- Trump’s tariff payout plan sparks brief crypto rally.

- Bitcoin hits $105K; Ethereum rebounds above $3,600.

- ETF inflows signal tentative institutional re-entry.

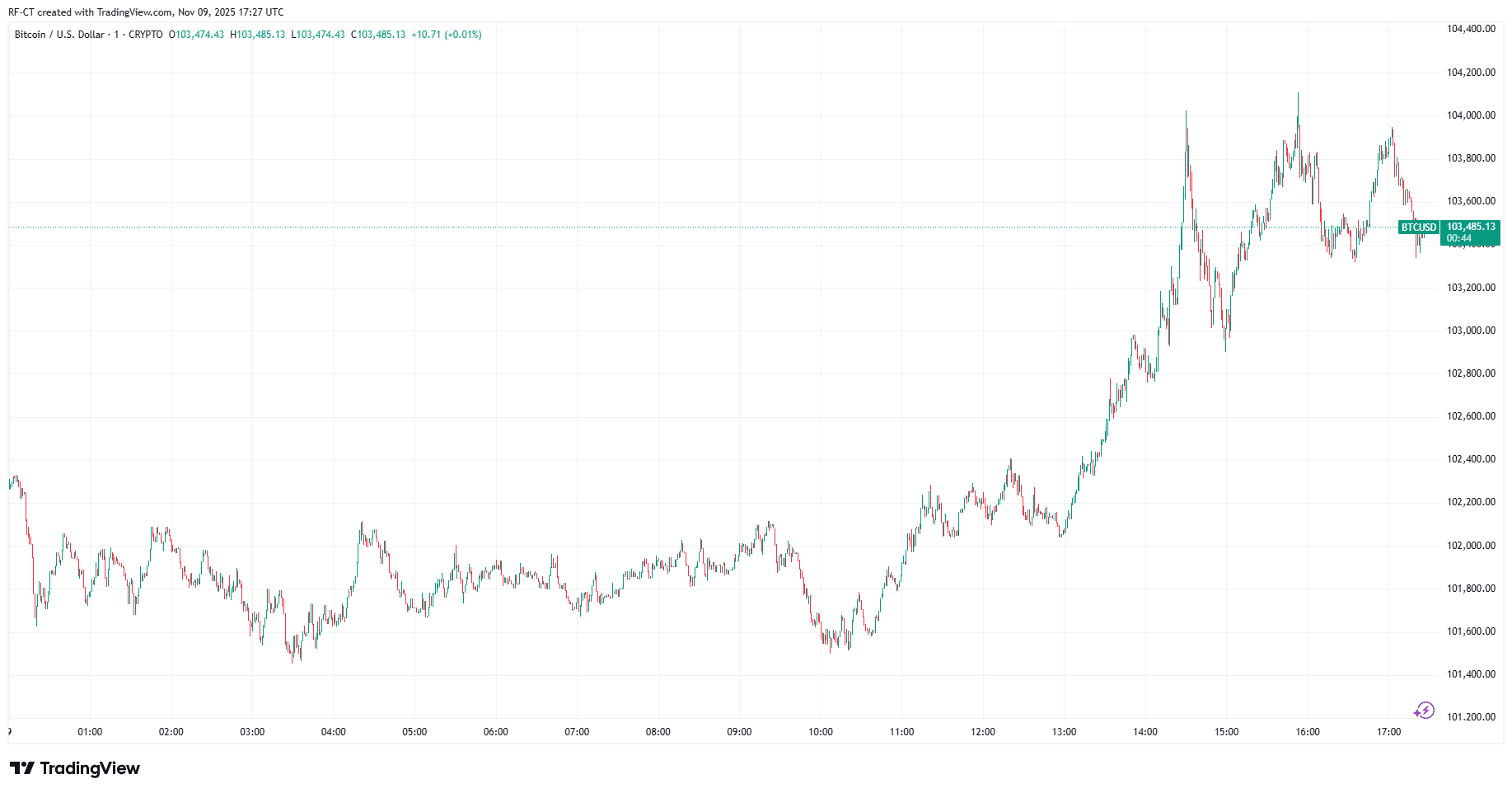

President Trump’s Sunday announcement promising at least $2,000 in tariff-funded payouts to most Americans jolted crypto out of its weekend doldrums.

Bitcoin rocketed to $105,000 while Ethereum climbed back above $3,600, as traders suddenly rediscovered their appetite for risk assets.

The CoinDesk 20 index snapped its brutal 15% weekly decline with the prospect of fresh stimulus money potentially flowing into digital currencies.

Bitcoin consolidates near $105K amid market fear

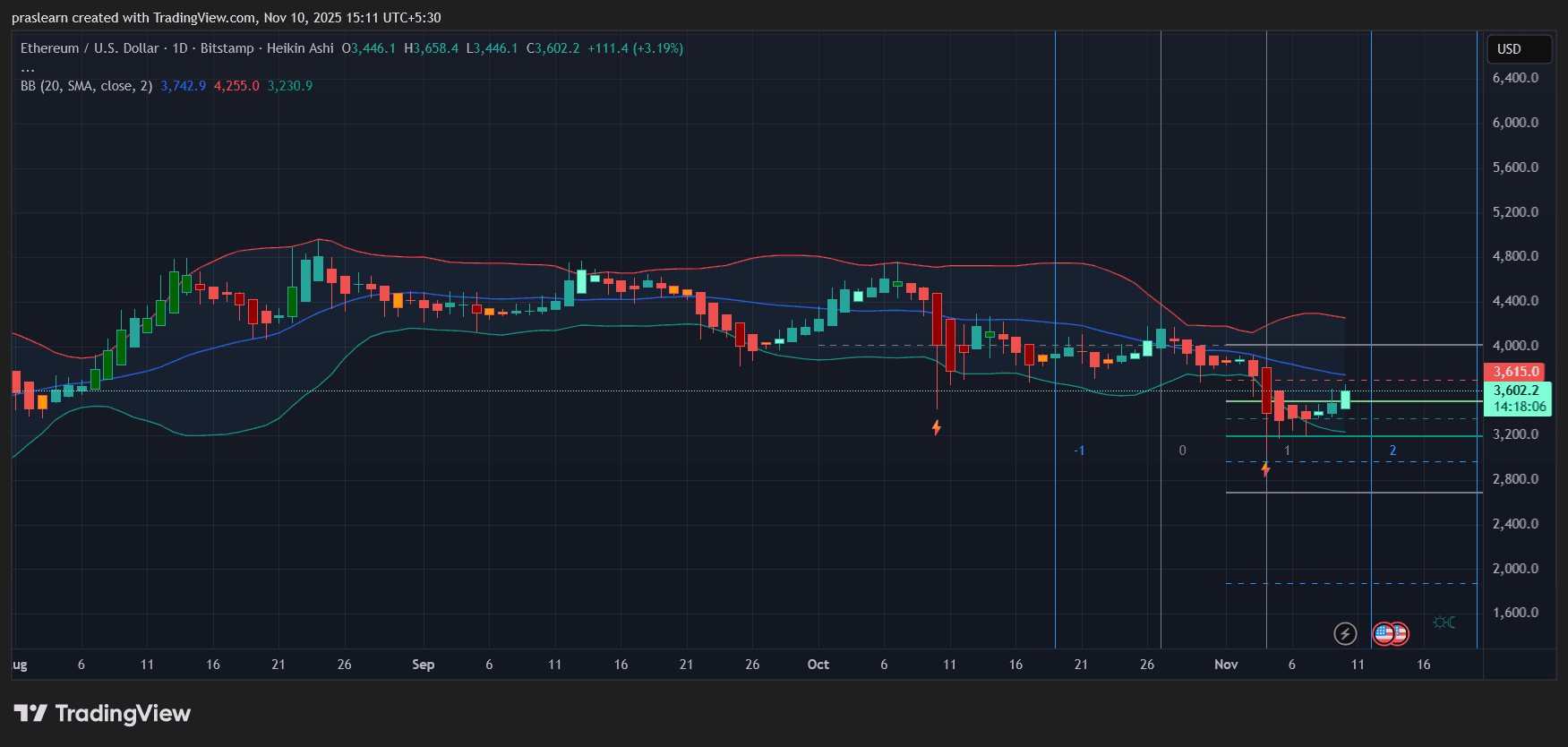

Ethereum jumped 7% to $3,631, wiping away three days of losses and signaling that institutional nervousness had finally eased, at least temporarily.

Solana posted a 6.08% gain to $167.36 as altcoin traders felt encouraged by Bitcoin’s renewed strength.

The broader picture shows recovery momentum. BNB climbed modestly, while XRP benefited from Bitcoin’s coattails as risk sentiment improved across the board.

The important detail here is that Bitcoin spot ETFs captured $252 million in fresh capital on November 6, ending a six-day outflow drought that had erased confidence across the entire market.

Ethereum ETFs added $12.5 million the same day, suggesting institutions were quietly accumulating during the weakness.

Importantly, these aren’t spectacular gains. They’re relief rallies. Bitcoin remains down 5.7% for the week while Ethereum sits 7.5% lower, despite Sunday’s bounce.

The market is essentially trying to recover from a self-inflicted wound rather than establishing genuine new momentum.

A week of pain and the road ahead

Last week was brutal. Bitcoin cratered below $100,000 for the first time since late June , triggering a wave of liquidations that sent $19 billion in leveraged positions to the exit at once.

Ethereum mirrored the weakness, sliding as institutional buyers vanished and retail capitulation accelerated.

The culprit was simple: nobody was buying anymore. Federal Reserve rate cuts that traders expected to fuel crypto demand simply didn’t materialize as catalysts.

Instead, the 10-year Treasury yield remained stubbornly above 4%, making speculative bets unattractive versus safer fixed-income plays.

Meanwhile, the US government shutdown drained liquidity from financial markets while lawmakers bickered over spending bills.

This week’s outlook hinges entirely on whether Trump’s tariff dividend actually happens.

If Congress approves it and the Supreme Court green-lights the tariff regime, crypto could enjoy sustained inflows as stimulus recipients hunt for inflation hedges.

But that’s two massive ifs. Budget experts already flagged that tariff revenues total roughly $90 billion after accounting for collateral tax damage, nowhere near the $300 billion needed for the payouts.

Traders are essentially betting on political miracles. Unless something changes quickly, expect Bitcoin to test $98,000 to $95,000 if support cracks at $100,000 again.

The rally feels good, but it’s built on hope rather than fundamentals.