Altcoins Collapse: Less Than 5% Beat Bitcoin as BTC Dominance Hits 60%+

Bitcoin is reclaiming control of the crypto market as altcoins “bleed,” with dominance soaring above 60% for the first time in years. Analysts warn that 2025 may favor Bitcoin and high-quality sectors like DeFi and RWA, leaving speculative altcoins behind.

After more than two months of weakness, Bitcoin is reasserting its dominance. The Bitcoin Dominance Index surpasses the 60% mark, the highest level since mid-2021.

Meanwhile, most altcoins have plunged, with fewer than 5% of the top 55 tokens outperforming BTC. As institutional inflows continue to favor Bitcoin, a clear “risk-off” sentiment is spreading across the market, firmly placing crypto in a new “Bitcoin Season.”

Bitcoin Consolidates Power as Altcoins Lose Ground

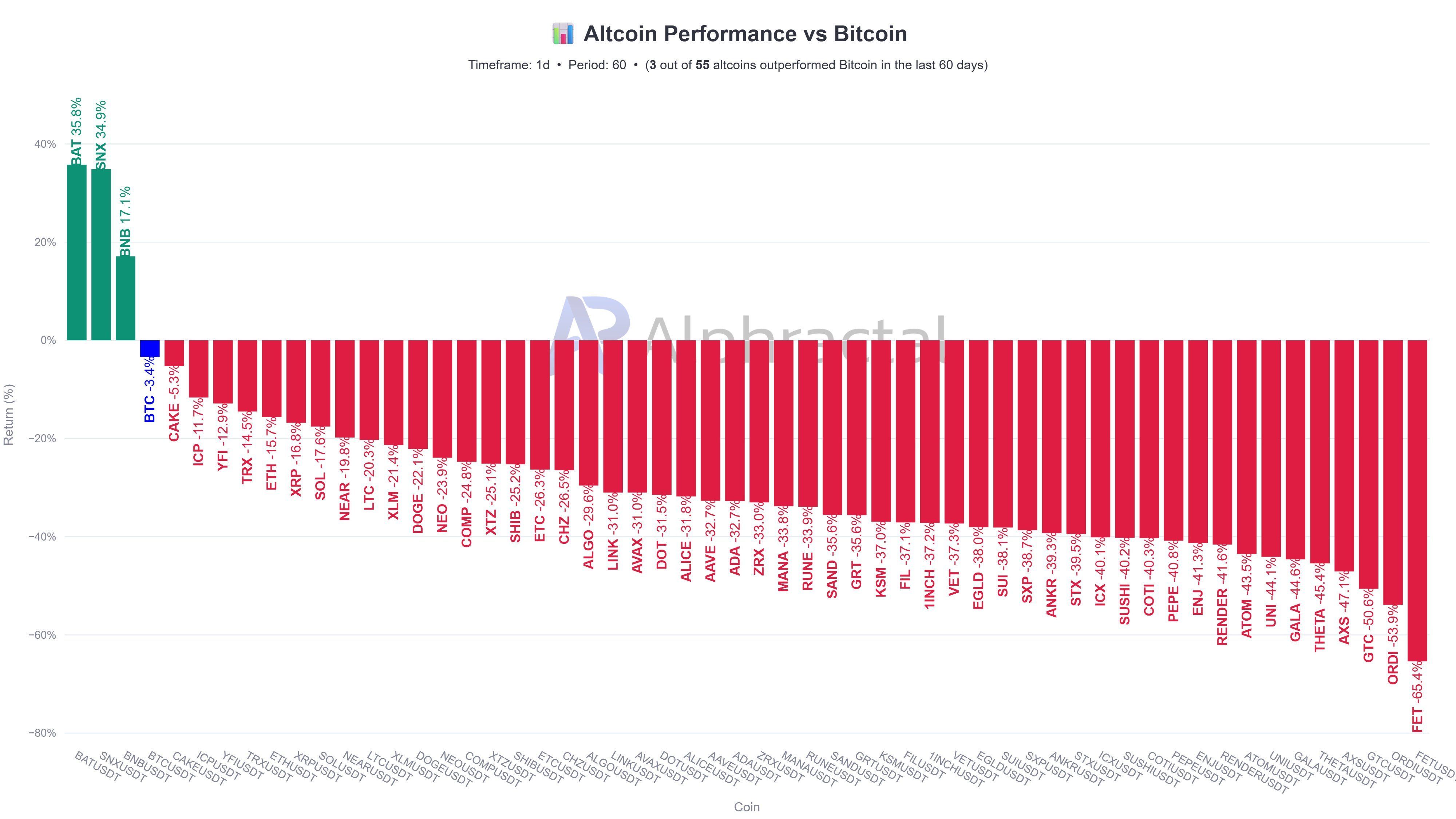

According to data from Alphractal, only 3 out of 55 major altcoins have outperformed Bitcoin (BTC) over the past 60 days, while the rest have lost between 20% and 80% of their value. The broader altcoin market remains deeply in the red, as reflected in the Altcoin Season Index, which currently hovers around 25-29, indicating that the market is in a Bitcoin Season.

Altcoin performance vs Bitcoin. Source:

Alphractal

Altcoin performance vs Bitcoin. Source:

Alphractal

On the Bitcoin Dominance (BTC.D) chart, the index reached 60.74%, up from 59% at the end of September, marking the highest level over two years. This signals that capital rotates out of riskier assets and back into Bitcoin. Analysts, such as Benjamin, forecast that altcoins could drop another 30% against Bitcoin in the coming weeks if Bitcoin’s uptrend continues.

BTC.D chart. Source:

TradingView

BTC.D chart. Source:

TradingView

Selling pressure across the altcoin market has intensified after several analysts noted that the structure established following the October crash is now breaking down. If this selling momentum persists, altcoins could enter a deeper downside phase.

Still, some traders remain optimistic about the broader market structure over the next three to six months. Bitcoin continues to hold above its 50-week EMA, with liquidity rising and expectations growing for a potential Fed rate cut in December. According to one trader, altcoins will eventually follow as long as BTC maintains its trend.

“Ignore fear, follow structure,” the user emphasized.

At this stage, we may witness a familiar liquidity rotation, capital flowing out of altcoins to reinforce Bitcoin’s dominance. As long as BTC remains strong on the weekly timeframe and institutional capital continues to enter the market, altcoins are unlikely to break out independently. This environment favors a defensive strategy, prioritizing BTC and stablecoins over speculative assets.

Recovery Signs May Emerge, but Not for All

Despite the short-term bearish outlook for altcoin performance vs Bitcoin, several analysts highlight the possibility of a technical bounce soon. According to another X user, the “Others vs BTC” chart just closed its monthly candle with a long wick to the downside, a pattern that has historically preceded short-term rebounds as markets “fill gap” in subsequent sessions.

Others/BTC chart. Source:

Bitcoinsensus

Others/BTC chart. Source:

Bitcoinsensus

While Bitcoin holds the upper hand, any pause or pullback in BTC’s momentum could allow altcoins to stage a selective recovery. This would enable speculative capital to flow back into smaller-cap tokens.

In summary, while a short-term recovery is possible, only a few market segments are likely to benefit, particularly projects with strong fundamentals and tangible applications, such as RWA, DeFi, or AI-linked tokens. The market is becoming increasingly selective, leaving little room for narrative-driven altcoins with weak fundamentals. Therefore, late 2025 may not bring a broad-based “altseason,” but rather a selective mini-altseason defined by quality over hype.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain Betting's Legal Challenge: Is It Considered Gambling or a Derivative?

- NBA star Tristan Thompson advocates blockchain-based sports prediction markets, aligning with DeFi's potential to transform fan engagement. - Kalshi faces legal scrutiny as a federal judge questions whether its event contracts qualify as derivatives under U.S. commodity laws. - Blockchain startups like Ideosphere and Portage Biotech explore prediction markets for scientific funding, leveraging tokenized assets and staking revenues. - Regulatory ambiguity over derivatives vs. gambling risks stifling innov

From Spectator to Participant: How Prediction Markets Are Transforming the Way Fans Interact with Sports

- NBA star Tristan Thompson predicts prediction markets will boost sports viewership by integrating real-time betting into broadcasts. - FanDuel launches a standalone app with CME Group , offering sports and economic prediction contracts while addressing regulatory and consumer protection concerns. - Polymarket partners with UFC and NHL to introduce live prediction scoreboards, transforming passive viewing into interactive trading during events. - Growing industry adoption by Google, Yahoo Finance, and pla

Federal Judge Blocks Trump’s Attempt to Pressure UC Through Funding

- A federal judge blocked Trump's plan to defund UC over antisemitism claims, citing First and Tenth Amendment violations. - The $1.2B funding demand and civil rights investigations were deemed coercive tactics to suppress "woke" academic views. - UC warned the financial threat would devastate its research programs, while critics called the strategy authoritarian. - The ruling preserves UC's funding but leaves unresolved tensions over government influence in higher education.

Ethereum News Today: Ethereum’s Unyielding Approach: Shutting the Door on Centralization

- Ethereum co-founders release "Trustless Manifesto" on blockchain to reinforce decentralization amid ecosystem centralization risks. - Document encoded in ownerless smart contract emphasizes self-custody, public verifiability, and rejecting convenience-driven centralization. - Warns against AWS outages and hosted RPCs creating single points of failure, citing 25% throughput loss on Coinbase's Base chain. - Critiques Paradigm's growing influence and institutional staking risks, proposing DVT to mitigate ce