The November 2025 Bitcoin Leverage Liquidation Event: Exposing Systemic Vulnerabilities in DeFi Lending and Margin Trading

- The 2025 Bitcoin leverage liquidation crisis exposed critical DeFi vulnerabilities, triggering $1.3B in liquidations and destabilizing protocols like Balancer and Stream Finance. - Exploits in stable pools and opaque Curator models caused $160M in frozen funds, with Euler facing $137M in bad debt after Stream Finance's xUSD collapse. - Experts warn of systemic risks as DeFi's interconnectedness amplifies failures, while solutions like RedStone's Credora aim to address real-time credit monitoring gaps. -

Bitcoin’s sharp 17% drop to $103,000 in the wake of the Balancer hack intensified the crisis, causing over $1.3 billion in forced liquidations and pushing leading altcoins into bearish territory, as noted in a

A major contributor to the crisis was the opaque Curator model used by platforms such as Euler and Morpho. These protocols enabled off-chain strategies to deliver high annual yields, but the lack of visibility created risks similar to peer-to-peer lending. The downfall of Stream Finance, set off by the liquidation of an external Curator’s positions during market swings, resulted in $160 million of user assets being frozen and $137 million in bad debt for Euler, according to the

The aftermath also exposed the shortcomings of conventional risk management approaches. Even with repeated audits, protocols remained susceptible to advanced attacks, underscoring the importance of real-time monitoring. RedStone’s Credora platform has been highlighted as a possible answer, providing live credit and collateral tracking to help prevent future domino effects, as outlined in the

As DeFi continues to confront these obstacles, the events of November 2025 stand as a stark warning about the systemic dangers present in interconnected, lightly regulated environments. Both investors and regulators must focus on improving transparency, conducting stress tests, and fostering collaboration across protocols to prevent future disasters.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

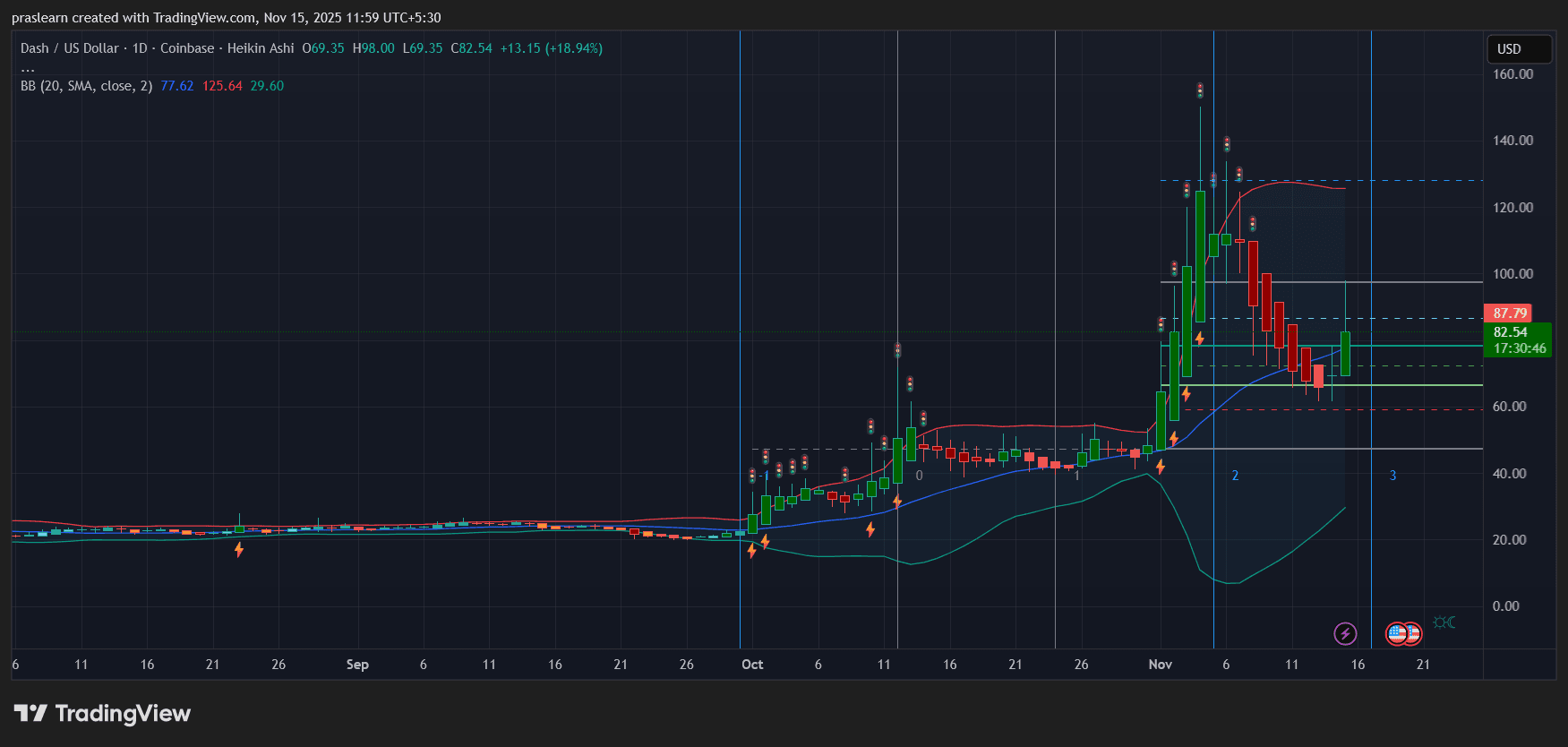

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce