Bitcoin’s Path To $120,000 Could Be Delayed as Illiquid Supply Shrinks

Bitcoin’s price recovery faces resistance as illiquid supply declines and new demand weakens. A move above $115,000 is key for BTC to target $120,000.

Bitcoin’s price has been slowly recovering after recent declines, and it has been trading cautiously over the past few days. The rebound has been modest, but the underlying data suggest potential challenges ahead.

A decline in illiquid supply — long-term holdings that rarely move — may hinder Bitcoin’s ability to sustain its upward trajectory.

Bitcoin Holders Are Offloading

Illiquid Bitcoin supply has started to decline again, with approximately 62,000 BTC moving out of inactive wallets since mid-October. This shift indicates that more coins are re-entering circulation, increasing potential selling pressure.

When illiquid supply falls, available liquidity rises, often making sustained price rallies more difficult.

Historically, shrinking illiquid supply signals reduced conviction among long-term holders. Unless new inflows balance this movement, Bitcoin could face headwinds in maintaining its recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Illiquid Supply. Source:

Glassnode

Bitcoin Illiquid Supply. Source:

Glassnode

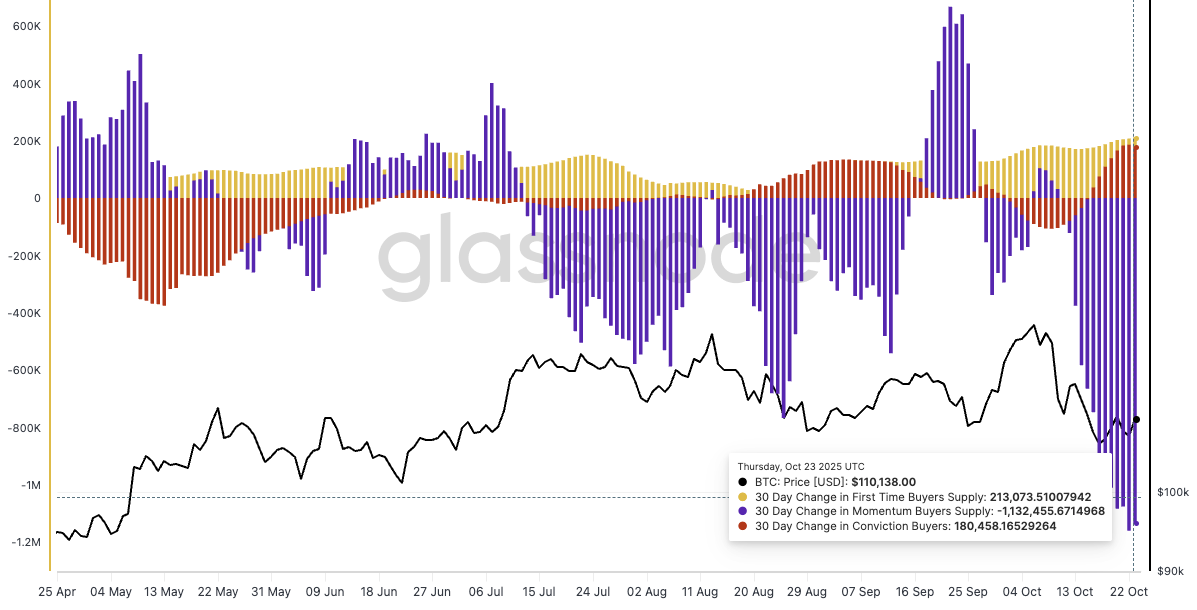

Buyer and seller dynamics show that momentum traders have mostly exited the market. Meanwhile, dip-buyers have not stepped in aggressively enough to counter the growing sell-side pressure. This imbalance has weakened Bitcoin’s upward momentum, keeping it vulnerable to price stagnation or short-term retracement.

Additionally, first-time buyers have remained largely inactive, highlighting limited spot demand. The lack of fresh capital inflows continues to weigh on market strength. Until a stronger wave of buyers re-emerges, the existing equilibrium between sellers and holders is likely to restrain Bitcoin’s breakout potential.

Bitcoin Buyer/Seller Dynamics. Source:

Glassnode

Bitcoin Buyer/Seller Dynamics. Source:

Glassnode

BTC Price Could Face Consolidation

Bitcoin’s price currently stands at $112,513, just above the $112,500 mark. Establishing this level as solid support is critical for sustaining recovery. However, weak inflows and cautious sentiment could make holding this position difficult as traders await stronger signals of renewed demand.

The present market structure suggests Bitcoin may struggle to push past $115,000. Unless liquidity conditions improve, price action may remain rangebound or consolidate above $108,000. Without strong buying momentum, attempts to rally could lose traction quickly.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

For Bitcoin to target $120,000, renewed interest from both retail and institutional investors is essential. A decisive move above $115,000 would likely invalidate the bearish scenario, triggering fresh momentum and attracting new capital into the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HBAR ETF Gets Green Light, But Convincing Altcoin Doubters Remains Challenging

- Hedera's HBAR token dropped 6% post-ETF approval, contrasting with Solana's $56M debut volume. - The $8M HBAR ETF launch highlights altcoin market skepticism despite regulatory progress and institutional backing. - Technical indicators like death cross and declining on-chain metrics signal bearish momentum for HBAR. - Analysts note ETFs provide regulated institutional access, though broader crypto volatility and SEC delays dampen immediate adoption. - Hedera's enterprise partnerships and USDC growth on i

Ethereum Updates Today: The Foundation of Blockchain Enters the Public Eye as Consensys Engages with Wall Street

- Consensys, MetaMask's developer, hires JPMorgan and Goldman Sachs for IPO advisory, joining crypto peers like Circle and Bullish in public market moves. - MetaMask expands beyond wallet functionality with MASK token launch and Polymarket integration, while Consensys operates key Ethereum infrastructure like Infura and Linea. - Favorable market conditions include Fed rate cuts, SPAC fundraising growth, and institutional crypto adoption, positioning Consensys for potential 2025 listing as Wall Street embra

The CEO's Independent Journey: Creating Innovation While Navigating Solitude and Market Pressures

- Apple, Airbnb, and PepsiCo CEOs highlight leadership isolation amid innovation pressures and market volatility. - Apple introduces vapor chamber cooling for M6 iPad Pro (2027) and local ads in Maps (2026) to boost revenue. - Airbnb faces insider stock sales and post-pandemic challenges as CEO Chesky navigates hybrid work-travel shifts. - Talkspace acquires Wisdo Health to address leader loneliness through AI-driven mental health solutions. - Tesla's Tavares warns of existential risks from Chinese EV comp

Regulations and Technological Advances Shape Corporate Approaches in 2026

- Simply Good Foods (SMPL) reported a 17.5% stock drop due to Q4 2025 losses and 2026 guidance, citing flat sales and margin declines, with plans for marketing and buybacks. - British American Tobacco delayed Vuse One vape launch amid FDA scrutiny, reflecting industry-wide regulatory challenges for nicotine products and market uncertainty. - Wix partnered with PayPal to integrate AI-driven commerce tools, enabling merchants to leverage AI for product discovery and payments via agentic commerce platforms. -