Date: Fri, Nov 07, 2025 | 05:40 AM GMT

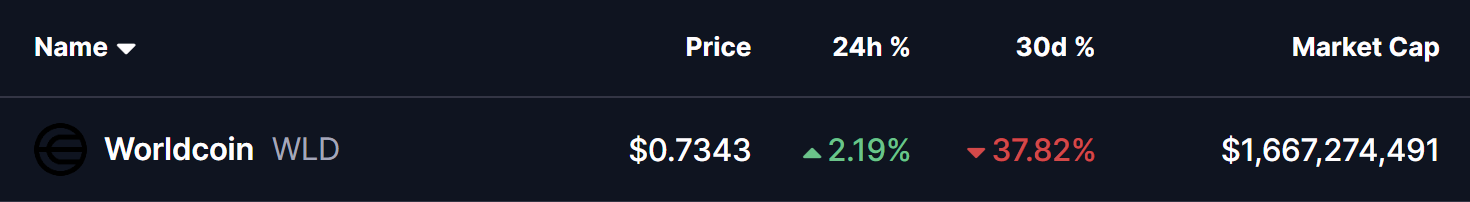

In the cryptocurrency market, both Bitcoin (BTC) and Ethereum (ETH) are trading in the red today with a 1% decline. However, despite the broader weakness, some notable altcoins are showing signs of strength — including Worldcoin (WLD).

WLD has turned green today but still records a sharp 37% drop over the past month. That said, its current technical setup is hinting at a potential short-term rebound, as the token continues to hold a crucial support zone that could determine its next major move.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Broadening Wedge in Play

On the 4-hour chart, WLD remains inside a descending broadening wedge, a bullish reversal pattern commonly seen during extended corrective phases.

During the latest pullback, WLD was rejected from the wedge’s upper boundary near $0.8960, sending it down to the lower trendline around $0.6529. Encouragingly, buyers stepped in right at this key zone, pushing the price back up to $0.7343, where the token now trades above the wedge support and its recent lows.

Worldcoin (WLD) 4H Chart/Coinsprobe (Source: Tradingview)

Worldcoin (WLD) 4H Chart/Coinsprobe (Source: Tradingview)

What’s Next for WLD?

If buyers continue to hold the lower wedge boundary, a decisive breakout above the wedge’s upper boundary would confirm a bullish continuation, opening the door for a stronger recovery toward the 200-day moving average (MA) at $0.9353 in the coming sessions.

However, any breakdown below $0.6529 would invalidate the bullish setup and could trigger further downside pressure, signaling that sellers have regained control.

For now, WLD’s outlook leans cautiously optimistic — the descending broadening wedge remains intact, and the recent support defense increases the odds of a rebound if broader market sentiment stabilizes.