Investors Drive Mutuum's $17.8 Million Growth Amid DeFi Lending Boom

- Mutuum Finance (MUTM) raised $17.8M in presale with 17,500 holders, achieving 250% price growth from $0.01 to $0.035. - The DeFi project allocates 45% of token supply for early sales, with Phase 7 pricing set to rise to $0.04 as 75% of Phase 6 tokens sell out. - Its decentralized lending protocol will launch on Sepolia testnet in Q4 2025, featuring mtTokens for yield generation and CertiK-verified security (90/100 score). - Future plans include Layer-2 integration, multi-chain expansion, and a USD-pegged

Mutuum Finance (MUTM), a decentralized finance (DeFi) initiative based in Dubai, has raised significant community attention, with nearly 17,500 holders, as reported by a

Mutuum Finance’s decentralized lending and borrowing system, scheduled for Sepolia testnet release in Q4 2025, is designed to link on-chain transactions with token functionality. Participants can deposit crypto assets to earn interest through mtTokens—digital receipts that accumulate yield. Borrowers may use

A share of platform fees will support a buy-and-redistribute approach, purchasing MUTM from the market and distributing it to stakers. This setup ties token demand to platform activity, which could enhance long-term value, according to a

After completing the first phase of its roadmap, Mutuum has moved into Phase 2, concentrating on building out the protocol and infrastructure. The initial V1 release will feature liquidity pools, debt tokens, and a liquidator bot for collateral management, as described in a

The project’s approach of launching both the token and platform together is intended to speed up exchange listings and adoption. With Phase 6 nearly 80% complete, the next price increase is imminent as the project gains traction ahead of its testnet launch, the GlobeNewswire update mentioned.

Mutuum’s expansion comes as the DeFi sector experiences renewed growth, with platforms like

Mutuum’s current progress and transparent roadmap make it a notable player in the DeFi lending arena. By prioritizing openness, security, and practical use, the project meets investor expectations for well-structured, high-potential crypto ventures, the BlockchainWire announcement concluded.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

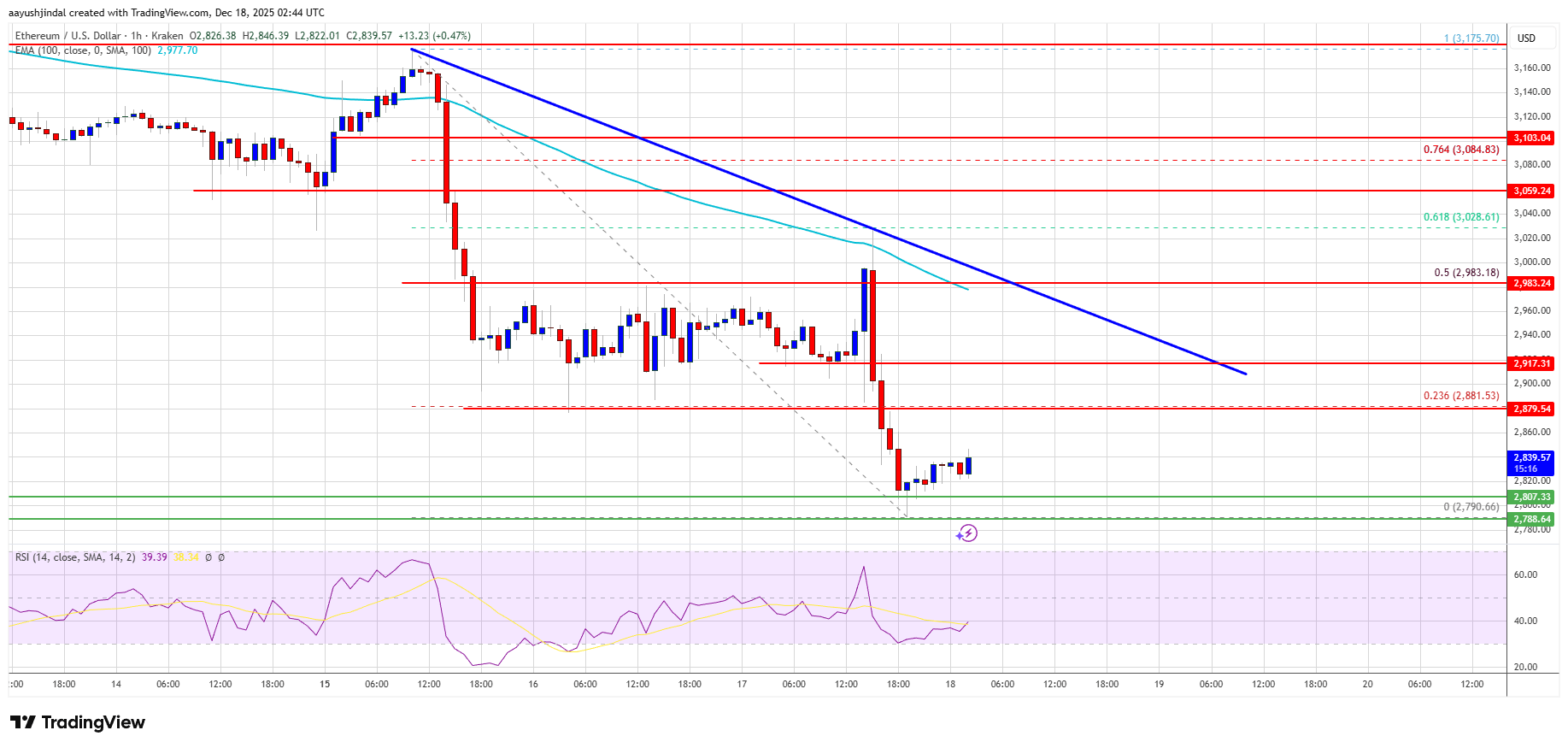

Ethereum Price Continues to Slide—Where Is the Next Support?

Ethereum Whale Sells Entire ETH Position After 1127-Day Hold, Realizes $4.245 Million Profit

Tether’s USDT Payment Stats Show the Real State of Crypto Adoption in 2025

Circle Launches Arc Developer Fund to Accelerate Real-World Finance Apps on Arc Network