USD1 puts users at the center with innovative rewards, reshaping how stablecoins are embraced in the DeFi landscape

- World Liberty Financial (WLFI) distributed 8.4 million tokens to USD1 stablecoin users via its Points Program, aiming to boost adoption and DeFi utility. - The initiative generated $500M in trading volume across six exchanges, with USD1 now ranking as the sixth-largest stablecoin at $2.98B market cap. - Future plans include Apple Pay-compatible debit cards and real-world asset tokenization, despite regulatory challenges and competition from USDT/USDC.

World Liberty Financial (WLFI) has revealed it will distribute 8.4 million

The token distribution, which will occur in multiple stages, benefits users who have actively traded USD1 pairs or maintained balances on partner platforms such as KuCoin, Gate.

The USD1 Points Program has already generated substantial momentum for the stablecoin, which now stands as the world’s sixth-largest stablecoin with a market cap of $2.98 billion, according to

This airdrop also reflects growing institutional interest in USD1. Earlier this year, Abu Dhabi-based MGX investment group used USD1 to complete a $2 billion investment on Binance, a milestone for the stablecoin, according to

Experts see the rewards initiative as a calculated effort to strengthen USD1’s position in the market. The $500 million surge in just two months points to robust user engagement, especially on exchanges like Gate.io and KuCoin, where USD1 trading activity has increased sharply. Nonetheless, the project still faces hurdles, such as regulatory concerns over reserve transparency and rivalry from established stablecoins like

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

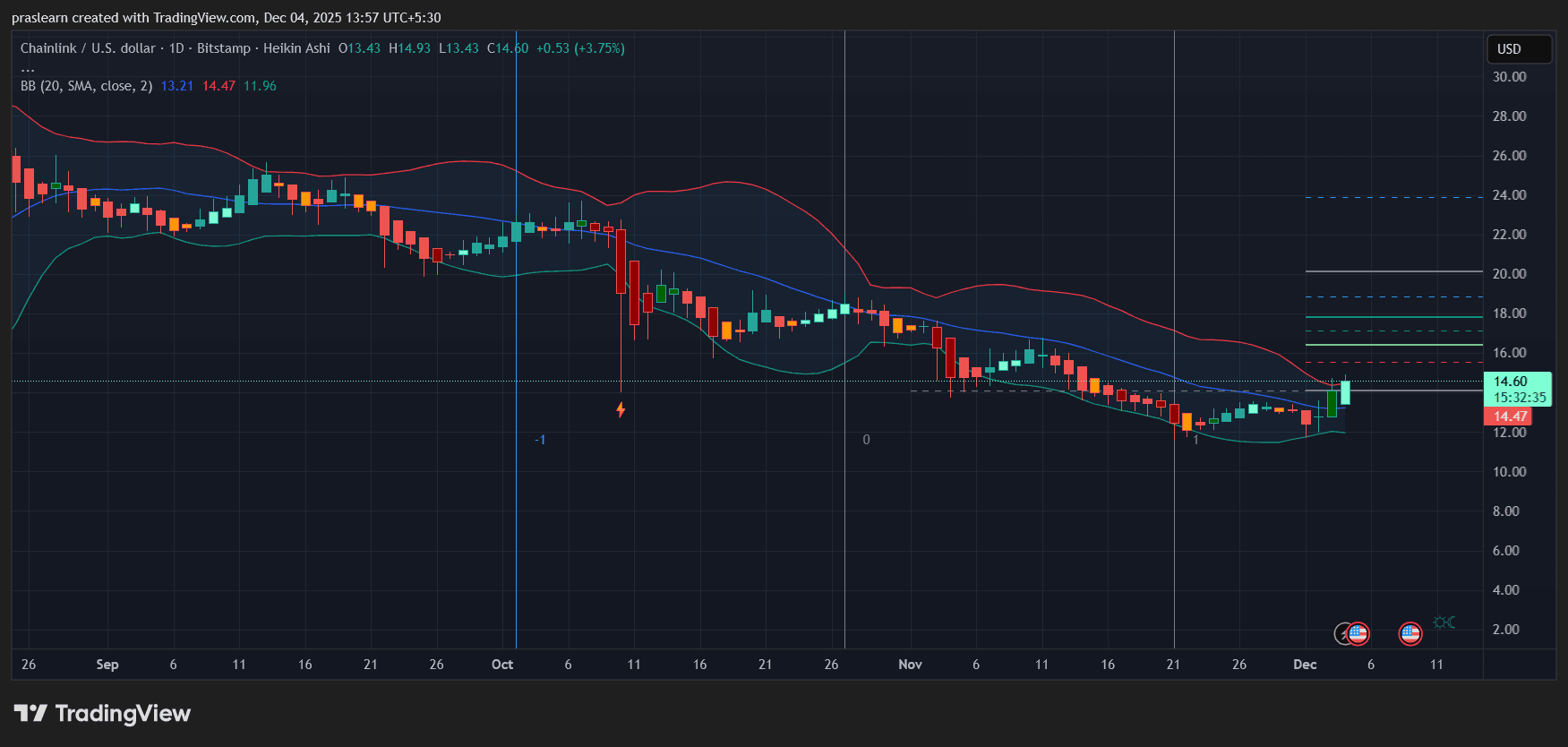

Will Chainlink Price Reach $50?

Top 3 Reasons Why Bitcoin Price Should Go Up Next

Fusaka Just Changed Ethereum’s Speed Limit

The Influence of Vitalik Buterin's Support for ZKsync on the Uptake of Layer-2 Solutions

- Vitalik Buterin's 2025 endorsement of ZKsync boosted its ZK token price by 50%, driving institutional adoption and market validation. - ZKsync's Atlas upgrade achieved 30,000 TPS with Ethereum compatibility, raising TVL to $3.3B through enterprise partnerships and GPU-optimized proofs. - Unlike StarkNet's niche scalability or Loopring's trading focus, ZKsync balances Ethereum compatibility, developer accessibility, and enterprise-grade performance. - Deflationary tokenomics and Deutsche Bank partnerships