Fed and ETF Boost Cryptocurrency Market! Institutional Investors Sell Ethereum (ETH), Rush to Bitcoin and These Two Altcoins!

This week, Bitcoin and altcoins are focused on the Fed's October interest rate decision and the meeting between US President Donald Trump and Chinese President Xi Jinping.

At this point, while it is almost certain that the FED will cut interest rates by 25 basis points, BTC and the market started the critical week with an increase.

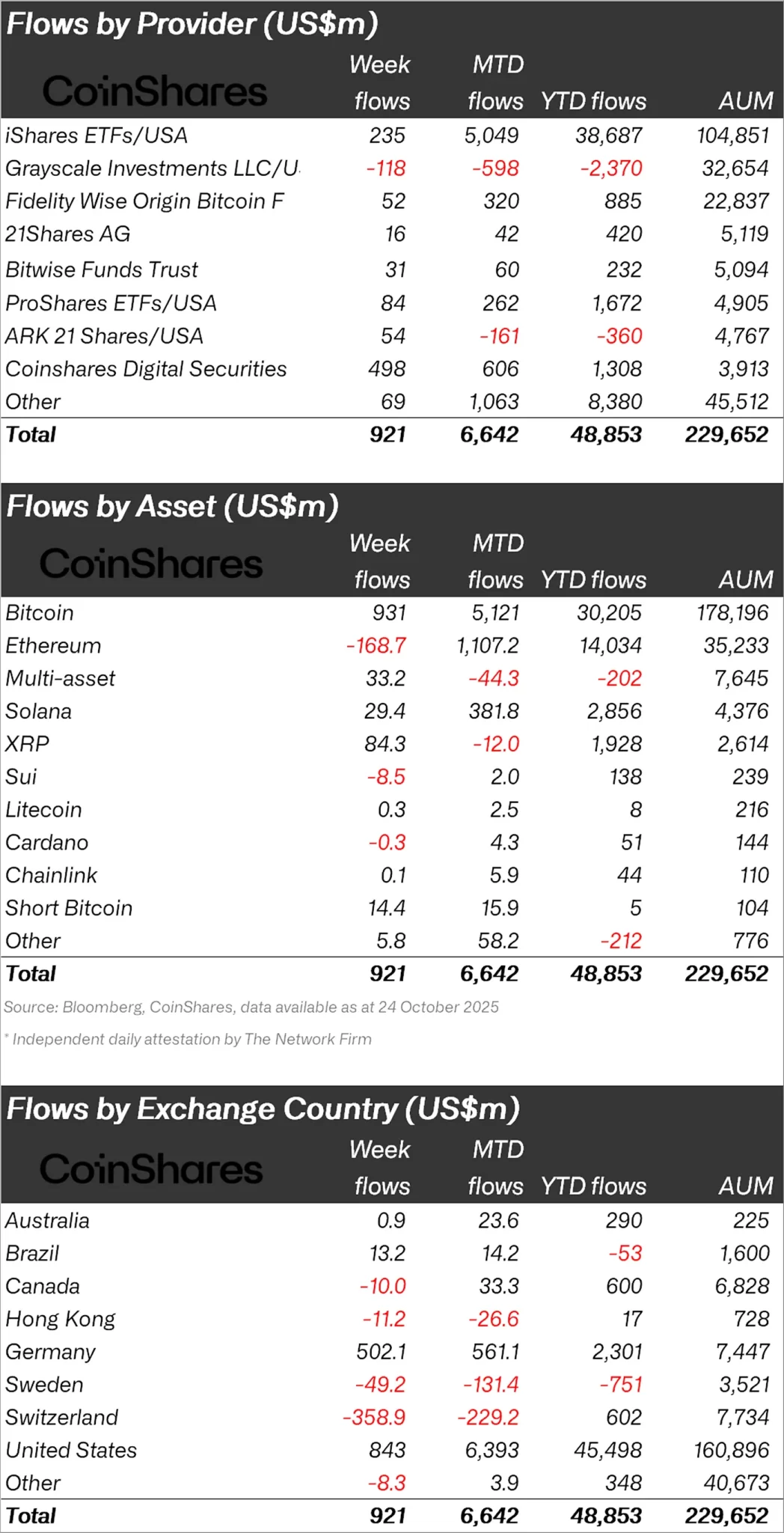

As investors continue to closely monitor market developments with the recovery, CoinShares released its weekly cryptocurrency report and stated that $921 million in inflows occurred last week.

“Following lower-than-expected US Consumer Price Index (CPI) data, investor confidence increased, resulting in an inflow of $921 million into cryptocurrency investment products.”

Bitcoin Enters, Ethereum Exits!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $931 million, Ethereum (ETH) experienced an outflow of $168.7 million.

When we look at other altcoins, Solana (SOL) experienced an inflow of $29.4 million and XRP $84.3 million, while Sui (SUI) experienced an outflow of $8.5 million.

“A total of $931 million inflows have been made into Bitcoin, bringing cumulative inflows since the US Federal Reserve (Fed) began cutting interest rates to $9.4 billion.

Ethereum saw total outflows of $169 million for the first time in 5 weeks, and daily outflows remained stable throughout the week.

Solana and XRP saw outflows of $29.4 million and $84.3 million, respectively, ahead of their US ETF launches.

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $843 million.

Following the USA, Germany had an inflow of $502 million and Brazil $13.2 million.

In the face of these inflows, Switzerland experienced an outflow of $358.9 million and Sweden $49.2 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kyrgyzstan Launches KGST Stablecoin on BNB Chain and Moves Toward a National CBDC

Falcon Finance Integrates $27 Trillion Gold Market into DeFi, Expanding Onchain Yield Opportunities

- Falcon Finance integrates Tether Gold (XAUt) as collateral for USDf stablecoin, bridging traditional finance with DeFi via tokenized real-world assets (RWAs). - The $27T gold market, with $3B tokenized onchain, aims to expand DeFi utility by enabling users to access gold-backed stability and earn yields via sUSDf. - Andrei Grachev highlights the move as a key step in USDf's adoption, aligning with Falcon's mission to create universal yield-generating infrastructure for all value forms. - Tether Gold offe

Solana News Today: GMGN.Ai Compensates Every Attack Victim, Strengthening Confidence in DeFi

- GMGN.Ai announced full reimbursement for users affected by phishing and MEV sandwich attacks, impacting 836 accounts/transactions. - The platform completed 100% compensation within 48 hours, automatically crediting funds to wallets without user action. - Founder Haze confirmed phishing threats are neutralized while investigating MEV vulnerabilities, pledging enhanced security protocols. - The response earned community praise for transparency, highlighting DeFi's growing risks and need for stronger blockc

XRP News Today: Technical Challenges Stall XRP's $100 Ambitions Amid ETF Postponements and Growing Doubts

- XRP price surged to $2.68 in October amid 147% trading volume spike, but remains fragile above $2.61 support. - Analyst Jake Claver predicts $100 by 2025, citing institutional demand, ETF approvals, and Ripple's Hidden Road acquisition. - Technical analysts warn of volatility, noting declining open interest and bearish RSI trends despite institutional XRP accumulation. - Regulatory delays and Fed rate uncertainty cloud ETF approval timelines, with $6T market cap needed for $100 target. - Market reset to