YFI Value Falls by 40.84% Over the Past Year Due to Market Fluctuations and Anticipated Interest Rate Reductions

- Yearn.finance (YFI) rose 0.23% in 24 hours to $4,754 but fell 40.84% in one year amid DeFi market instability. - Analysts warn macroeconomic uncertainty and lack of institutional adoption could further pressure YFI unless regulatory clarity emerges. - YFI's weak performance reflects broader DeFi struggles, with shrinking market cap and no clear technological upgrades to drive recovery. - Technical indicators remain unreliable for YFI due to high volatility, complicating efforts to identify meaningful sup

On October 25, 2025, Yearn.finance (YFI) saw its price rise by 0.23% over the previous day, reaching $4,754. Despite this short-term gain, the token has faced substantial losses over longer periods, falling 2.07% in the past week, 12.09% over the last month, and dropping 40.84% in the past year. These numbers highlight the persistent volatility in the DeFi sector, especially for assets with high price swings and limited uptake of institutional-level infrastructure. Experts suggest that ongoing global economic uncertainty and changes in investor sentiment could continue to weigh on

In recent months, the DeFi sector has delivered mixed results, with YFI’s price trends closely mirroring those of the broader cryptocurrency market. While

Technical analysis tools like moving averages and the relative strength index (RSI) have often failed to give dependable signals for YFI, largely due to its extreme price volatility and occasional lack of liquidity. Still, market observers continue to use these indicators to pinpoint possible support and resistance zones, hoping to determine whether the latest decline could be a buying opportunity or signals a continued downward trend. Although these tools are not always accurate, they remain widely used for analyzing price movements when there is no clear fundamental driver.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Biconomy Powers PancakeSwap’s Infrastructure with Scalable Smart Accounts

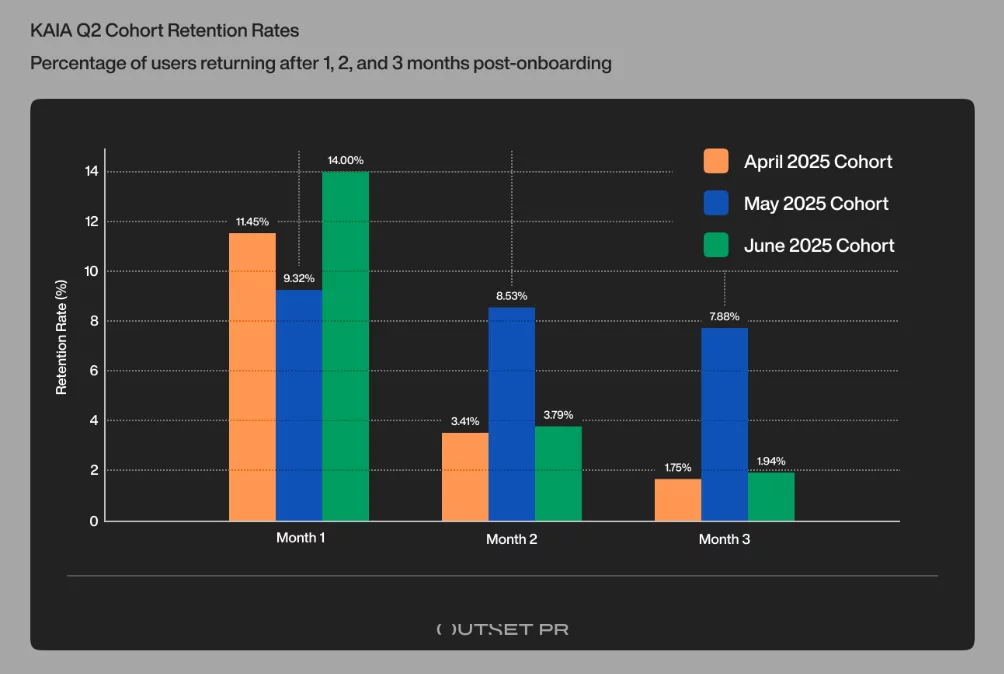

Korea drives 57 million Q2 visits but on-chain retention remains 1-2%

Analytics Firm Messari Releases Its 2026 Cryptocurrency Forecasts

Hyperliquid price weakens below $26 as oversold signals fail to stop bears