Zcash Halving 2025: Impact on Cryptocurrency Markets and Investment Approaches

- Zcash's next halving in late 2028 will cut block rewards to 0.78125 ZEC, accelerating its 21M supply cap. - Historical data shows 500%+ price surges post-halving, driven by scarcity and growing institutional adoption like Grayscale's $137M Zcash Trust. - Privacy-focused demand and counter-cyclical price trends highlight Zcash's unique role, though regulatory risks to shielded transactions persist. - Investors are advised to balance long-term positioning with diversification and monitor utility-driven upg

Blockchain Economics: Limiting Supply and Miner Motivation

Zcash implements a halving every four years, slashing block rewards by half after every 1,680,000 blocks are produced

While Zcash’s deflationary approach is similar to Bitcoin’s, it also introduces its own unique factors. By reducing the rate at which new coins are created, Zcash will see its annual inflation rate drop from 6.25% after 2024 to 4% by the end of 2025

Speculative Demand: Past Trends and Institutional Influence

Looking back, there is a notable link between Zcash halving events and significant price increases. The 2020 halving triggered a 500% surge in value, while the 2024 halving led to a 92% jump by the last quarter of 2025

Greater institutional involvement has also fueled speculative interest. The introduction of the $137 million Grayscale Zcash Trust in 2025

Market Behavior: Divergent Trends and Regulatory Challenges

Zcash’s price movements often contrast with Bitcoin’s, especially during bearish markets. In late 2025, ZEC climbed 750% as investors turned to privacy coins while Bitcoin experienced turbulence

Privacy coins like Zcash continue to face uncertain regulatory environments. Although the SEC’s 2025 decision to exempt PoW mining from securities regulations

Investor Strategies: Key Points to Consider

For those investing in Zcash, understanding the interplay between limited supply, speculative forces, and regulatory uncertainty is essential. Recommended approaches include:

1. Long-Term Holding: With Zcash’s supply steadily decreasing, maintaining positions through multiple halving cycles could offer cumulative returns.

2. Portfolio Diversification: Spreading investments across Zcash and other privacy coins or

3. Tracking Network Developments: Innovations like Zashi and CrossPay may drive demand based on utility, independent of speculative trends

Conclusion

Zcash’s halving cycle provides valuable insight into both blockchain economics and speculative market behavior. Although the next halving is slated for 2028, the aftermath of the 2024 event—characterized by institutional participation and price stability—demonstrates Zcash’s promise as a privacy-oriented asset and a potential store of value. Investors should carefully balance these opportunities with the risks posed by regulatory shifts and market volatility, ensuring their strategies are in step with broader economic trends and the ongoing evolution of the Zcash ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Coin’s Pursuit of AI Faces Challenges from Market Instability and Scalability Issues

- Pi Coin (PI) fell below $0.30 amid market volatility, despite a 21% surge driven by whale activity and 535% higher trading volume. - Node 0.5.4 upgrades improved reward accuracy and network reliability, addressing bugs in block creation and automatic updates. - Collaboration with OpenMind demonstrated Pi Nodes' AI processing potential, positioning the network as a decentralized computing alternative. - Sustaining gains above $0.27 is critical to test $0.36 resistance, while competition from Bitcoin and S

Ethereum News Update: Ethereum’s $201B Utility Boom Contrasts with ETH’s Stagnant Price—Is Broader Market Direction Needed?

- Ethereum's tokenized assets hit $201B, capturing 64% of global market share, driven by institutional adoption and stablecoin dominance. - Stablecoins like USDT/USDC and PayPal's PYUSD ($18.6B in 2025) fuel DeFi, cross-border payments, and exchange liquidity. - Tokenized RWAs ($12B) and BlackRock/Fidelity's on-chain funds surge 2,000% since 2024, outpacing traditional finance infrastructure. - ETH price remains below $3,500 despite strong fundamentals, with technical indicators showing weak buying pressur

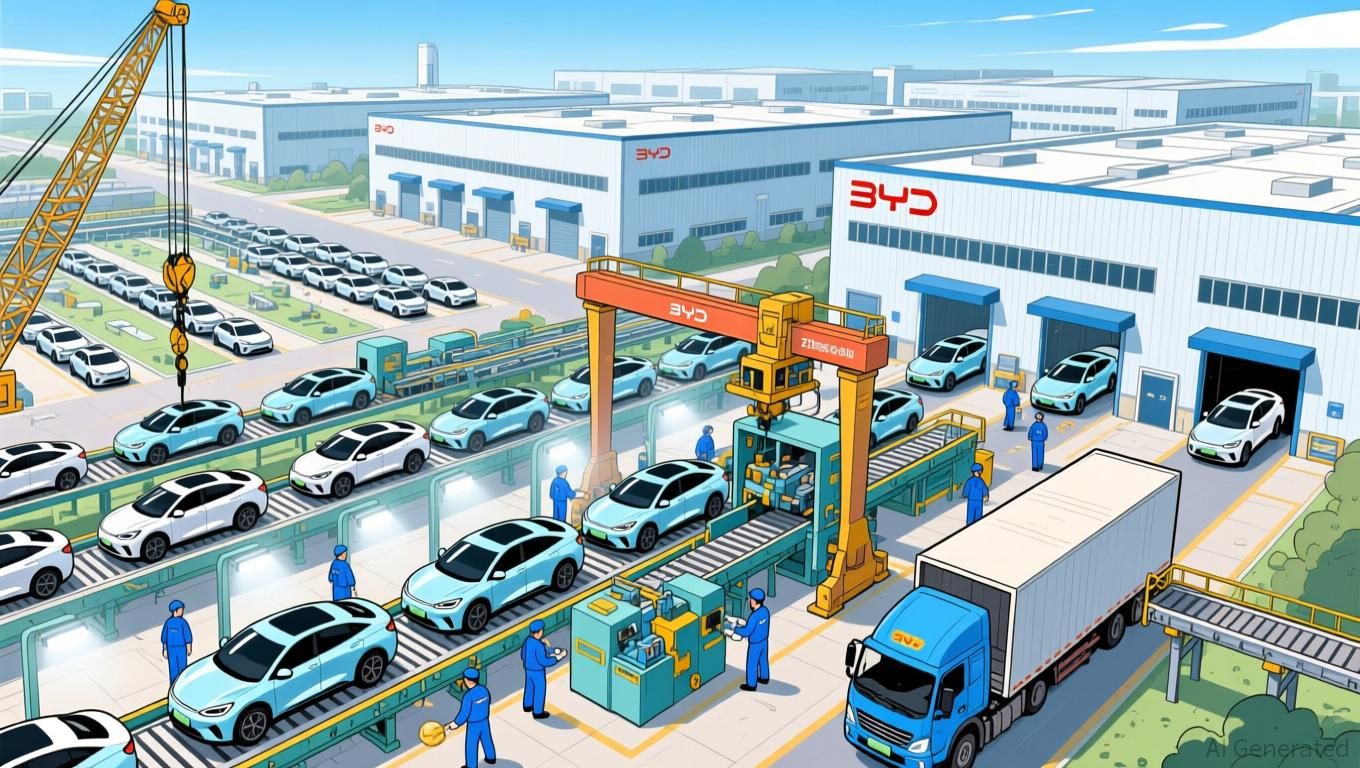

Chinese electric vehicles push Ford to rethink its strategy as it faces major challenges and tariff issues

- Ford CEO Jim Farley warns Chinese EVs pose an "existential threat" to U.S. automakers , surpassing historical Japanese competition in scale and pricing risks. - Ford cancels three-row electric SUV, delays electric pickup to 2027, and prioritizes hybrids/commercial EVs amid $4.5B annual losses and 70% import tariffs. - BYD's Zhengzhou megafactory, producing 545K vehicles in 2024 and expanding to 20K employees, exemplifies Chinese rivals' aggressive production and market expansion. - Farley admits driving

These 3 AI-Rated Undervalued Altcoins Could Deliver Massive Returns Soon