Bitcoin Steady Amid Fed Rate Decision and US-China Talks

- The Federal Reserve’s upcoming rate decision influences Bitcoin trading.

- Market awaits effects of a 25 basis point cut.

- US-China trade talks add uncertainty to the market.

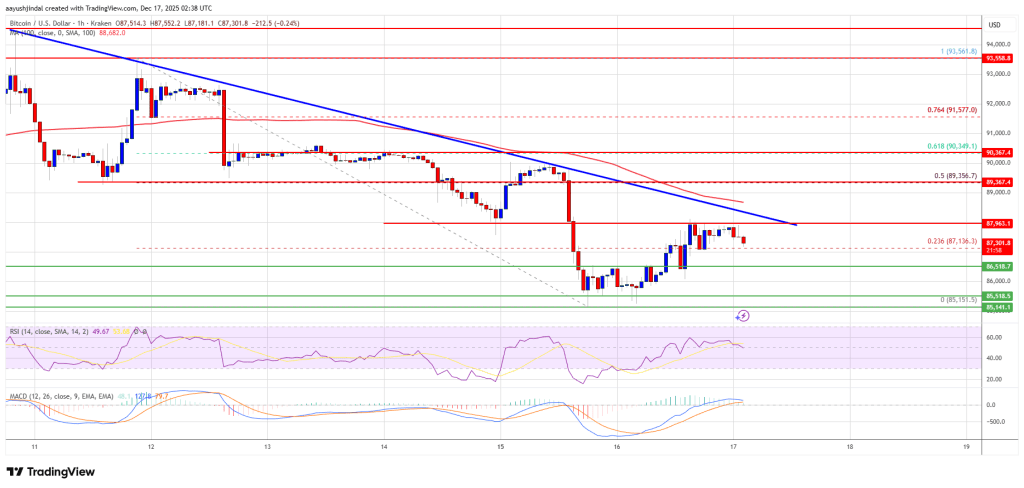

Bitcoin is currently trading between $110,000 and $116,000 as traders await the Federal Reserve’s rate decision, potentially impacting pricing trends. Chair Jerome Powell noted that recent labor market weaknesses influenced the decision-making process.

The narrow trading range reflects ongoing market uncertainty, influenced by anticipated Federal Reserve moves and geopolitical factors. Traders are particularly attentive to potential short-term volatility.

The primary influencer in this event is Federal Reserve Chair Jerome Powell, whose leadership steers monetary policy. Market participants keenly monitor the potential 25 basis point rate cut , which reflects concerns over U.S. growth indicated by labor market weaknesses.

Bitcoin remains a focus due to its current trading range. Meanwhile, traders also watch for potential impacts on Ethereum and other major altcoins. The Federal Reserve’s decisions routinely affect digital assets’ valuation and sentiment. According to Jerome Powell, Chair of the Federal Reserve, “Recent evidence of weakness in the labor market prompted the central bank to shift their balance of risks to prioritize growth concerns… There is no preset course to future rate decisions, but policy remains restrictive.”

The potential rate cut could signal a shift toward growth-centric monetary policies, prompting further analysis of market directions. The ongoing US-China trade negotiations also play a critical role in shaping financial landscapes.

Historical precedence shows similar scenarios in 2020 and 2022 affecting digital currencies. However, as of now, no definitive impacts have been documented from the upcoming Federal Reserve actions or US-China trade dynamics.

Official exchanges have not released statements regarding TVL or liquidity changes directly linked to these events. Observers suggest monitoring regulatory updates and key financial influencers for further developments. The ongoing geopolitical context could influence market dynamics across the financial sectors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price regroups after decline—Is a directional breakout imminent?

Two main reasons why the current decline of ONDO is only temporary.