Hyperliquid’s Push Into Lending Meets Rising Security Risks From Fake App

The fake Hyperliquid app has already stolen more than $281,000, underscoring the vulnerability of traders as official mobile support remains absent.

Hyperliquid is experimenting with a borrowing and lending module on its Hypercore testnet, signaling a potential expansion of the platform’s core offering.

The development surfaced after on-chain researcher MLM noted that the team has begun running tests for a feature labeled BLP, which he believes stands for BorrowLendingProtocol.

Is Hyperliquid Exploring a Native Lending Market?

His finding suggests that Hyperliquid may be preparing to introduce a native money-market layer on Hypercore. This layer would support borrowing, supplying, and withdrawing assets.

MLM said the testnet version of BLP currently lists only USDC and PURR, but he noted that even limited asset support creates a foundation for something larger.

The Hyperliquid team is currently testing something called BLP on the Hypercore testnet – which I assume stands for BorrowLendingProtocol. It appears to be a native borrowing and lending market on Hypercore, with functions like borrowing, supplying, and withdrawing.Currently,…

— MLM (@mlmabc) November 8, 2025

He argued that integrating a lending layer could help Hyperliquid introduce multi-margin trading more safely. In his view, margin positions would sit on top of verifiable lending pools rather than isolated balance sheets.

That architecture would mirror systems already used across established DeFi money markets and could make leverage more transparent for traders.

If rolled out, this feature would expand Hyperliquid’s footprint beyond perpetuals and provide users with access to DeFi functions currently missing from the ecosystem.

The move could also consolidate activity on a single platform, creating a more integrated trading environment for users who now rely on external lending markets.

Fake Hyperliquid App Sparks Security Concerns

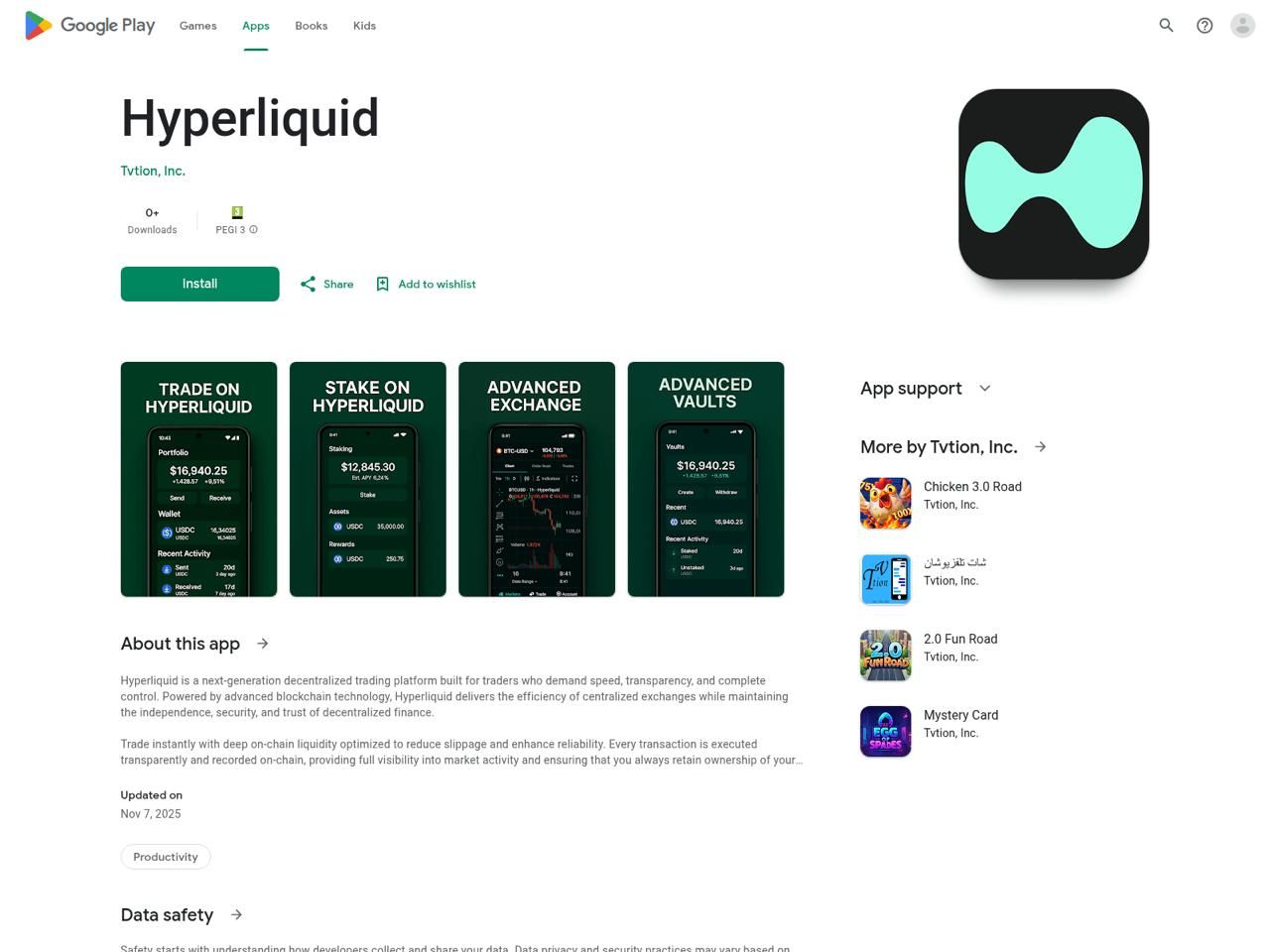

While the team experiments with new functionality, Hyperliquid users are battling a separate threat: a fraudulent mobile application that has appeared on the Google Play Store.

The app mimics Hyperliquid’s branding despite the exchange not offering an official Android or iOS product. Its presence has raised questions about app-store screening standards, especially as users increasingly rely on mobile platforms for financial activity.

Crypto investigator ZachXBT warned that the fake app is designed to steal funds by phishing wallet credentials and private keys.

He identified an Ethereum address linked to the operation that has already collected more than $281,000 in stolen assets. His alert prompted users to check recent downloads and revoke permissions to avoid further losses.

Fake Hyperliquid App On Google Play Store

Fake Hyperliquid App On Google Play Store

The fake listing fits into a broader pattern. Several malicious developers have created look-alike applications for projects such as SushiSwap and PancakeSwap, exploiting the convenience of mobile access to mislead users.

Scammers often combine these apps with sponsored ads on Google, ensuring that fraudulent links appear above legitimate search results. This increases the likelihood that unsuspecting users click through.

As Hyperliquid experiments with new infrastructure and users search for easier access points, the coordinated wave of impersonation attempts highlights a persistent risk.

Attackers continue to target platforms as they grow, and users remain vulnerable when official mobile apps do not exist.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC Faces DeFi Turning Point: Selig Advocates for Regulation that Encourages Innovation

- Michael Selig, Trump's CFTC nominee, defended innovation-friendly DeFi regulation during a Senate hearing, warning rigid rules could drive activity offshore. - CFTC faces leadership vacuum with only acting Chair Caroline Pham, raising bipartisan concerns over regulatory clarity and legal risks from unconfirmed vacancies. - Selig advocated tailored on-chain application regulation, aligning with Senate Republicans who argue CFTC alone should oversee digital commodities trading. - Congressional repeal of IR

XRP News Today: XRP ETFs Fail to Halt Sell-Off; $1.55 Pullback on the Horizon

- XRP faces 25% correction risk to $1.55 despite first U.S. spot ETFs (XRPC/EZRP) failing to stabilize prices at $2.22. - Weak institutional demand, profit-taking by long-term holders, and fragile on-chain metrics drive bearish momentum. - Whale activity ($645M in transfers) and underwater token supply (41.5% at loss) amplify downward pressure post-ETF launch. - Technical indicators show XRP trading below key averages, with critical support at $2.07–$2.10 at risk of breakdown. - Ripple's ecosystem growth c

Bitcoin News Update: Quantum Threat Approaches—Cryptocurrency’s Urgent Quest for Survival

Adversaries Reportedly Received Voting Rights in Crypto Company Supported by Trump

- U.S. Senators Warren and Reed demand federal investigation into Trump-linked crypto firm WLF over alleged sales to sanctioned entities including North Korea, Russia, and Iran. - WLF denies claims, asserting "rigorous AML/KYC checks," but faces scrutiny for granting adversaries voting rights over its governance and Trump family's $3B stake in tokens. - Critics highlight conflicts of interest as Trump family members lead WLF while prioritizing token sales over compliance, alongside expansion plans involvin