Ozekibart's 52% Reduction in Risk Sparks 70% Jump Amid Concerns Over Liver Safety

- Inhibrx Biosciences’ ozekibart showed 52% reduced disease progression risk in chondrosarcoma, driving a 70% post-market stock surge. - Combination trials in colorectal and Ewing sarcoma showed 23%–64% response rates, suggesting broader oncology potential. - Hepatotoxicity concerns led to monitoring strategies, reducing adverse events to 11.8% in ozekibart group. - Company plans 2026 BLA submission; stock surged 63% pre-market after prior 10% decline.

Shares of Inhibrx Biosciences (NASDAQ:INBX) soared by more than 70% in after-hours trading on October 23, 2025, after the company announced encouraging Phase 2 trial data for its investigational cancer therapy ozekibart (INBRX-109) in chondrosarcoma, a rare and aggressive bone malignancy that currently lacks approved systemic treatments, as reported by an

Ozekibart’s safety profile was generally acceptable, though liver toxicity was identified as a significant issue. Early in the study, a fatal liver-related incident led to the adoption of risk mitigation strategies, including excluding patients with advanced liver dysfunction and closely monitoring liver function during the initial treatment cycles. These interventions reduced the rate of treatment-related liver side effects to 11.8% in the ozekibart group versus 4.5% in the placebo group, with most cases being mild or moderate in severity, as detailed in

In addition to chondrosarcoma,

The company intends to file a Biologics License Application (BLA) with the U.S. Food and Drug Administration in the second quarter of 2026, according to Investing.com. Comprehensive data from the ChonDRAgon study will be presented at the Connective Tissue Oncology Society Annual Meeting on November 14, 2025, as noted by Tokenist.

The market responded strongly to the announcement, with

Financially, Inhibrx has a market capitalization near $457 million and maintains strong liquidity, with a current ratio close to 5, according to

INBX shares have climbed 140% year-to-date, reflecting strong investor confidence, though some warn that commercial success will depend on overcoming regulatory challenges and proving long-term effectiveness. With no approved therapies for chondrosarcoma, ozekibart’s potential to be first to market has drawn parallels to other breakthrough drugs in specialized oncology fields, according to Stocktwits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation Proposed Three Solutions for One of ETH’s Biggest Problems

Fading ETF Interest Puts Pressure on Dogecoin as Price Approaches Critical Cost-Basis Zone

Why British politicians are flocking to American tech giants

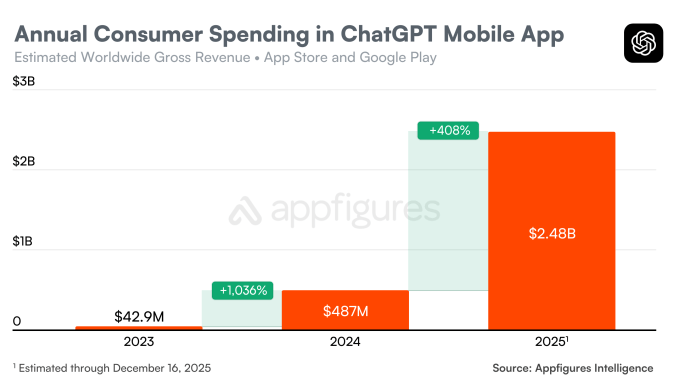

ChatGPT’s mobile app hits new milestone of $3B in consumer spending