Japan Positioned as AI Hub: SoftBank and OpenAI Aim for Worldwide Business Adoption

- SoftBank and OpenAI launch SB OAI Japan to deploy Crystal Intelligence in Japan, targeting a 2026 IPO. - Strategic partnership combines SoftBank's infrastructure with OpenAI's AI tech to address finance, healthcare, and customer service sectors. - OpenAI CEO Sam Altman highlights Japan's mature tech ecosystem as a model for global AI integration. - SoftBank commits infrastructure and 5G expertise to scale AI solutions, leveraging prior Vision Fund investments. - Japan's AI market projected to exceed ¥1.2

SoftBank Group Corp. and OpenAI have revealed the creation of a new joint venture, SB OAI Japan, with the goal of speeding up the introduction of advanced artificial intelligence solutions in Japan, as reported by

This partnership brings together two major players: SoftBank, renowned for its investments and technological infrastructure, and OpenAI, the American AI research organization behind the GPT large language models. Through this alliance, SB OAI Japan intends to combine OpenAI’s state-of-the-art AI technologies with SoftBank’s vast domestic reach to create customized solutions for Japanese enterprises. The initiative targets industries such as finance, healthcare, and customer support, where AI implementation is accelerating but remains inconsistent, according to the Phemex report.

During a press conference, OpenAI CEO Sam Altman underscored the broader significance of the venture, describing it as an "essential move to integrate transformative AI technologies into the workflows of international businesses." He identified Japan as an "ideal initial market" thanks to its advanced tech landscape and supportive regulatory framework for AI progress. Altman also suggested that this partnership could serve as a template for future collaborations with global corporations, noting that the joint venture is intended to demonstrate how AI-powered services can be scaled internationally, as detailed in the Phemex report.

SoftBank’s participation brings substantial financial resources and operational expertise to the table. The Japanese conglomerate, which has a history of backing AI startups through its Vision Fund, has pledged to supply infrastructure, local knowledge, and distribution networks to fuel SB OAI Japan’s expansion. A SoftBank representative pointed out that the company’s background in rolling out 5G and cloud technologies makes it well-suited to seamlessly embed AI into current business operations, according to the Phemex report.

The anticipated IPO in 2026 demonstrates strong belief in the joint venture’s growth potential and the overall direction of the AI sector. Experts predict that Japan’s AI market could surpass ¥1.2 trillion (about $8.5 billion) by 2030, propelled by increasing needs for automation and data-driven insights. Nevertheless, obstacles such as data security and workforce adaptation persist. The joint venture’s future will hinge on its capacity to address these challenges while delivering measurable value to business clients, the Phemex report noted.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

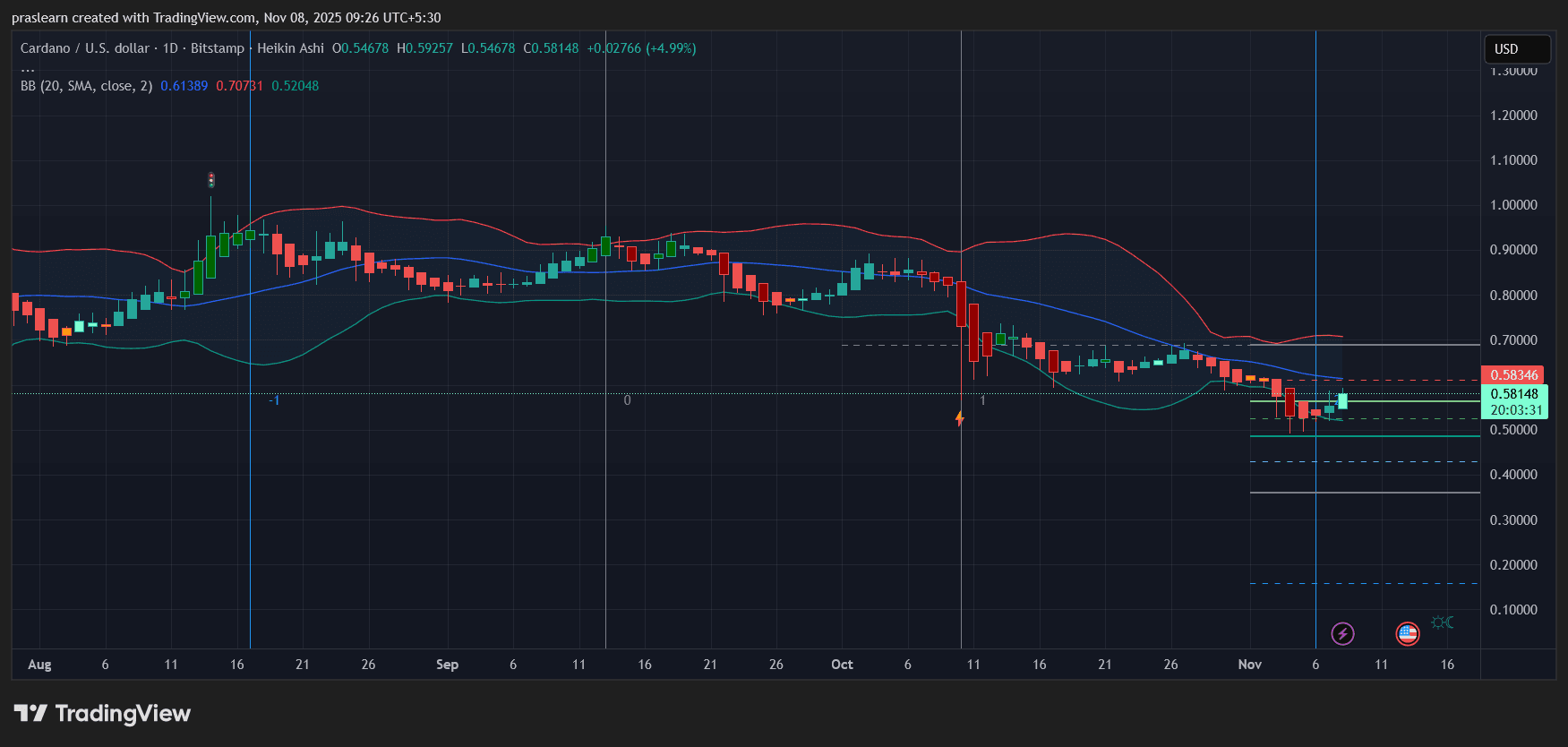

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res