Bitcoin miners Cipher, Bitdeer, and HIVE narrow hashrate divide

Mid-tier Bitcoin miners are closing the gap on industry leaders in realized hashrate following the 2024 halving.

- Mid-tier miners rapidly expanded after the 2024 halving, closing in on top players.

- Public miners doubled their realized hashrate to 326 EH/s, a one-year record increase.

- Mining sector debt surged to $12.7B amid heavy investment in rigs and AI ventures.

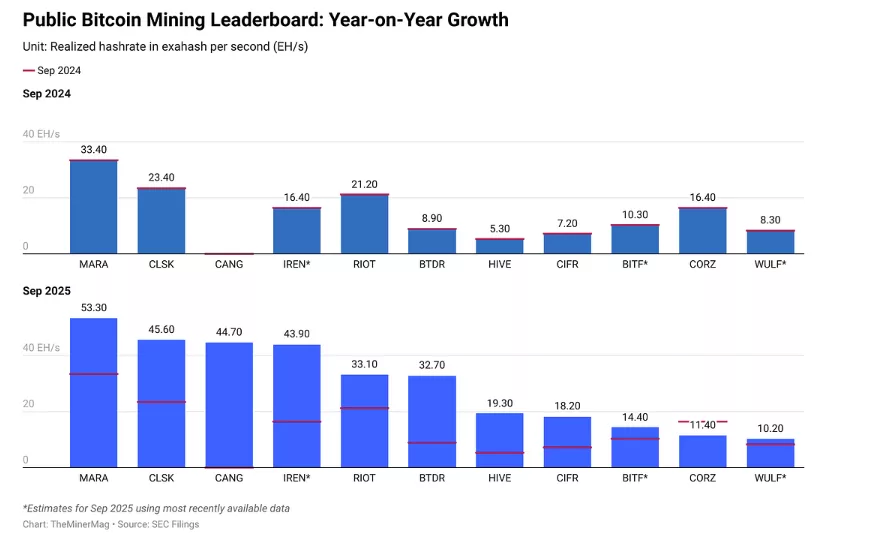

Cipher Mining, Bitdeer and HIVE Digital have quickly expanded their operations after years of infrastructure growth and narrowed the distance to top players like MARA Holdings, CleanSpark and Cango.

The change is a more level playing field in the mining sector. “Their ascent highlights how the middle tier of public miners — once trailing far behind — has rapidly scaled production since the 2024 halving,” The Miner Mag wrote in its latest Miner Weekly newsletter.

Top Bitcoin miners doubled realized hashrate

MARA, CleanSpark and Cango maintained their positions as the three largest public miners. Rivals including IREN, Cipher, Bitdeer and HIVE Digital posted strong year-over-year increases in realized hashrate.

The top public miners reached 326 exahashes per second (EH/s) of realized hashrate in September, more than double the level recorded a year earlier. Collectively, they now account for nearly one-third of Bitcoin’s ( BTC ) total network hashrate.

Public Bitcoin mining leaderboard: Source: The Miner Mag

Public Bitcoin mining leaderboard: Source: The Miner Mag

Hashrate measures the computational power miners contribute to securing the Bitcoin blockchain. Realized hashrate tracks actual onchain performance, or the rate at which valid blocks are successfully mined.

For publicly traded miners, realized hashrate is a closer indicator of operational efficiency and revenue potential. The metric has become a key measure ahead of third-quarter earnings season.

Mining debt surges to $12.7 billion

Bitcoin miners are taking on record debt levels and also expands into new mining rigs, artificial intelligence infrastructure and other capital-intensive ventures. Total debt across the sector has jumped to $12.7 billion, up from $2.1 billion just 12 months ago.

VanEck research noted that miners must continuously invest in next-generation hardware to maintain their share of Bitcoin’s total hashrate and avoid falling behind competitors.

Some mining companies have turned to AI and high-performance computing workloads to diversify revenue streams. The change comes after dropping margins following the 2024 Bitcoin halving, which reduced block rewards to 3.125 BTC.

The debt increase shows aggressive expansion plans across the industry. Mining companies face pressure to scale operations quickly or risk losing market share to better-capitalized rivals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Altcoin Market Forms Bullish Triangle—Is 2026 Set to Mirror the Past?

- Altcoin market shows bullish triangle pattern in TOTAL3 index, nearing $1.5T breakout threshold with $988B liquidity shift to smaller assets. - Analysts highlight Raydium (220% Q3 revenue), Sei (Crypto.com integration), and Algorand (World Chess partnership) as top altcoin rebound candidates. - Bitcoin ETFs see $283M inflows vs Ethereum outflows, while Solana's SSK ETF hits $400M AUM amid 14% stablecoin growth and $48B transaction volume. - Binance's CZ pardon sparks BNB institutional interest, while Coi

Fan Governance Transforms Blockchain Fan Communities as $HUGS Whitelist Approaches Full Capacity

- Milk Mocha ($HUGS) whitelist nears capacity as 40-stage presale with escalating pricing attracts early investors seeking exponential returns. - Deflationary tokenomics, DAO governance, and NFT utility create hybrid fandom model blending blockchain scarcity with community-driven creativity. - Ecosystem integrates metaverse gaming, physical merchandise, and charitable voting, positioning $HUGS as a utility-first meme token with real-world applications. - Structured token burns, 50% APY staking, and transpa

Tokenizing Emotion: $HUGS Combines Brand Loyalty and Blockchain Functionality

- $HUGS token merges IP loyalty of Milk & Mocha with blockchain utility via staking, NFTs, and gamified mechanics. - Deflationary design, 50% APY staking, and NFT-burning mechanisms create dual financial and social incentives for holders. - Charity-linked revenue allocation and pre-existing fanbase differentiate it from speculative memecoins through ethical value alignment. - Whitelist access with no KYC barriers targets broad adoption while prioritizing ecosystem development over short-term hype.

Stellar News Today: Institutional Investments Drive RWA Tokenization Boom in November 2025

- RWA tokenization surges in Nov 2025 as institutional demand and on-chain innovations drive 6.3% 24-hour growth, with SYRUP, KTA, and XLM leading the rally. - Maple Finance's SYRUP shows bullish RSI divergence and MIP-019 reforms, targeting $0.52 if it breaks $0.46 resistance amid steady institutional lending pool interest. - Keeta's KTA gains 22.6% weekly with $5.9M whale inflows, leveraging real-world credit tokenization to capitalize on easing interest rates and diversified capital flows. - Stellar's X