Bitcoin News Today: Bitcoin Faces $109K Support Challenge: Falling Below May Trigger Drop to $93K, Holding Steady Could Lead to $107K

Bitcoin's ability to remain above $100,000 has become a major point of interest among traders. However, experts caution that the $109,200 support area could be pivotal in determining whether the cryptocurrency maintains its current levels or experiences a sharper pullback, as highlighted in a

Ethereum (ETH) is currently in a fragile technical position, with sellers recently pushing the price below the $3,350 support, indicating renewed downward momentum, as per

XRP's recent price movement has echoed Ethereum's challenges, having dropped below the $2.19 support and now testing the $1.61 mark, according to Cointelegraph price predictions. The coin's consolidation around $2.20 may indicate an accumulation phase, further supported by Ripple's choice to keep 25% of its tokens—a decision analysts see as a sign of confidence in future demand, as suggested by the Coinpedia analysis. Still, if XRP falls below $2.00, it could head toward $1.70, while a move above the 20-day EMA ($2.46) could renew buying interest, based on Cointelegraph's outlook.

The overall crypto market remains cautious, with a total market cap of $3.71 trillion, a Fear & Greed Index at 33 (indicating extreme fear), and an average RSI of 46.3, according to the Coinpedia price prediction.

Despite the current bearish mood, institutional involvement and historical seasonal patterns may provide some optimism. Bitcoin's average return of 42.5% in November since 2013, along with its proximity to important moving averages, could set the stage for a late-month rally if buyers defend the $109,200 level, according to the Coinpedia price prediction. For

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

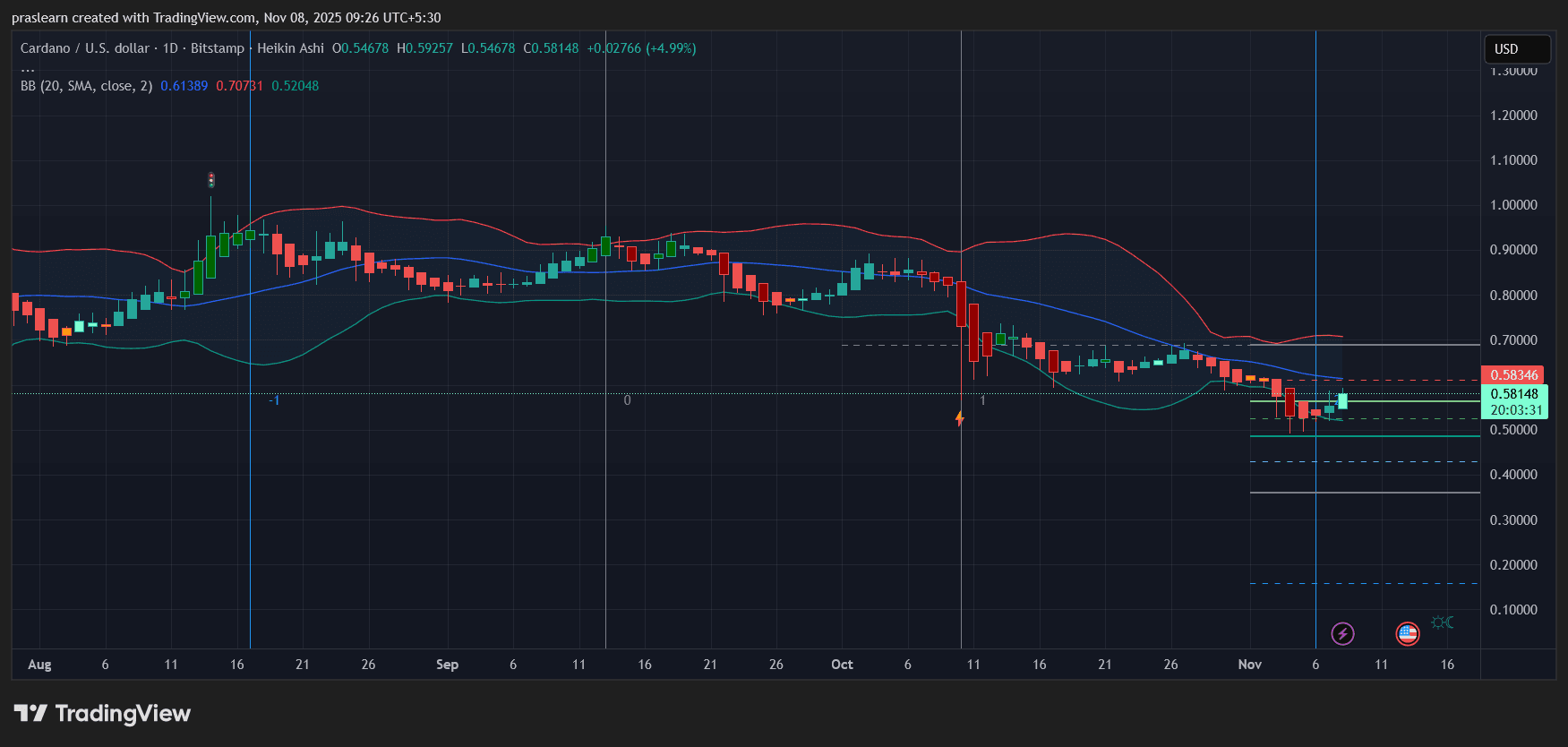

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res