Long-term holders sell 325,600 Bitcoin in sharpest monthly drawdown since July 2025

Key Takeaways

- Long-term Bitcoin holders sold 325,600 BTC over the past month, representing the largest monthly drawdown since July 2025.

- The sell-off signals major profit-taking activity among veteran investors, shifting market dynamics.

Long-term holders sold 325,600 Bitcoin in the last 30 days in the sharpest monthly drawdown since July 2025, according to data tracked by CryptoQuant’s analyst JA Maartun.

The selling pressure from long-term holders reflects a broader trend of profit-taking among this investor cohort. Meanwhile, short-term buyers have also exited their positions, according to recent reports.

The current selling activity contrasts with accumulation patterns observed in other investor groups. As long-term investors reduced positions, Bitcoin whales have recently stepped in to absorb the increased supply, signaling renewed accumulation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Partners with GROW to Connect Crypto and Traditional Finance

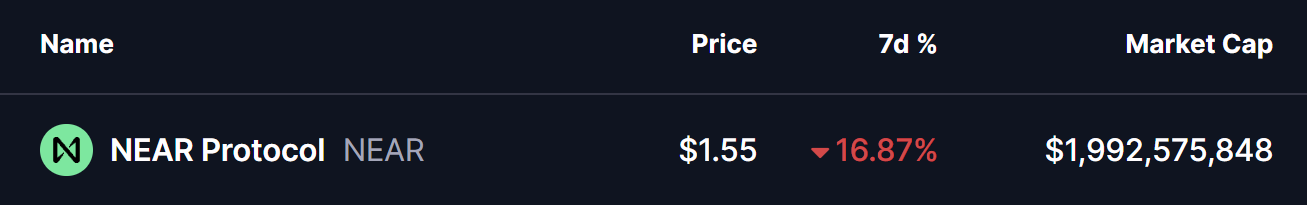

Near Protocol (NEAR) Flashes Potential Bullish Reversal Setup – Will It Bounce Back?

Solana Price Prediction: Grayscale Predicts New Bitcoin ATH, DeepSnitch AI’s Snowball to $900K Fuels the 100x Narrative

Whole Foods to install smart food waste bins from Mill starting in 2027