3 Storage Coins Showing Strong Accumulation — Kicking Off a New Capital Rotation Trend

After the Privacy Coin rally, investors appear to be rotating into Storage tokens like Filecoin, BitTorrent, and Storj. Whale accumulation and declining exchange supply indicate growing confidence in the decentralized storage sector.

After the Privacy Coin wave, where might investors turn next? Data from the first week of November suggests the spotlight may shift to Storage tokens.

At the start of November, traders who missed the Privacy Coin rally appear to be accumulating decentralized storage projects — long-established tokens in the market that have yet to recover their value. Which altcoins are drawing attention?

3 Promising Storage Altcoins for November

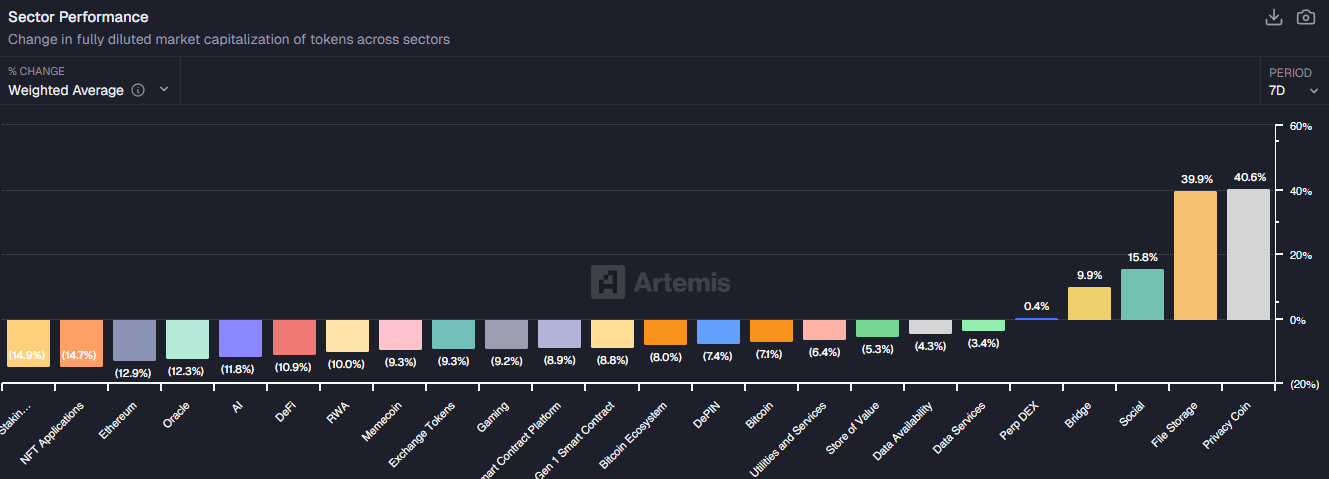

According to Artemis data, Storage tokens have nearly caught up with Privacy Coins during the first seven days of November, delivering an average performance of almost 40%.

Crypto Sector Performance. Source:

Crypto Sector Performance. Source:

These projects have real-world applications and generate revenue from customers, but their token prices have declined significantly.

“After Privacy tokens, File Storage tokens are also outpacing BTC,” investor iWantCoinNews predicted.

In this environment, potential altcoins are those that show signs of accumulation or breakout from long-term consolidation zones. Below are several notable examples in the decentralized storage sector.

1. Filecoin (FIL)

Data from CoinGecko shows that Filecoin (FIL) is leading the Storage Coin category in early November.

A recent BeInCrypto report noted that FIL’s trading volume exceeded $1.4 billion. Meanwhile, Grayscale has been increasing its FIL holdings this month, reflecting growing investor demand.

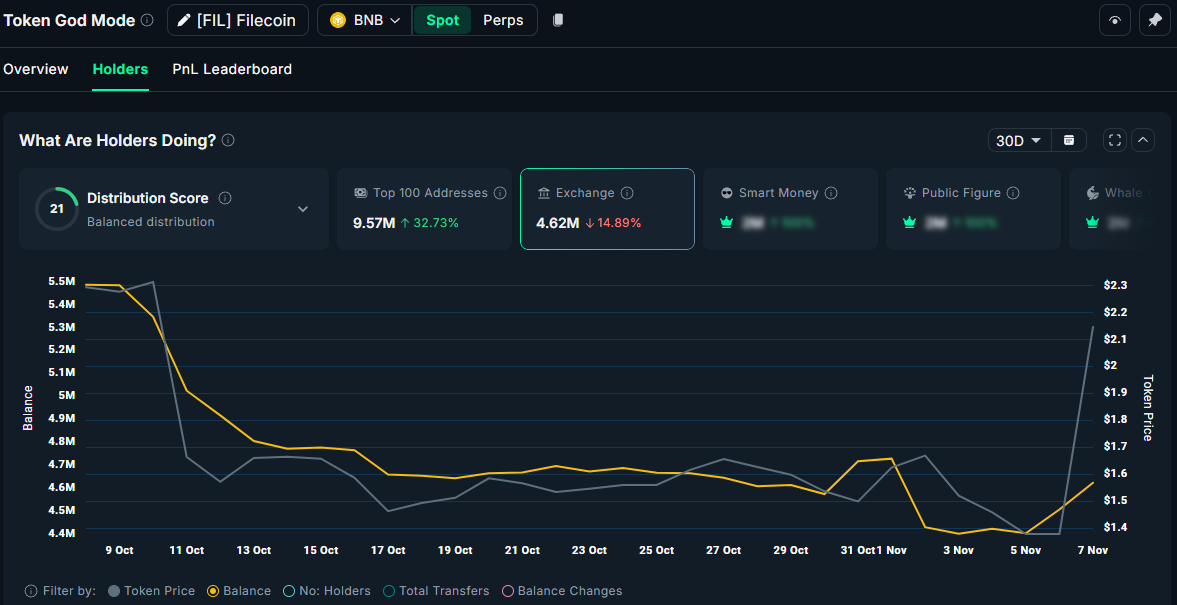

Filecoin Supply on Exchanges. Source:

Filecoin Supply on Exchanges. Source:

Additionally, Nansen data reveals that top FIL whale wallets have accumulated over 32% more tokens in the past month, while the available FIL balance on exchanges has dropped by nearly 15%.

These positive signals have led analysts to predict further price increases. CryptoBoss expects FIL to surpass $2.5 soon and potentially reach $5.

$FIL flip 2.5 and 5$ is next. Send it

— CryptoBoss (@CryptoBoss1984)

2. BitTorrent (BTT)

BitTorrent (BTT) is a decentralized data-sharing platform built on blockchain technology and the BitTorrent protocol — one of the world’s oldest and most popular peer-to-peer (P2P) file-sharing systems.

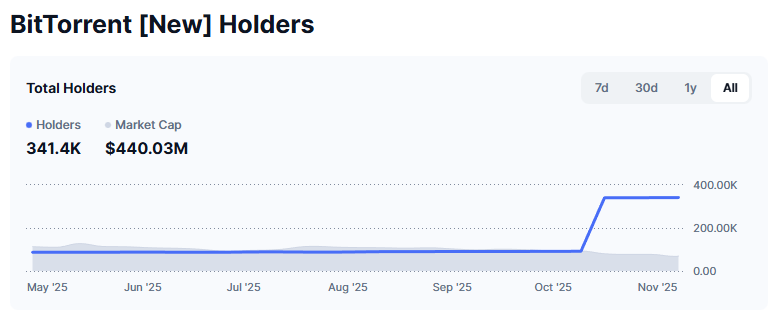

BTT stands out in this list due to significant changes in its holder data during the fourth quarter.

In October, the number of BTT holders was around 91,000, but by November it had surged to 341,000.

BitTorrent Holders. Source:

BitTorrent Holders. Source:

Since June, the available BTT balance on exchanges has fallen by more than 6%, while the top 100 wallets have increased their holdings by 5.8%.

BTT Supply on Exchanges. Source:

BTT Supply on Exchanges. Source:

These figures indicate that investors are actively accumulating BTT, despite the token’s 50% decline over the past year.

If this accumulation trend continues and investor interest in Storage Coins remains high, BTT could have room for recovery.

3. Storj (STORJ)

Alongside Filecoin, Storj was one of the decentralized storage projects highlighted in NVIDIA’s report late last year.

Santiment data shows that despite STORJ’s prolonged downtrend, the number of holders continues to climb, reaching a record high of over 103,000 in November.

Total Amount of STORJ Holders. Source:

Total Amount of STORJ Holders. Source:

The token price has also risen more than 20% in the past 24 hours, signaling renewed optimism among investors. Analysts have observed a rotation of capital into Storage Coins, and STORJ may be one of the next beneficiaries.

“It’s evident that the storage narrative has started. First ICP > FIL > AR > Storj. Storj looks like a top play among low caps with maximum ROI potential,” investor The BitWhale predicted.

The key question now is how strong and how long the Storage Coin trend will last. All of these projects share a common risk — many holders are still stuck at high entry prices from the previous cycle. They may be ready to move tokens back to exchanges and exit if prices recover.

Read the article at BeInCrypto

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

300% Gains in Just Days: Discover Why Experts Crown ZKP the Best Crypto to Buy Over Solana and Zcash

From Anonymity to Selective Disclosure: The Next Era of Privacy Coins

Shiba Inu (SHIB) Price Alert: Bulls Lose Control as Popular Indicator Signals 14% Drop

803,780,000 XRP Now Locked in ETFs as Major Repricing Looms