NFT sales plunge 14% to $84m, CryptoPunks sales drop 25%

NFT sales volume has fallen by 14.06% to $84.44 million, down from last week’s $98.18 million.

- NFT sales volume dropped 14% to $84.44m as Bitcoin and Ethereum prices weakened.

- Buyer participation plunged 96%, showing one of the sharpest drops

- DMarket led with $6.88M in sales, while top Ethereum collections like BAYC declined.

According to CryptoSlam data, market participation has seen a notable drop, with NFT buyers plunging by 96.76% to just 20,302 and sellers dropping by 95.05% to 23,241. NFT transactions declined by 4.21% to 1,405,561.

This is happening at a time when the Bitcoin ( BTC ) price has slumped to the $102,000 level as market pressure intensifies.

Ethereum ( ETH ) has lost the $3,400 level, and the global crypto market cap has contracted to $3.48 trillion, down from last week’s $3.71 trillion.

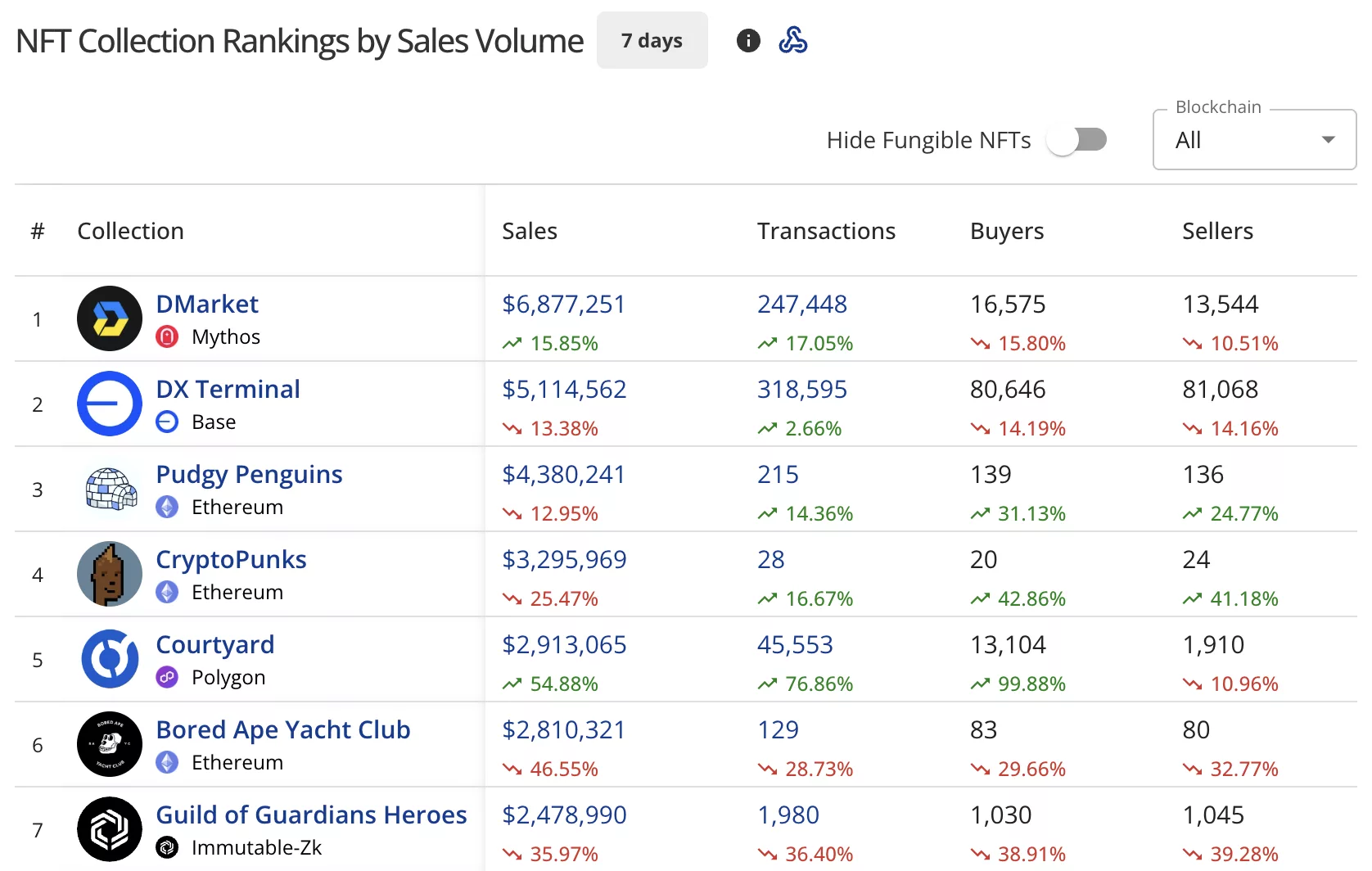

DMarket climbs as major collections retreat

DMarket on the Mythos blockchain has extended its lead with $6.88 million in sales, up 15.85% from last week’s $5.92 million. The collection processed 247,448 transactions and attracted 16,575 buyers and 13,544 sellers.

DX Terminal on Base remained in second place at $5.11 million, down 13.38% from last week’s $5.62 million. The collection recorded 318,595 transactions with 80,646 buyers and 81,068 sellers.

Pudgy Penguins held third position with $4.38 million, down 12.95% from last week’s $4.85 million. The Ethereum collection saw 215 transactions with 139 buyers and 136 sellers.

Source: Top collections by NFT Sales Volume

Source: Top collections by NFT Sales Volume

CryptoPunks dropped to fourth with $3.30 million, falling 25.47% from last week’s $3.79 million. The collection had just 28 transactions with 20 buyers and 24 sellers.

Courtyard on Polygon ( POL ) surged into fifth place with $2.91 million, up 54.88%. The collection processed 45,553 transactions with 13,104 buyers and 1,910 sellers.

Bored Ape Yacht Club tumbled to sixth at $2.81 million, down 46.55% from last week’s $5.22 million. The collection recorded 129 transactions with 83 buyers and 80 sellers.

Guild of Guardians Heroes rounded out the top seven with $2.48 million, down 35.97% from last week’s $3.88 million.

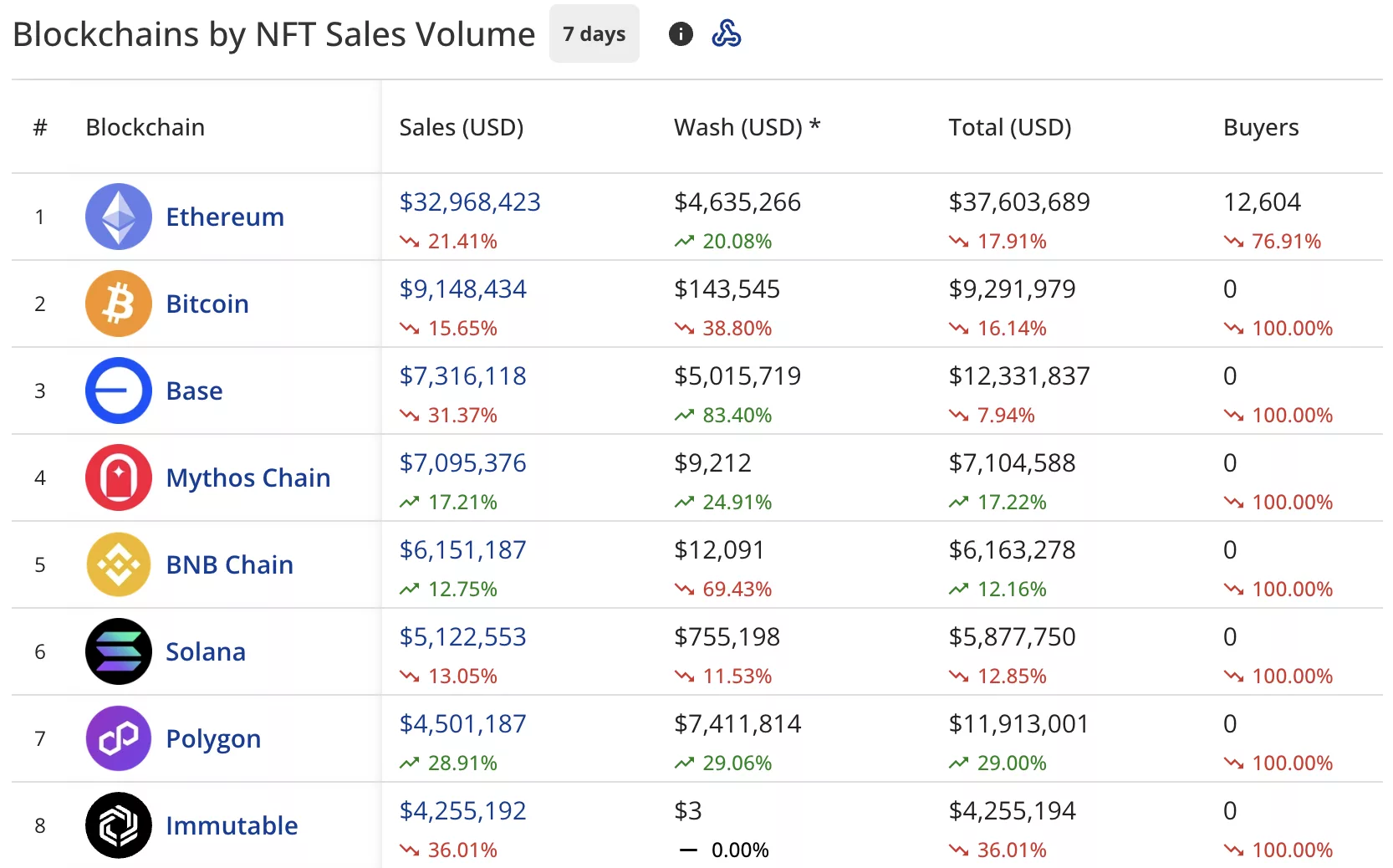

Ethereum slides as buyer data shows anomalies

Ethereum maintained first position with $32.97 million in sales, down 21.41% from last week’s $41.72 million.

The network recorded $4.64 million in wash trading, bringing its total to $37.60 million. Buyers fell sharply by 76.91% to 12,604.

Bitcoin held second place with $9.15 million, down 15.65% from last week’s $11.55 million. The network recorded zero buyers, down 100.00%.

Base dropped to third with $7.32 million, down 31.37% from last week’s $10.36 million. The blockchain recorded $5.02 million in wash trading, with zero buyers reported.

Source: Blockchains by NFT Sales Volume

Source: Blockchains by NFT Sales Volume

Mythos Chain climbed to fourth at $7.10 million, up 17.21% from last week’s $6.09 million. The blockchain showed zero buyers, up from 46,981 last week.

BNB Chain ( BNB ) secured fifth position with $6.15 million, up 12.75% from last week’s $5.25 million. Zero buyers were recorded.

Solana ( SOL ) placed sixth at $5.12 million, down 13.05% from last week’s $6.16 million, also with zero buyers.

Polygon entered the rankings at seventh with $4.50 million, up 28.91%. The blockchain recorded $7.41 million in wash trading, bringing its total to $11.91 million.

Immutable ( IMX ) landed in eighth at $4.26 million, down 36.01% from last week’s $6.56 million.

CryptoPunks lead top sales

CryptoPunks dominated the top individual sales, claiming all five positions:

- CryptoPunks #8295 led at $196,275.14 (54.69 ETH), sold four days ago.

- CryptoPunks #5361 placed second at $173,369.70 (45 ETH), sold five days ago.

- CryptoPunks #5295 sold for $165,743.73 (49.99 ETH) two days ago.

- CryptoPunks #9537 fetched $160,023.86 (41.5 ETH) five days ago.

- CryptoPunks #2845 completed the top five at $151,059.23 (39 ETH), sold six days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI’s Bold Bet: Some Soar While Others Falter Amid Turbulent Tech Transformation

- AI sector volatility highlights divergent outcomes as firms adopt agentic AI systems, with SoundHound AI and Rightmove exemplifying contrasting success and risk. - SoundHound AI's Red Lobster partnership and margin improvements reduced risk perception despite high valuation, driving analyst optimism about enterprise AI adoption. - Rightmove's 25% stock plunge followed AI investment plans that slashed 2026 profit forecasts, reflecting investor skepticism toward short-term profitability trade-offs. - C3.ai

Bitcoin News Update: Nationalist Cryptocurrency Fraud Cons People Out of $6.5 Billion, Affecting 128,000

- Chinese "Cryptoqueen" Zhimin Qian faces UK sentencing for orchestrating a $6.5B Bitcoin Ponzi scheme targeting 128,000 victims, including elderly investors. - Her Lantian Gerui company used patriotic marketing and false 200% returns promises, with proceeds funding a £17,000/month London mansion and £6B in seized crypto assets. - UK authorities seized 61,000 BTC (worth $6B) and are pursuing asset recovery, as Qian's case highlights risks of unregulated crypto investments amid global regulatory crackdowns.

Pi Network’s Mainnet: Evolving from Smartphone Mining to an AI-Powered Blockchain Platform

- Pi Network's Testnet 1 achieves near-zero transaction failures, accelerating Mainnet v23 launch after successful high-volume stress tests. - Price jumps 3.5% as AI integration with OpenMind and decentralized computing prove scalability, while KYC streamlining boosts user onboarding. - Upcoming Mainnet will enable smart contracts and DeFi tools, but faces challenges including 10% price decline and only 296 active nodes currently operational.

a16z Elevates Wuollet to Lead Crypto Regulatory Affairs and Drive Innovation Strategy

- Andreessen Horowitz promoted Guy Wuollet to crypto general partner, focusing on infrastructure, DeFi, and DePIN to drive blockchain innovation. - U.S. regulatory clarity on crypto ETP staking and CFTC discussions on domestic spot trading align with a16z's advocacy for market-friendly policies. - The firm's investments in projects like Pakistan's ZAR stablecoin and stakes in Solana/EigenLayer highlight its strategy to bridge traditional and decentralized finance. - Wuollet's track record of 20+ crypto inv