Date: Tue, Nov 04, 2025 | 08:45 AM GMT

The cryptocurrency market continues to experience heightened volatility as both Bitcoin (BTC) and Ethereum (ETH) saw sharp declines — with ETH dropping nearly 5% in the last 24 hours. Despite this pressure on major altcoins, privacy-focused tokens are showing surprising resilience, and one of them — Dusk (DUSK) — is starting to stand out with a notable surge.

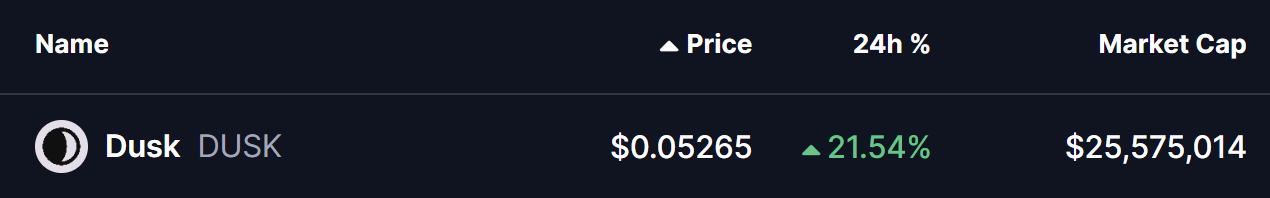

The $DUSK token, the native asset of the Dusk Network — a privacy-centric Layer-1 blockchain — has jumped by 21% today. While that price action alone is impressive, what’s attention is the technical pattern formation on its chart, suggesting a potential bullish breakout could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Broadening Wedge Pattern in Play

On the 4-hour chart, DUSK is forming a broadening wedge pattern — a structure typically marked by increasing volatility where both highs and lows expand over time. This pattern often precedes a strong move once price breaks above or below the wedge boundaries.

During its recent correction phase, DUSK successfully tested the lower wedge support near $0.0395, where strong buying pressure emerged. The token then rebounded sharply, moving up to around $0.0526, hovering just below the wedge’s upper resistance trendline.

Dusk (DUSK) 4H Chart/Coinsprobe (Source: Tradingview)

Dusk (DUSK) 4H Chart/Coinsprobe (Source: Tradingview)

Adding to the bullish narrative, DUSK has reclaimed its 100-period moving average (MA) around $0.0469, now acting as immediate support. Sustaining above this level indicates improving short-term momentum and growing buyer confidence.

What’s Next for DUSK?

If bulls manage to push and close above the upper wedge resistance, DUSK could confirm a breakout, setting the stage for a potential rally toward $0.0725 — a projected upside of nearly 37% from current levels.

However, failure to break above resistance could keep the token range-bound within the wedge for a while longer. In that scenario, $0.0469 remains the key short-term support level to watch. A drop below it might invalidate the bullish setup and trigger a retest of lower support zones.

For now, the technical setup looks constructive, and with market sentiment gradually shifting toward privacy-based projects, DUSK could soon be among the altcoins preparing for a strong upside move in the coming sessions.