Grayscale’s Filecoin (FIL) Holdings Hit Record High as Price Shows Signs of Recovery

Filecoin’s price recovery in November 2025 reflects rising confidence in decentralized storage solutions. With Grayscale expanding its FIL holdings and trading volumes soaring, institutional and retail investors are betting on FIL’s long-term relevance in the AI and DePIN sectors.

Filecoin (FIL), a leading cryptocurrency in the decentralized storage sector, is showing strong signs of recovery in November 2025. Although the price remains far below the peak of its previous cycle, market sentiment has clearly shifted. Investors are now focusing more on projects with real-world applications.

What’s driving investors’ optimism about FIL’s future? Here are some notable points.

Filecoin Trading Demand Surges in November

Filecoin (FIL) is a decentralized blockchain project designed to create an open data storage marketplace. It enables users to rent or lease storage capacity globally, eliminating the need for centralized providers like Google Drive, Amazon S3, or Dropbox.

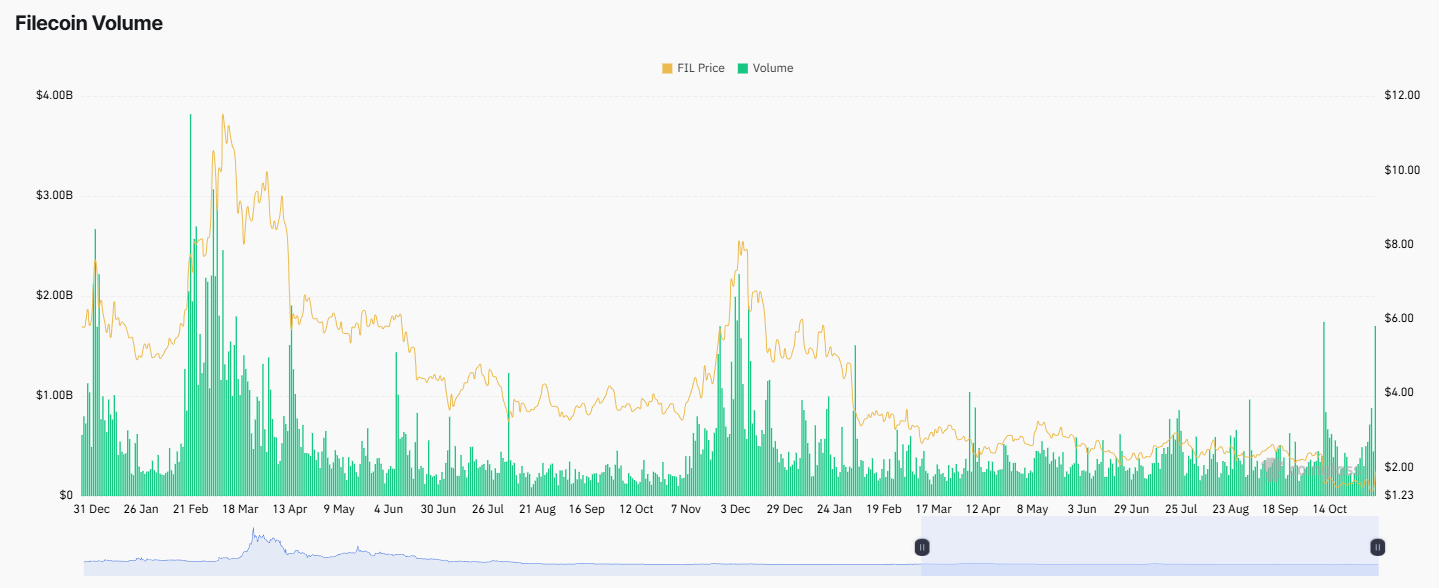

According to BeInCrypto data, Filecoin’s price surged nearly 60% during the first week of November, with 24-hour trading volume exceeding $1.4 billion.

Filecoin Price & Volume. Source:

Coinglass

Filecoin Price & Volume. Source:

Coinglass

Historically, such high trading volumes have only occurred a few times in the past two years. Each time the volume exceeded $1 billion, it was followed by a strong price rally, as seen in February 2024 and December 2024.

The return of billion-dollar daily trading volume in November reflects rising market activity and renewed investor interest. Market sentiment has also shifted dramatically.

Investors are increasingly favoring projects with practical use cases that have survived multiple cycles. This trend explains the recent gains in altcoins such as Zcash (ZEC), Dash (DASH), and Internet Computer (ICP).

“Look, Filecoin woke up after months of silence. Up more than fifty percent in twenty-four hours as DePIN and AI storage narratives collide. For years people dismissed it as outdated infrastructure, but the truth is AI needs storage that’s massive, decentralized, and fast. FIL was built for that before it was cool,” investor Justin Wu said.

Grayscale’s Filecoin (FIL) Holdings Reach New High

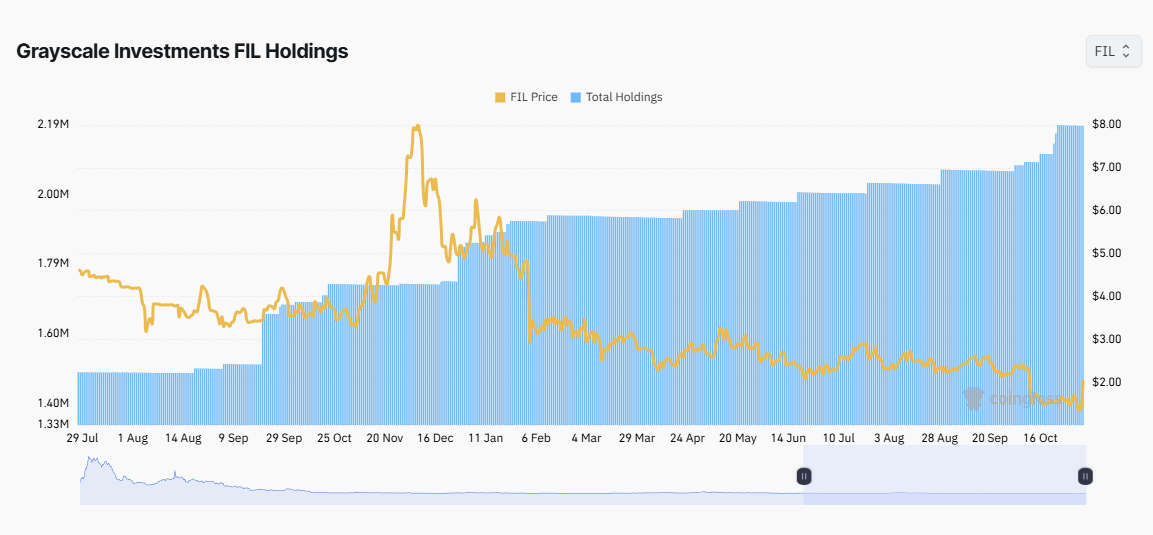

Further evidence of Filecoin’s growing recognition can be seen in Grayscale’s actions. Grayscale Investments — one of the world’s largest crypto funds — has been steadily accumulating FIL over the past two years. In November, its holdings reached an all-time high of more than 2.2 million tokens.

Grayscale Investment FIL Holding. Source:

Coinglass

Grayscale Investment FIL Holding. Source:

Coinglass

Interestingly, Grayscale continued to increase its FIL position even as the token’s price fell from above $10 to below $2. For the fund, the decline appeared to be an opportunity to accumulate more of this altcoin.

The Grayscale Filecoin Trust is one of the first investment vehicles allowing investors to gain exposure to Filecoin (FIL) in the form of a security. It offers a way to participate in FIL’s performance without dealing directly with the challenges of purchasing, storing, or safeguarding the token.

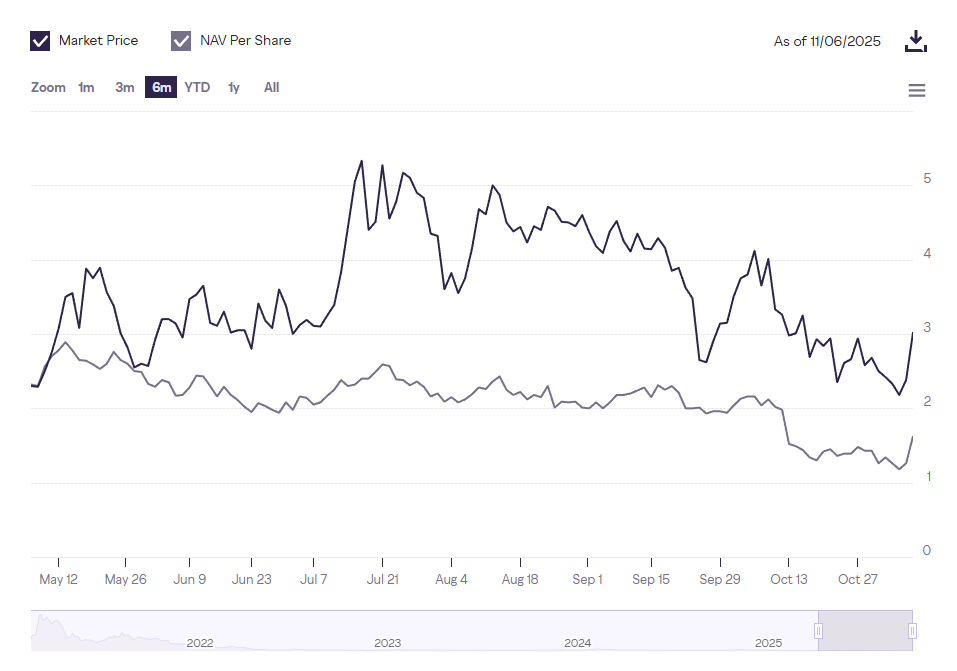

The Grayscale Filecoin Trust Performance. Source:

Grayscale

The Grayscale Filecoin Trust Performance. Source:

Grayscale

Currently, the Grayscale Filecoin Trust trades above $3 per share — higher than FIL’s spot market price. Meanwhile, its NAV per share remains lower than the trust market price, a situation that has persisted for years. This means the trust’s shares are trading at a premium, implying that investors are willing to pay more than the actual value of the assets held by the fund.

Analysts suggest that institutional investors often accept such premiums because they believe the underlying asset is worth that price — or potentially even more.

Despite these positive signals, Galaxy Research reports that FIL remains one of the worst-performing altcoins among the top 100, having fallen as much as 99% from its peak. The recovery journey, therefore, may take time and is unlikely to happen overnight.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Update: Significant Leverage, Limited Liquidity: POPCAT's $5 Million DeFi Breach

- Hyperliquid suffered a $4.9M loss after a trader manipulated Solana-based memecoin POPCAT through leveraged long positions and a sudden price crash. - The attacker used $3M in USDC from OKX to create a $20–30M leveraged position, inflating POPCAT’s price before triggering cascading liquidations. - Hyperliquid paused its Arbitrum bridge to stabilize the platform, highlighting vulnerabilities in DeFi’s automated liquidation systems and low-liquidity markets. - Experts warn such attacks expose DeFi risks, u

Vitalik Buterin's Advances in Zero-Knowledge Technology and the Prospects for Blockchain Scalability: An Investment Outlook for 2025

- Vitalik Buterin's GKR protocol breakthrough reduces ZK verification costs by 10-15x, enabling 43,000 TPS on ZKsync with near-zero fees. - ZK Layer 2 market grows at 60.7% CAGR to $90B by 2031, driven by Ethereum's "Lean Ethereum" optimizations and institutional adoption. - ZKsync, StarkNet, and Immutable lead DeFi/gaming expansion, but face regulatory risks (Zcash scrutiny) and technical barriers to mass adoption. - Investors must balance ZK's scalability potential with execution risks, regulatory uncert

Vitalik Buterin Supports ZKsync and the Advancement of Scalable Blockchain Technology

- Vitalik Buterin endorsed ZKsync's Atlas upgrade, boosting its market profile as Ethereum's scalability solution. - ZKsync now achieves 15,000 TPS, 1-second finality, and real-time Ethereum liquidity access, outperforming Layer-2 rivals. - The ZK token surged 50% post-endorsement, with growing institutional adoption and RWA integration as key drivers. - ZKsync's zero-knowledge proofs and decentralized governance model position it as a leader in secure, scalable blockchain infrastructure.

Bitcoin News Update: Clearer Regulations and Growing Institutional Interest Propel Crypto Market to $2.4 Trillion as Industry Evolves

- U.S. crypto market surges to $2.4T as institutional adoption, regulatory clarity, and macro optimism drive gains. - Bitcoin and Ethereum rebound post-government shutdown, with crypto-linked stocks like SBET and GLXY rising 3-5% pre-market. - Regulatory frameworks like CLARITY Act and Project Crypto aim to resolve ambiguity, boosting institutional confidence. - Analysts caution volatility risks despite ETF inflows and blockchain adoption milestones, urging diversified long-term strategies.