ALGO has dropped 52.88% since the start of the year, facing a combination of varied news and ongoing technical declines

- ALGO fell 52.88% year-to-date despite a 0.19% 24-hour gain, reflecting prolonged bearish momentum. - Kenadyr Metals' rebrand to Algo Grande Copper Corp. and Mexican mining project lacks direct impact on ALGO's trading dynamics. - Technical analysis shows ALGO trading below $0.16 with weak support at $0.15, risking further decline to $0.135. - Backtesting reveals 10%+ drops in ALGO yield negative returns (-11% at 30 days), with no reliable recovery patterns.

As of November 6, 2025,

ALGO’s latest price action demonstrates a significant downward trend throughout the year, even though there was a slight uptick in the last 24 hours. The recent 0.19% daily gain points to some short-term buying, but the overall picture remains bearish, with a 52.88% annual loss underscoring persistent negative sentiment. This pronounced drop raises concerns about whether the token can recover, especially given ongoing macroeconomic challenges and shifting market attitudes.

One notable development is a rebranding and exploration initiative by Kenadyr Metals Corp., which intends to change its name to Algo Grande Copper Corp. The company is moving forward with the Adelita Copper-Gold-Silver Project in Mexico, having obtained all required permits to commence exploration in November 2025. This strategic decision aims to strengthen the company’s operations and broaden its presence in the mining industry. Nevertheless, the rebranding and mining project do

Additionally, a recent article examined the risks and tactics involved in algorithmic trading. It stressed the necessity of robust risk management, such as employing multiple stop-loss orders and enforcing strict trading limits. These approaches are essential for investors navigating the unpredictable crypto landscape, including those trading ALGO. The article also pointed out the increasing sophistication of algorithmic trading systems and the importance of vigilant oversight to manage risks like slippage and liquidity shortages.

From a technical analysis standpoint, ALGO continues to move within a downward channel, repeatedly testing important support levels. The latest 10% decline failed to spark a meaningful recovery, reflecting weak buyer interest. Market participants are monitoring the $0.15 level, which has previously served as minor support. Should the price fall below this threshold, further declines could follow, possibly reaching the next support at $0.135. On the other hand, a sustained move above $0.16 might indicate a shift in sentiment, though this appears unlikely given the prevailing trend.

Backtest Hypothesis

A recent backtest evaluated ALGO’s performance after single-day drops of 10% or more, analyzing 29 such instances from January 1, 2022, to November 6, 2025. The study reviewed price action after these events over holding periods from 3 to 30 days. Results showed that the token consistently struggled to recover from sharp declines. Average returns stayed negative—about –1% after three days and –11% after thirty days—demonstrating a lack of effective rebound.

The win rate was just above 50% immediately following the declines but quickly fell below 35% after two weeks. This indicates that short-term strategies aiming to profit from rebounds after 10% drops have produced unreliable outcomes. Moreover, performance across all timeframes tested was not statistically different from a flat benchmark, suggesting the pattern does not offer a dependable edge.

Risk-adjusted results further highlight the weakness of this approach. Attempting to catch 10% down days for quick bounce trades in ALGO has not resulted in steady returns or significant risk-adjusted benefits. The evidence suggests investors should be cautious with such strategies and consider incorporating broader economic and sentiment indicators into their trading plans.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

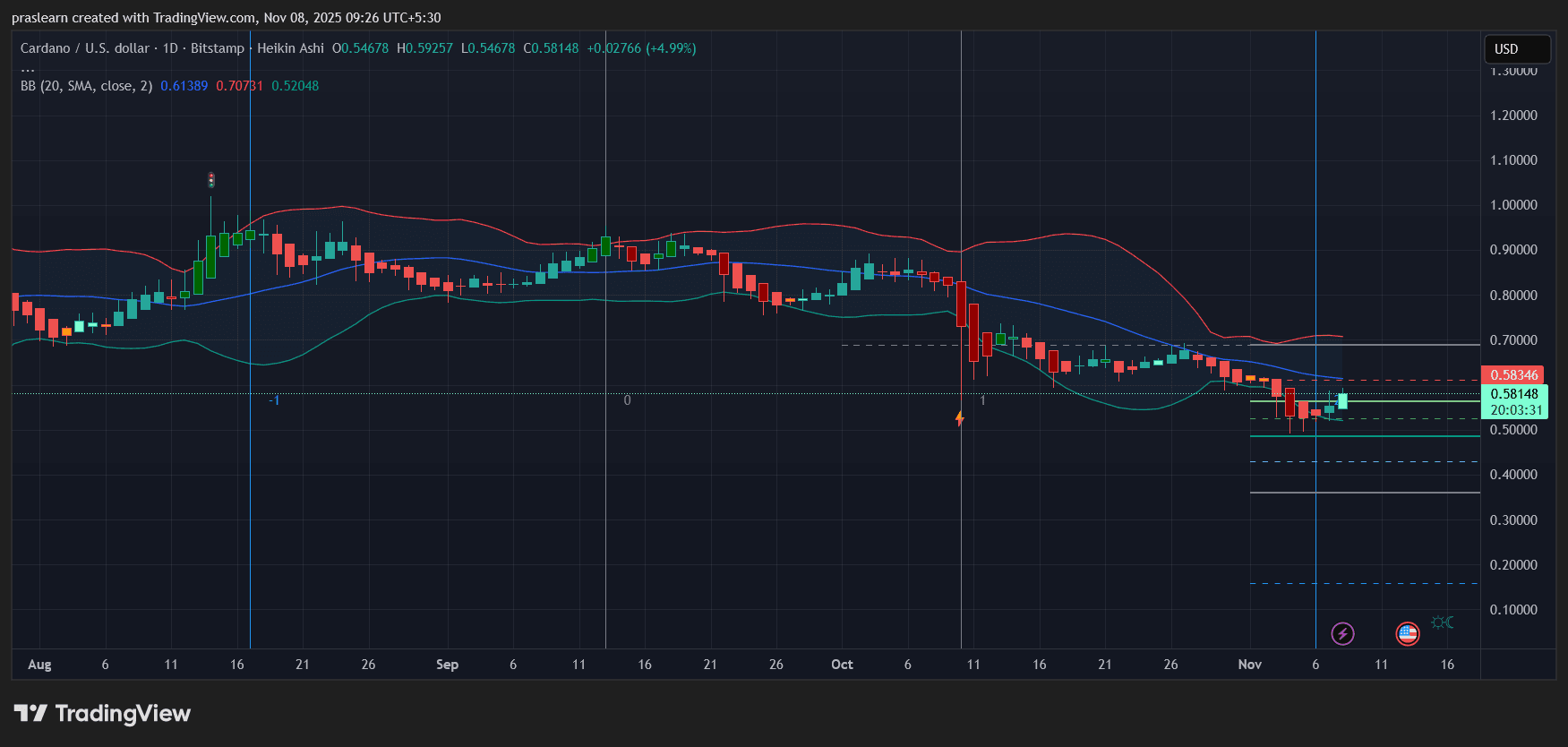

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res