Bitcoin miner hashprice nearing $40, miners back in 'survival mode': Report

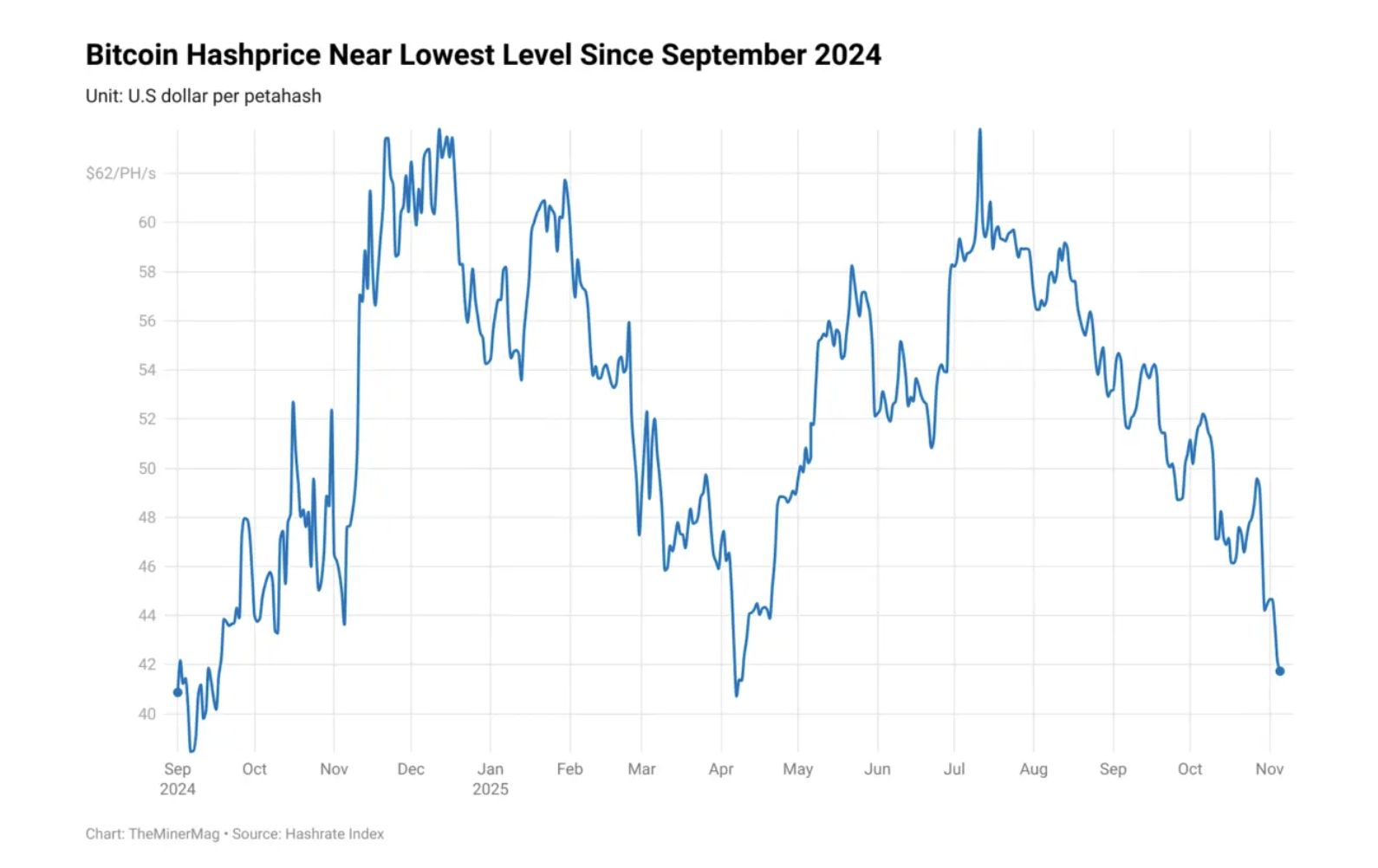

Bitcoin’s mining sector is under mounting pressure as the hash price, the industry’s key profitability metric, slips toward levels that could force smaller operators offline and strain the wider supply chain.

Hash price, which measures expected daily revenue per unit of computational power, is currently around $42 per petahash per second (PH/s). The metric has been in steady decline since July, when it surged above $62 per PH/s.

The push toward the $40 level leads Bitcoin mining operations, which are already facing razor-thin profit margins, to consider shutting down their rigs, according to TheMinerMag.

The decline in hash price is also affecting the mining supply chain. Hardware providers are filling fewer orders to struggling miners and are also taking a hit on any BTC-denominated sales due to the drop in price after the October market crash, the report said.

Mining hardware manufacturers, such as Bitdeer, have turned to self-mining to offset the shortfall in demand for mining machines.

The razor-thin profit margins, high capital expenditure on upgrading hardware and rising energy costs have caused many Bitcoin miners to pivot to AI and high-performance computing data centers to generate revenue as Bitcoin mining becomes more competitive.

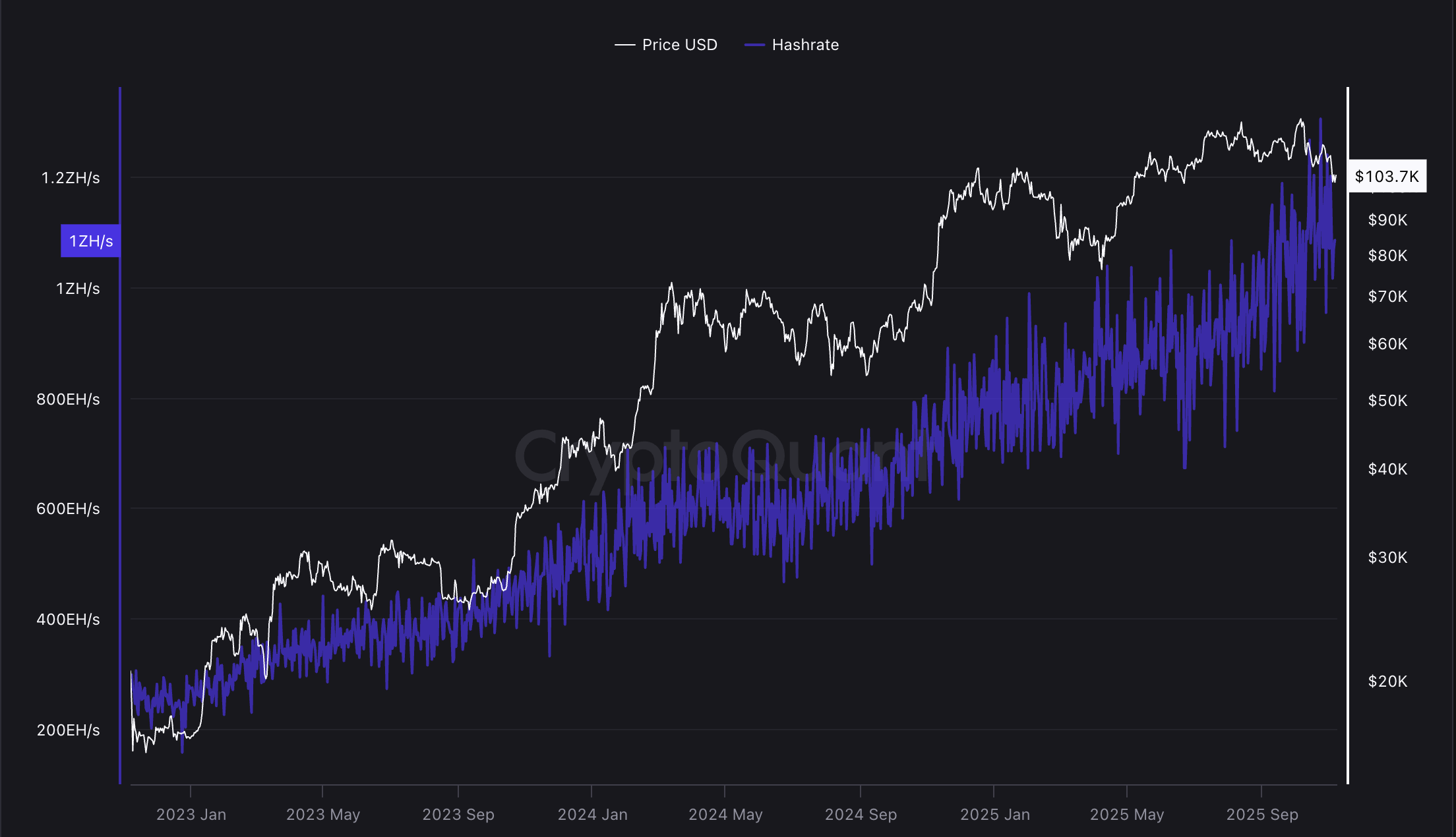

Miners pivot to AI amid constantly increasing hashrate

Bitcoin miners are guaranteed to have their rewards slashed by 50% every four years during the Bitcoin halving, as the computational power and electricity needed to mine blocks continue to climb.

The initial block reward for successfully mining a block in 2009 was 50 BTC, and node runners were mining BTC using CPUs on personal computers.

Following the April 2024 halving, the BTC block reward decreased to 3.125 BTC, and today, specialized mining hardware known as application-specific integrated circuits (ASICs) is required to mine BTC.

These challenging economics have forced many miners to diversify into adjacent AI data center and compute businesses, which have generated billions of dollars in revenue for companies that made the switch.

In October, Cipher Mining inked a $5.5 billion deal with tech giant Amazon to provide compute power to Amazon Web Services over a 15-year period.

IREN, a Bitcoin mining company, signed a similar deal with Microsoft in November to provide GPU computing services, valued at $9.7 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Internet Computer's Unexpected Rise in 2025: Will the Momentum Last or Is It Just Temporary Excitement?

- Dfinity's 2025 AI-driven upgrades and Caffeine tool triggered a 56% ICP price surge, boosting trading volume by 131%. - Partnerships with Microsoft and Google Cloud enhance ICP's scalability, addressing blockchain interoperability challenges. - Speculation about Coinbase listing and $1.14B trading volume highlight institutional interest, aligning with Coinbase's 2025 strategy. - Regulatory scrutiny and recent 11% price drop underscore risks, questioning ICP's sustainability amid AI-blockchain convergence.

Bitcoin Updates: The Two Sides of Leverage—A Whale Faces $3 Million Loss While an Insurer Gains €1.12 Billion

- Unipol Assicurazioni (UNI) reported €1.12B net profit in Q1-Q3 2025, driven by BPR Banca gains and strong life/property segments despite market shifts. - Crypto whale "BTC OG" incurred $3M unrealized loss on leveraged BTC/ETH longs, contrasting UNI's stability amid volatile leveraged trading risks. - UNI's 158% solvency ratio and cost-cutting/digital transformation efforts highlight traditional insurers' resilience versus crypto's amplified market sensitivity. - Divergent outcomes underscore institutiona

Uniswap News Today: Uniswap's 100 Million UNI Token Burn Sparks 38% Rally as Deflationary Changes Transform DeFi

- Uniswap's UNI token surged 38% after the Foundation and Labs launched the "UNIfication" governance overhaul, activating protocol fees and token burns. - The proposal includes a 100M UNI retroactive burn (16% of supply), fee redirection to deflationary mechanisms, and a 20M UNI Growth Budget for DeFi innovation. - Structural changes consolidate teams under Uniswap Labs, eliminate interface fees, and establish a 5-member board to align governance with DUNA's decentralized framework. - Market reaction saw U

Solana's Value Soars: Key Factors Fueling Investor Confidence Toward the End of 2025

- Solana (SOL) surges in late 2025 due to infrastructure upgrades, institutional adoption, and strong on-chain metrics. - Firedancer validator client boosts TPS to 1M+, while Alpenglow aims for sub-second finality, enhancing scalability for real-time finance. - Institutional holdings of SOL jump 841% to 16M tokens, with Visa and R3 partnerships validating its role in cross-chain global finance. - Network records 17.2M active addresses and 543M weekly transactions, maintaining 8% DeFi market share despite b