Patience Rewarded: Polymarket’s Postponed Token Sparks $15B Jump in Valuation

- Polymarket plans to launch a native token and airdrop after reentering the U.S. market via a $112M QCX acquisition. - The token prioritizes "real utility" and fair distribution, with 5-10% allocated to user-based airdrop rewards. - Institutional backing including ICE's $2B investment has driven Polymarket's valuation to $12-15B, up from $1B in June. - Strategic U.S. expansion includes NHL partnerships and DraftKings integration, positioning it as a crypto-traditional finance bridge.

Polymarket, a major player in the prediction market sector, is set to introduce its own token as it reestablishes its presence in the U.S., according to Chief Marketing Officer Matthew Modabber. During an appearance on the Degenz Live podcast, Modabber outlined these initiatives, clarifying that the token launch will only proceed after the company secures its U.S. operations, which were put on hold in 2022 due to regulatory challenges, as noted in a

Polymarket’s return to the U.S. marks a significant regulatory achievement, made possible by its $112 million purchase of QCX, a derivatives exchange registered with the Commodity Futures Trading Commission (CFTC), earlier this year, as detailed by Yahoo Finance. Regulatory documents suggest the platform could go live as soon as October 2, 2025, according to the same Yahoo Finance report. Modabber highlighted that the company’s immediate priority is to make a strong impact in the U.S. before turning its focus to the token. This approach reflects the platform’s recent momentum: WalletInvestor reported that trading volumes reached $20 billion by October 2025, with $6 billion of that occurring in just the first half of the year.

Polymarket’s valuation has soared alongside its expansion. According to Coindesk, Bloomberg reported that the company is in preliminary discussions to raise capital at a valuation between $12 and $15 billion, a dramatic increase from its $1 billion valuation in June. Institutional investment has played a crucial role: Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, has agreed to invest $2 billion at a $9 billion valuation, Coinpaper noted. Earlier this year, Founders Fund led a $200 million funding round that valued Polymarket at $1 billion, as per Coindesk.

The platform’s growth is also attracting mainstream attention. It has secured multi-year licensing agreements with the National Hockey League (NHL) and is set to act as a clearinghouse for DraftKings’ potential prediction market, according to Coinpaper. Meanwhile, competitor Kalshi, which recently secured $300 million at a $5 billion valuation, is also drawing investor interest, with offers valuing it between $10 and $12 billion, as reported by TradingView. Both companies are benefiting from a boom in prediction trading, with weekly volumes surpassing $2 billion in October, according to CryptoNews Australia.

Modabber’s comments highlight Polymarket’s measured strategy: "Why rush a token if our main focus should be the U.S. application?" he told Blockworks. This approach has been well received by investors, who view the platform as a link between traditional finance and blockchain technology, Coinpedia reported. With regulatory barriers removed and growing institutional backing, Polymarket’s upcoming token is poised to reinforce its leadership in the prediction market industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

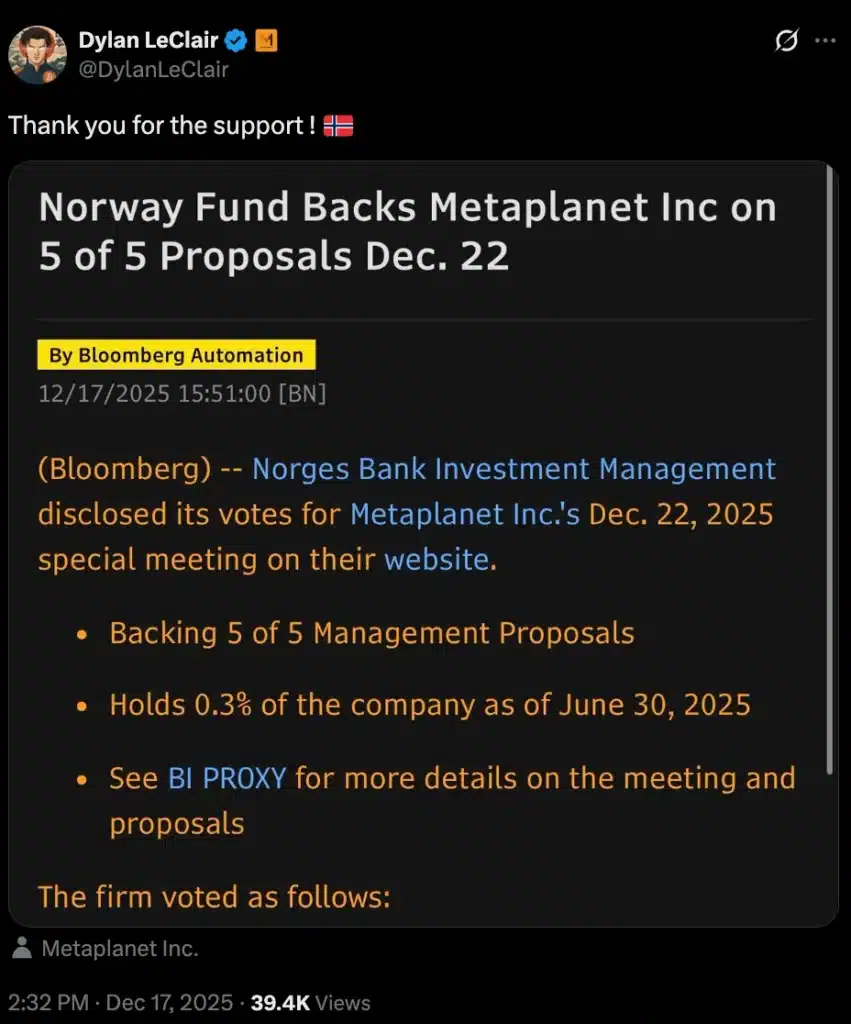

Norway’s $2T fund just backed Metaplanet – What’s happening?

Bitcoin Excluded: TXBC ETF Among 2026 Crypto Index ETFs to Watch, Tracking FTSE Crypto 10 ex-BTC

Bloomberg ETF Analyst Backs Bitwise’s 100+ Crypto ETFs by 2026, Warns Many Could Liquidate by 2027

Stunning Prediction: Bitcoin Volatility to Plummet Below Nvidia’s in 2025