FourMeme Surpasses Pumpfun With $43 Million in Monthly Revenue

Mutlichain memecoin launchpads continue to pop up, and with BNB Smart Chain (BSC) activity taking off, the chain’s go-to memecoin launchpad, FourMeme, is now earning more revenue than Solana-based pumpfun.

Over the last 30 days, FourMeme has earned $43 million in fees, outpacing pumpfun by 13%, making it the fourth-largest revenue generator in DeFi, trailing only Hyperliquid, Circle, and Tether.

While memecoin trading activity has fallen off significantly from the beginning of the year, memecoin trading infrastructure continues to rake in profits, with FourMeme, Pumpfun, Jupiter, Axiom, and PancakeSwap accounting for five of the top ten revenue generators in DeFi over the last month.

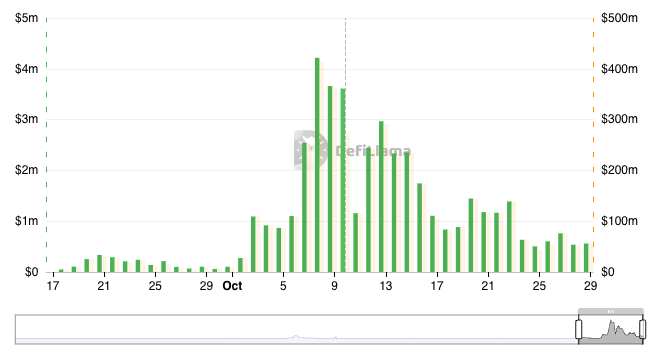

The rotation to Binance memecoin trading was potentially catalyzed by two token launches, ASTER and STBL, which both released on BSC and rallied more than 10x after traders bridged to the network to buy them. Aster furthered its hold on the BSC ecosystem through its post-TGE airdrop farm, which concluded in the first week of October, right when FourMeme volumes began to rise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins Form the Core of Financial Infrastructure While Regulators Rush to Update Frameworks

- NY Fed consults Wall Street dealers on permanent repo facility to ensure liquidity backstop amid market uncertainties. - FSB prioritizes stablecoin regulation alignment and debt market monitoring as institutional adoption accelerates. - Fireblocks processes $1.5T in stablecoin transactions, driving blockchain integration into traditional banking systems. - Qualigen rebrands as AIxCrypto, shifting from biotech to Web3/AI, reflecting blockchain-AI convergence trends. - Former Fed Governor Kugler resigns ov

Dogecoin News Today: "Meme Coins Shift Focus from Hype to Utility as Little Pepe Emerges as a Rival to Dogecoin"

- LILPEPE challenges Dogecoin with Layer-2 infrastructure and presale success, raising $27.4M in Stage 13. - Analysts predict a potential 341x price surge to $0.75 if it captures meme coin liquidity and secures exchange listings. - Combining meme culture with anti-sniper features, zero taxes, and CertiK audits, LILPEPE aims to redefine utility-driven memecoins. - Similar to Shiba Inu's growth trajectory, its $12.94B valuation target hinges on sustained speculation and favorable macroeconomic conditions. -

Bitcoin Updates Today: Bitcoin's Recent Decline Faces Calculated Buying as Miners Indicate a Shift in Market Trends

- Bitcoin miners and institutional investors are strategically accumulating Bitcoin as market sell pressure eases, signaling a potential inflection point after months of decline. - The selloff, driven by macroeconomic risks and ETF outflows, saw Bitcoin dip below $90,000 in November, with BlackRock’s IBIT recording $523M in redemptions. - Miners like KULR prioritize treasury growth through mining, while Bitfury pivots $1B to AI and crypto innovation, reflecting shifting risk management strategies. - Altern

Amazon’s Prime Video will introduce AI-powered video summaries for select television series