Bitcoin’s Abrupt Decline: Reasons Behind the Fall and What It Means for Cryptocurrency Investors

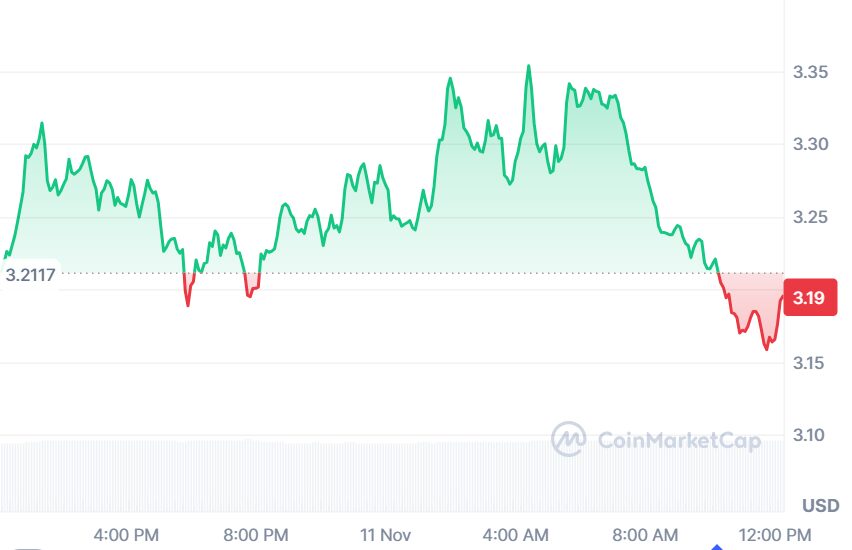

- Bitcoin's 2025 November drop below $104,000 revealed market fragility amid regulatory gaps, macroeconomic shifts, and institutional caution. - U.S. government shutdowns disrupted SEC/CFTC oversight, triggering $1.296B in liquidations and exposing crypto derivatives' liquidity risks. - Fed rate cuts initially boosted Bitcoin demand, but geopolitical tensions and $1.22B ETF outflows signaled institutional risk aversion. - Corporate Bitcoin purchases like Strategy Inc.'s $49.9M investment highlighted strate

Regulatory Uncertainty and Market Liquidity

Earlier in 2025, a U.S. government shutdown led to a lack of regulatory oversight, affecting agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), as detailed in a

Macroeconomic Shifts and Institutional Sentiment

When the Federal Reserve reduced interest rates by 25 basis points in September 2025, Bitcoin initially became more attractive as a non-interest-bearing asset in a low-rate setting, as noted in a

Implications for Crypto Investors

The events of November offer three main takeaways for those in the crypto space:

1. Diversification and Hedging: With Bitcoin rising 8% in Q3 2025 and outperforming the S&P 500, its value as a diversification tool in turbulent markets is clear, according to the Bitget outlook. Nevertheless, its exposure to liquidity risks means investors should maintain well-balanced portfolios.

2. Regulatory Vigilance: The government shutdown episode demonstrates the importance of staying alert to regulatory changes, especially in derivatives and ETF sectors, as highlighted by the Coinotag report.

3. Institutional Signals: Moves such as Strategy’s $49.9 million Bitcoin purchase serve as important sentiment indicators. Investors should consider these actions in the context of broader economic trends.

Conclusion

The November 2025 Bitcoin downturn resulted from a mix of regulatory lapses, economic uncertainty, and institutional restraint. Despite this, the asset’s fundamentals remain strong—as shown by its rebound above $106,000 and increasing corporate interest. Investors should stay alert, as the continued development of the crypto sector depends on navigating these challenges with careful planning.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC's 20-day review period begins, launching the XRP ETF competition toward mainstream adoption

- SEC's 20-day automatic review period for 21Shares' XRP ETF filing signals potential fast-tracked approval, mirroring Bitcoin/Ethereum precedents. - XRP's institutional adoption gains momentum with custodian partnerships and index-linked pricing, driving 6% price surge to $2.32. - Ripple's ecosystem growth (100M+ ledgers, Mastercard/WebBank deals) strengthens XRP's cross-border payment advantages over Ethereum's scalability challenges. - International XRP ETFs ($114.6M AUM) and institutional interest in p

Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

APT Price Update: Aptos Shows Early Recovery Signs to $3.50 as EV2 Presale Draws Web3 Gaming Interest

Jack Dorsey backs diVine, a new version of Vine that features Vine’s original video library