Crypto Analyst Says One Altcoin Is ‘Potential Steal’ As Bitcoin Tries To Break Out

A widely followed crypto trader says he’s keeping his eye on one of the market’s “best opportunities” while looking ahead to what’s next for Bitcoin ( BTC ) and Arbitrum ( ARB ).

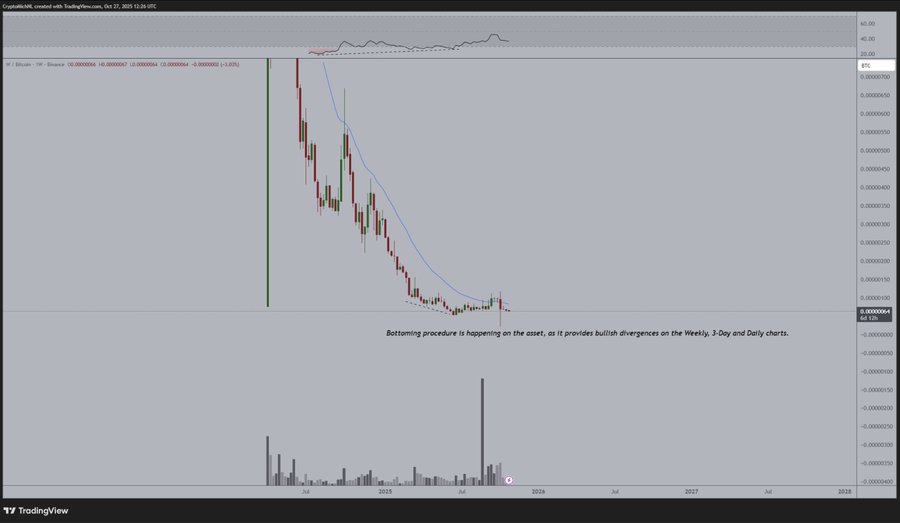

In a new post on X, crypto analyst Michaël van de Poppe tells his 812,700 followers that Wormhole ( W ), an interoperability project that allows communication between blockchains, is potentially a “steal” at its current price.

“In my opinion, one of the best opportunities in the markets.

Very glad that I’ve got W allocated in the Altcoin portfolio in the size that I’ve got it allocated.

The Altcoins were about to break to the upside, although the market crash wiped everything out again.

That’s why the next leg up should be higher than the previous one, and that brings W as a potential steal at these prices.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Looking at crypto king Bitcoin, Van de Poppe says the upcoming U.S. Federal Open Markets Committee (FOMC) meeting results will have major sway on BTC.

“Good start of the week.

As FOMC is approaching for Bitcoin, there’s likely a correction pre-FOMC taking place.

Retest of the $112,000 area wouldn’t be bad.

After that –> onwards to a new all-time high.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Finally, moving on to ARB, the analyst says that the Ethereum ( ETH ) layer-2 altcoin could potentially be up by 200% against BTC soon.

“ARB consolidating nicely on a strong support level.

One of the most active ecosystems within Ethereum, as they have just reached 2 billion transactions on-chain.

It’s hilarious that token prices aren’t moving upwards, but anyways, that’s still a window of opportunity for anyone interested into buying those assets.

Given that all liquidity has been taking surrounding the resistances in the previous run, I would assume that the next run will bring arbitrum higher up on the list.

That, technically, is a potential 200% run against Bitcoin in the coming period.

And that would bring ARB to $1.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Prospects in STEM Learning and Career Advancement: Sustained Institutional Commitment to Academic Initiatives Fueling Tomorrow’s Innovation

- Global STEM education is accelerating as AI and engineering drive economic transformation, with 2025 government initiatives expanding AI-focused programs and workforce development. - U.S. universities report 114.4% growth in AI bachelor's enrollments, supported by corporate partnerships and $25M+ in tech industry investments for AI labs and teacher training. - EdTech's AI-powered platforms, valued at $5.3B in 2025, are projected to reach $98.1B by 2034, with startups like MagicSchool AI securing $45M in

ICP Caffeine AI: Leading the Way in AI-Powered Investment Prospects within the Web3 Landscape

- ICP Caffeine AI, developed by DFINITY Foundation, merges AI and blockchain to enable no-code app development via natural language prompts. - Its "chain-of-chains" architecture and Chain Fusion technology enhance scalability and cross-chain interoperability for AI-native applications. - With $237B TVL and partnerships with Microsoft/Google Cloud, ICP faces competition from TAO and RNDR but aims to rival AWS with on-chain AI solutions. - Institutional adoption in finance and energy, plus regulatory alignme

Internet Computer's Rapid Rise: Could This Signal a Significant Change in the Crypto Landscape?

- Internet Computer's ICP 2.0 upgrade and partnerships with Microsoft , Google, and SWIFT drove a 30% price surge in late 2025. - Caffeine AI and Chain Fusion innovations reduced AI costs and enabled cross-chain interoperability, enhancing decentralization. - Institutional adoption via hybrid infrastructure and reverse-gas model boosted ICP's credibility and deflationary appeal. - November 2025 price spike showed 35% address growth but 91% fewer token transfers, indicating speculative activity. - Analysts

The Importance of Higher Education in Equipping Tomorrow’s Workforce for AI-Powered Sectors: Prioritizing Investment in Educational Technology and Universities Emphasizing STEM

- Higher education institutions are investing in EdTech and STEM to address AI talent shortages. - Farmingdale State College's $75M center and AI Management program align with industry needs. - The AI EdTech market is projected to grow from $5.3B to $98.1B by 2034, driven by personalized learning. - Challenges include data privacy and educator training, but government policies support sustainable investment. - Strategic investments in STEM-focused universities prepare future talent and deliver economic gro