Cardano Achieves Several Milestone This Month, But Price Remains Depressed

Cardano’s price has stalled even as on-chain activity and staking surge. Analysts point to whale sell-offs, but ADA’s fundamentals and retail backing remain solid, suggesting steady long-term potential.

Cardano’s price has been stagnating for several weeks, but the network has strong retail support. ADA reached 115 million on-chain transactions this week, and the Cardano network avoided any damage from the AWS outages.

There’s still a lot of community support, as evidenced by Cardano’s market cap and high rate of staked tokens. Whale activity may be blunting its forward momentum, but there could be other explanations.

Why is Cardano’s Price Lagging?

Cardano attracts a lot of community hype, and for good reason. In the last few days, the proof-of-stake blockchain network has reached a lot of milestones.

Although ADA’s token price hasn’t reacted much, on-chain analysts noted that Cardano’s user activity is through the roof.

MILESTONE: Cardano $ADA has surpassed 115,000,000 transactions on mainnet.Real transactions from real users.You can view them all on Cexplorer 😎

— Cexplorer.io 🅰️ (@cexplorer_io) October 23, 2025

This activity can be measured in several key ways beyond on-chain transactions. Cardano holders are staking 21.8 billion ADA tokens, which is 57% of the total supply.

In other words, the community has a strong faith in the altcoin, hoping to earn passive income from Cardano in addition to benefiting from price increases.

Furthermore, the recent AWS outages showed that the blockchain has real decentralization. Although major industry leaders like Ethereum and Coinbase saw persistent problems during this period, highlighting their centralized infrastructure, Cardano remained strong:

Congrats Cardano. You passed the test!

— Ben ✈️🇰🇷🇻🇳🇸🇬🇯🇵 (@benohanlon) October 21, 2025

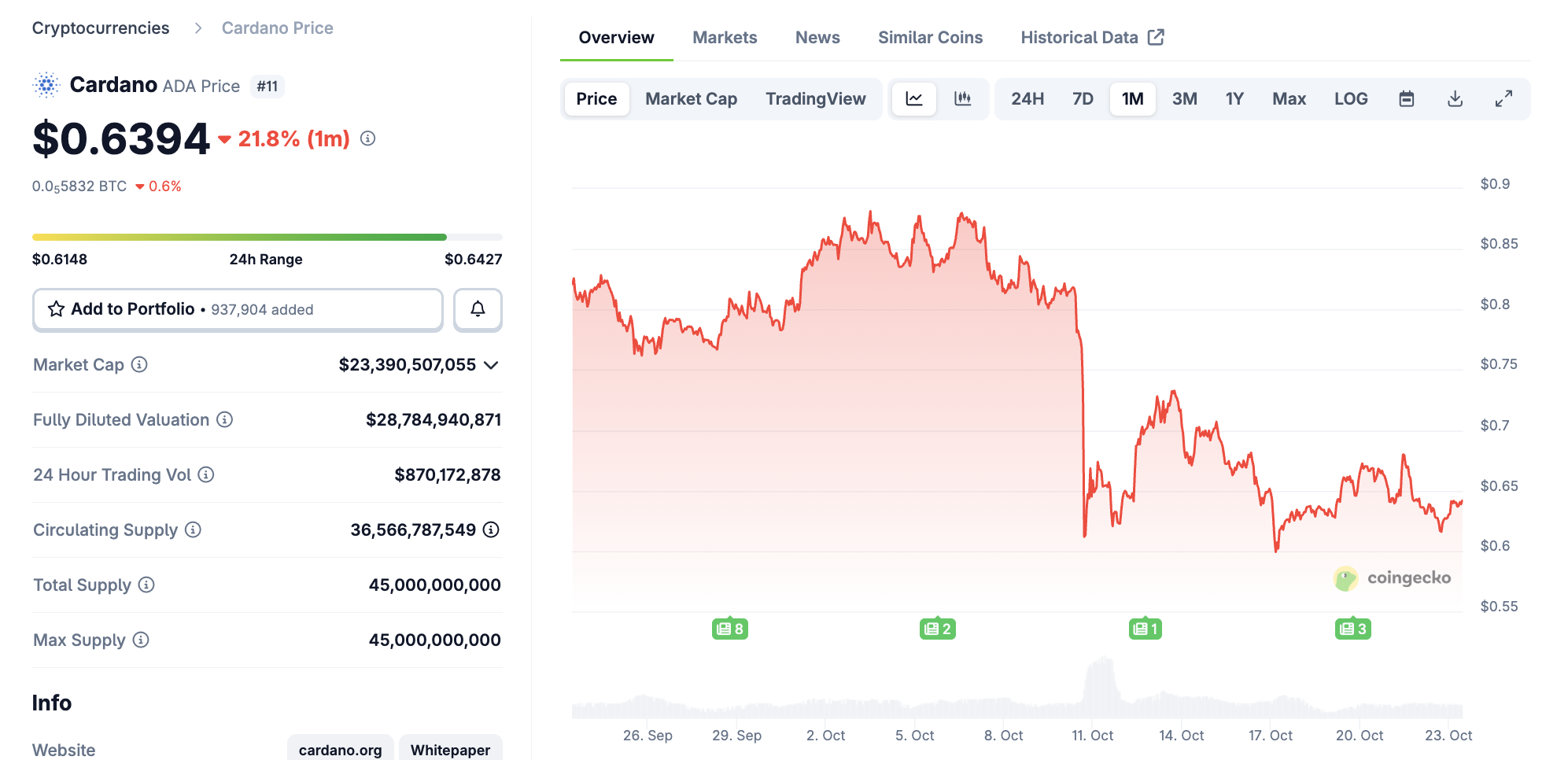

Despite these advantages, we have to talk about the elephant in the room. Although Cardano’s market cap has shown remarkably consistent competitiveness over the last several years, its price has been lagging behind for weeks.

Cardano Price Performance. Source:

CoinGecko

Cardano Price Performance. Source:

CoinGecko

A Case for Whale Activity

A few competing theories have arisen to explain Cardano’s price doldrums. For one thing, large holders can be a mixed bag. Although ADA whales backed the token despite bearish signals, they’ve recently initiated massive sales to block price rebounds. Whenever Cardano gets some forward momentum, rampant profit-taking subsequently blunts it.

Overall, this seems like the most likely hypothesis. Similar behavior has popped up several times in recent months, whereas other explanations involve macroeconomic concerns and other factors.

ADA has also shown some signs of weakening retail interest, even though on-chain transactions and staked tokens remain strong. Ultimately, we can only narrativize the data we have, but market narratives are still crucially important.

Whatever is causing Cardano’s ongoing price woes, the token still has strong support and fundamentals. Although it’s impossible to predict a full rebound, ADA still has strong community support to capitalize on any near-term bullish cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations

Clean Energy Market Fluidity and the Emergence of REsurety's CleanTrade Solution

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a regulatory breakthrough for clean energy trading infrastructure. - The platform addresses $16B+ in pent-up demand by providing liquidity, transparency, and institutional-grade safeguards for VPPAs, PPAs, and RECs. - CleanTrade's integration of carbon tracking analytics and ESG alignment tools enables institutional investors to quantify environmental impact alongside financial returns. - By resolving counterparty risks and enabling cross-asset

Altcoin Season Set Up Again? Bitcoin Dominance Rejection Signals Potential 250%+ Rally for 5 High-Risk Picks

Solana Must Hold $120 Support to Keep $500 Upside Path