced 45.7% price drops, highlighting volatility amid macroeconomic and Bitcoin-driven market sentiment shifts. - Long-term holders focus on post-Bur

Aster DEX on the Rise: The Transformation of Institutional Crypto Market Access Through Decentralized Exchanges

- Aster DEX's 19.3% perpetual market share and $11.94B 24-hour volume highlight its role as a key gateway for institutional crypto capital in 2025. - Its hybrid AMM-CEX model with 1001x leverage and hidden orders addresses liquidity fragmentation, attracting $5.7B in institutional buy volume. - Strategic partnerships and MiCA-compliant custody solutions bolster institutional trust, while CZ's $2M ASTER purchase signaled market validation. - Privacy features and 40.2% Q3 TVL growth position Aster to capture

Helius Labs Expands Solana Developer Power With New History API

Quick Take Summary is AI generated, newsroom reviewed. Helius Labs launched getTransactionsForAddress for Solana developers. The API enables full wallet transaction history queries. It replaces multiple RPC calls with a single efficient request. Faster archival systems improve performance and reduce costs.References X Post Ref

The ZK Atlas Upgrade: Revolutionizing Blockchain Infrastructure Scalability

- ZKsync's 2025 Atlas Upgrade boosts Ethereum L2 scalability to 43,000 TPS with $0.0001 fees via RISC-V zkVM and modular architecture. - Institutions like Deutsche Bank adopt ZKsync for real-time settlements, driving $3.5B TVL in ZK rollups by 2025. - Vitalik Buterin endorses the upgrade as critical for Ethereum's L2 roadmap, with Fusaka set to double throughput by December 2025. - ZK-based platforms now dominate L2 infrastructure, with ZKP market projected to reach $7.59B by 2033 at 60.7% CAGR.