Dogecoin News Update: Dual Narratives Emerge as Dogecoin Faces $0.21 Barrier and Pentagon Initiates DOGE Revamp

- Dogecoin (DOGE) faces a $0.21 price threshold critical for breaking out of consolidation near $0.20, with technical indicators like MACD and RSI signaling potential momentum shifts. - Order book data shows 4.28M DOGE support at $0.203 and key resistance at $0.20892-$0.21000, while Pentagon's DOGE unit overhauls military drone programs under Elon Musk. - The dual DOGE narrative combines crypto market dynamics with U.S. defense reforms, as regulatory debates emerge over both the coin's valuation and govern

Dogecoin (DOGE) has once again captured market interest as investors anticipate a possible breakout from its extended period of sideways trading near the $0.20 mark. Technical signals and order book trends point to a pivotal moment for the meme-inspired cryptocurrency, with bullish traders focusing on the $0.21 level as a gateway to a larger upward move. At the same time, the abbreviation "DOGE" now carries added significance, as the Pentagon’s Department of Government Efficiency (DOGE) leads a sweeping reform of military drone initiatives, deepening the coin’s cultural and financial story.

In the last month,

Looking at the bigger picture, Dogecoin’s price has dropped 75% from its 2021 high of $0.73, with the token hovering near $0.185 in late October 2025, as per Yahoo Finance. Nevertheless, its brand presence and user engagement remain strong, with blockchain data and social media trends pointing to increasing interest from both retail and institutional players. Large holders have been accumulating since mid-October, and steady open interest in futures markets suggests a stable, though cautious, trading environment, The Currency Analytics further noted.

Meanwhile, "DOGE" has become a focal point in U.S. defense discussions. The Pentagon’s DOGE division, under Elon Musk’s leadership, is revamping drone acquisition and ramping up domestic production of over 30,000 cost-effective unmanned systems to address competition from China and insights from the Ukraine conflict, according to Bitget. This effort intersects with the Replicator initiative, though coordination remains a challenge. In a separate development, crypto platforms like Webull have broadened DOGE futures offerings, allowing U.S. retail traders to access leveraged products tied to the coin, as also mentioned by Bitget.

The dual application of "DOGE" has fueled both regulatory and operational debates. The Department of Government Efficiency (DOGE) has faced backlash for its sweeping reductions to federal initiatives, including GSA leases, as reported by Pillsbury Law. Elsewhere, Transportation Secretary Pete Buttigieg remarked that an efficiency-driven approach similar to DOGE’s could have sped up the adoption of autonomous vehicles during the Biden era, according to Benzinga.

For those trading Dogecoin, the $0.21 mark is crucial. A confirmed close above this point could spark a rally toward $0.24, while a drop below $0.19 might extend the current consolidation, The Currency Analytics cautioned. Traders may consider waiting for a retest of the $0.20 support or watching for volume surges as signs of a potential trend change.

As both Dogecoin and the Pentagon’s DOGE program reach important crossroads, the intersection of technical trends and geopolitical developments highlights the shifting dynamics for digital currencies and government efficiency efforts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

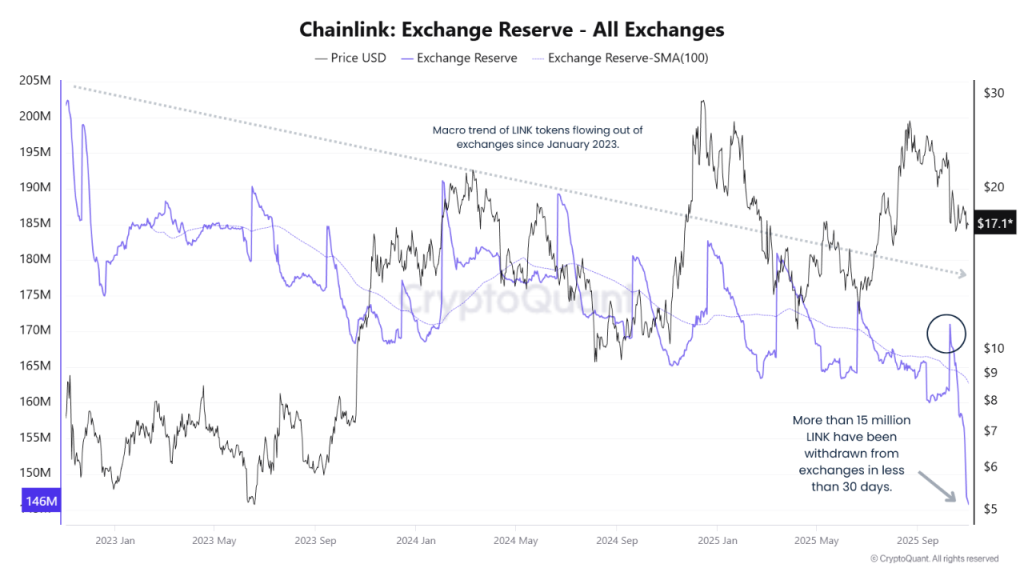

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including