Biopharma raises $100M for crypto treasury to back cancer treatment

Australia-based Propanc Biopharma has announced that it has secured $100 million from a crypto-focused family office to launch a crypto treasury — a move its CEO described as “transformative” as its cancer therapy product enters human trials next year.

The private placement, structured through convertible preferred stock, provides Propanc with an initial $1 million investment and up to $99 million in follow-on funding over the next 12 months from Hexstone Capital, a family office that invests in several crypto treasury companies.

The cancer-treating biotech company stated that the proceeds will be used to build a digital asset treasury and accelerate the development of its lead cancer therapy, PRP, which aims to enter first-in-human trials in the second half of 2026.

Propanc CEO James Nathanielsz said the crypto treasury would assist a “transformative phase” for the company by strengthening its balance sheet and advancing its proenzyme-based oncology platform.

“We can target not only patients suffering from metastatic cancer from solid tumors, but several chronic diseases based upon the mechanism of action of proenzyme therapy.”

While Propanc didn’t say which digital assets it plans to buy for its crypto treasury, Hexstone’s clients have invested in everything from Bitcoin (BTC), Ether (ETH), Solana (SOL), Injective (INJ) as well as some lesser-known cryptocurrencies.

Biotech companies adopting a crypto strategy

Propanc joins Sonnet BioTherapeutics, Sharps Technology and other biotech companies that have turned to crypto to reignite investor interest.

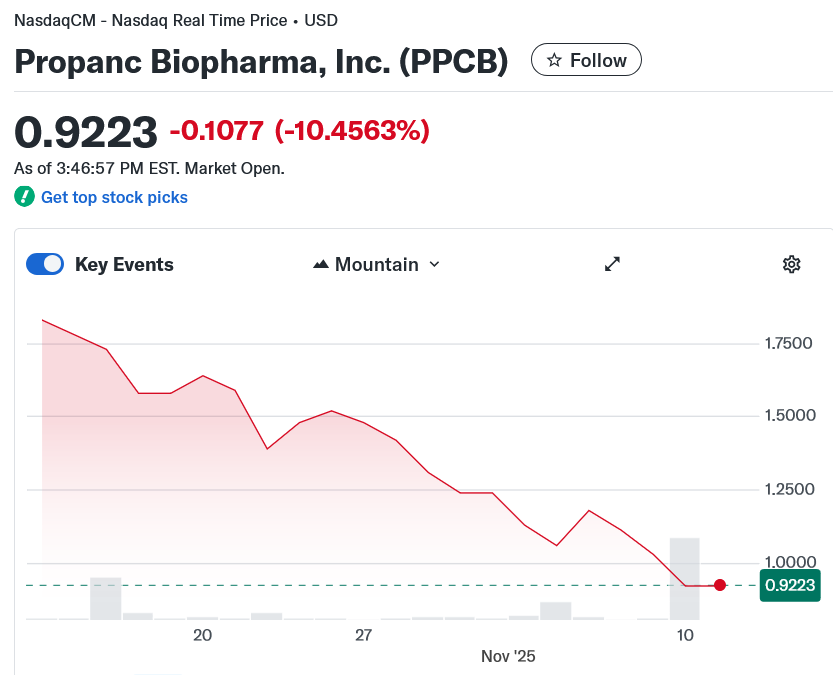

However, Propanc’s move was not received well by its investors, with PPCB shares diving 10.5% on the Nasdaq on Monday, according to Yahoo Finance data.

Crypto treasury strategies haven’t fared well lately

Bitcoin treasury holding companies have lost some of their sheen over the last few months as more companies flood into the space.

Related: ‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

Even Strategy, the largest corporate Bitcoin holder, has seen its market cap slide over 43% from $122.1 billion in July to $69.1 billion today.

Metaplanet, one of the best-performing stocks on the Tokyo Stock Exchange to start the year, has been hit even harder, falling around 55% since late June, while other Bitcoin treasury companies have even had to offload some of their BTC holdings to pay outstanding debt.

Magazine: Bitcoin OG Kyle Chassé is one strike away from a YouTube permaban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A former doctor has introduced Robyn, a compassionate AI partner

Cardano News Update: EMCD’s Crypto Card Connects Blockchain with Everyday Purchases

- EMCD launched a free crypto payment card enabling USDT spending via Mastercard , Apple Pay, and Google Pay, bridging digital assets to daily transactions. - Competitors like Exodus and Jour Cards introduced similar tools, targeting unbanked populations and expanding crypto utility for iTunes, gift cards, and global remittances. - Stablecoin transaction volumes hit $46 trillion in 2025, with 19% of crypto owners projected to use digital assets for payments by 2026, per eMarketer. - Traditional banks like

Lighter Secures $68 Million to Drive Institutional DeFi Expansion Despite Market Hesitancy

- Lighter secured $68M in a new round led by Founders Fund and Ribbit Capital, valuing it at $1.5B to boost DeFi trading infrastructure. - The funding aligns with a broader crypto VC surge, including Ripple's $500M and Lava's $200M, highlighting institutional interest in blockchain finance. - CEO Vladimir Novakovski emphasized scaling infrastructure with both equity and token subscriptions to enhance institutional-grade trading solutions. - Despite market caution, DeFi protocols like Lighter attract invest

JPMorgan and DBS Establish Unified Cross-Chain Protocol for Institutional Transactions

- JPMorgan and DBS develop blockchain framework for cross-chain tokenized deposit transfers, aiming to set institutional payment standards. - The framework links DBS Token Services with JPMorgan’s Kinexys, enabling 24/7 real-time settlements across public and permissioned blockchains. - It addresses cross-border transaction demands, reducing fragmentation as global banks adopt tokenization. - Overcoming interoperability challenges could redefine institutional liquidity access and market reach.