Cardano Looks Dormant, But Whales Quietly Scoop Up $200 Million Worth of ADA

Cardano whales are quietly accumulating ADA at the fastest pace since May, echoing patterns that preceded past bull runs. As consolidation continues and the Summit 2025 nears, on-chain data hints at a potential upside for ADA.

Although Cardano (ADA) remains among the top 10 altcoins by market cap, its price is still hovering around 2024 levels. While many holders express disappointment with ADA’s performance, accumulation continues quietly beneath the surface.

What evidence supports this trend, and what impact could it have? The following analysis draws on on-chain data and expert insights.

How Have Cardano (ADA) Whales Been Accumulating in November?

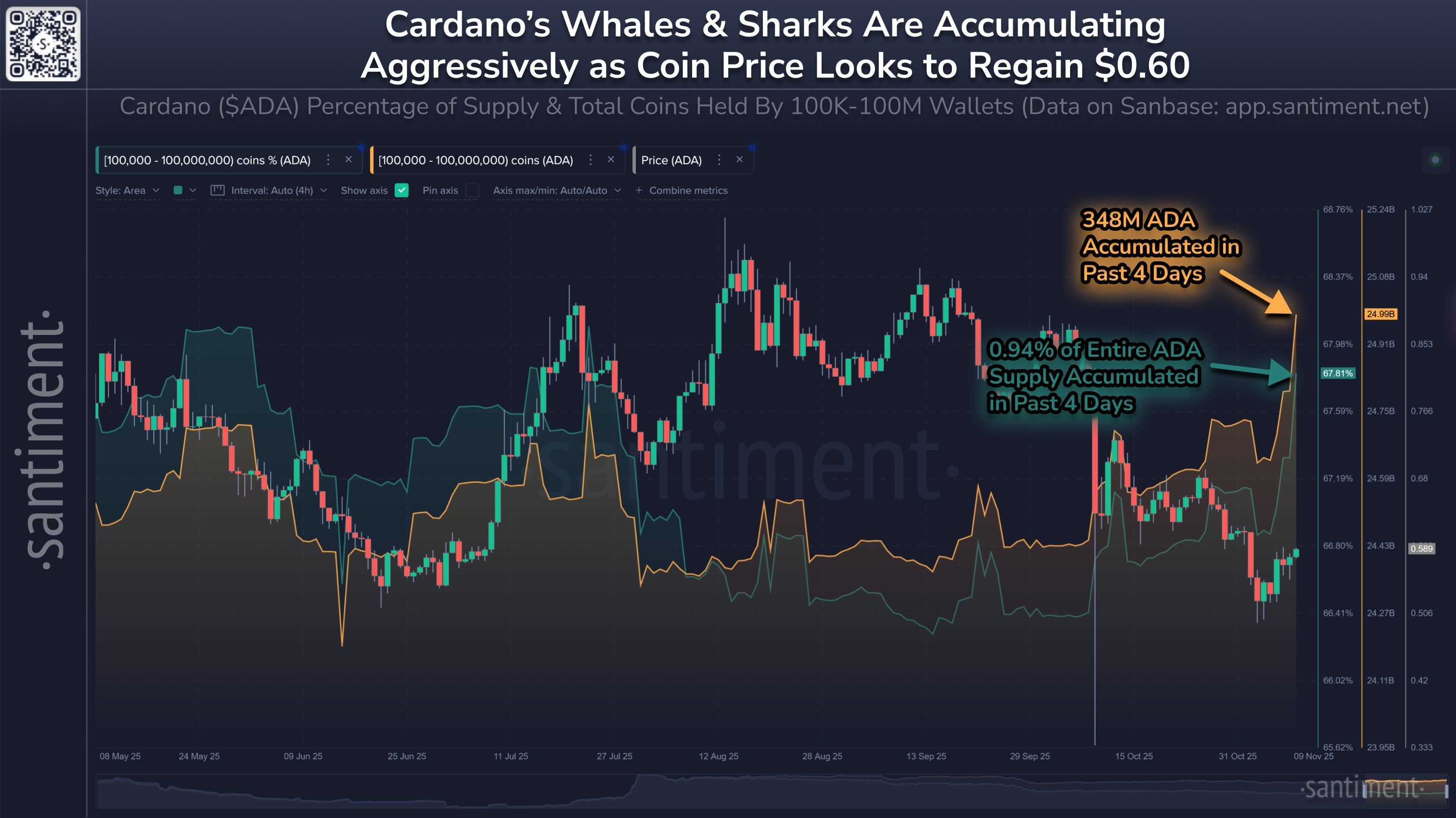

Data from Santiment shows that “whales” and “sharks” — investors holding between 100,000 and 100 million ADA — have been accumulating heavily in a short period.

Over the past four days, these large holders have purchased 348 million ADA, valued at approximately $204.3 million, which represents 0.94% of the total ADA supply.

Cardano Whales Accumulation. Source:

Santiment

Cardano Whales Accumulation. Source:

Santiment

This marks the strongest accumulation since May. Notably, this buying activity comes as ADA’s price has corrected by more than 30% from last month and remains below $ 0.60.

While many retail investors appear to have exited, whales seem to view the pullback as a chance to secure better entry positions. With smaller traders sidelined, smart money is accumulating quietly, creating minimal volatility. Analysts see this as a potential signal for an upcoming bullish phase.

“While many call Cardano (ADA) ‘dormant,’ the charts whisper a different story — millions of ADA are quietly being scooped up by whales and institutions. On-chain data shows this ‘silence’ isn’t weakness — it’s precision accumulation. With retail out of the picture, smart money is loading up without triggering alarms.” — BeLaunch.

Historical Patterns Suggest Possible Rally

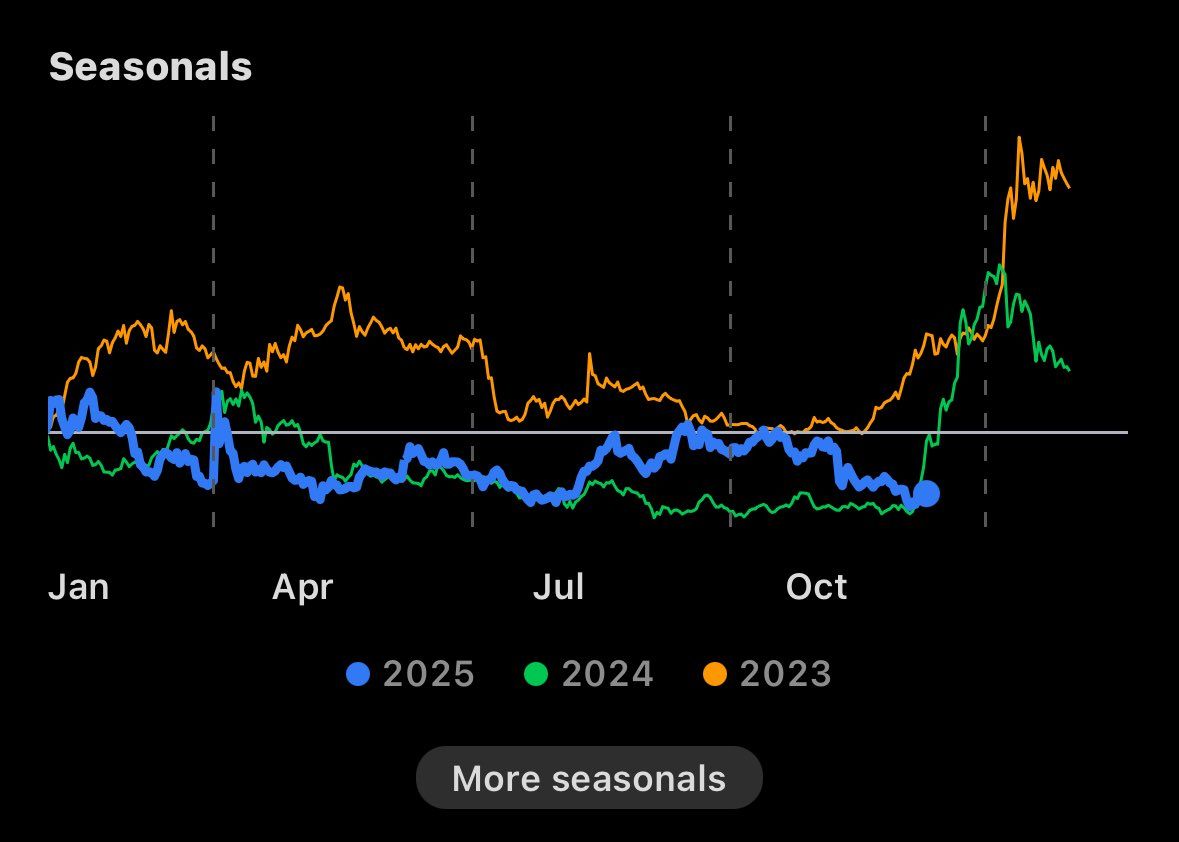

Historical ADA price patterns suggest that strong rallies frequently follow extended consolidation periods of approximately ten months.

The DApp Analyst highlighted this trend, comparing 2025’s behavior with that of the previous two years. In both 2023 and 2024, ADA experienced powerful bull runs following prolonged consolidation phases, delivering gains of 200% to 300%.

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Now, in October 2025, conditions appear similar to those of historical setups — potentially forming a base for another upward move. Combined with current whale accumulation, this alignment strengthens the bullish outlook.

“Will 2025 be like ‘23 & ‘24? $ADA has spent the entire year consolidating between $0.5 and $1.3. Can we finally get a breakout?” — The DApp Analyst.

November also brings the Cardano Summit 2025 in Berlin. Statements from project leaders at the event are expected to renew optimism among ADA investors this month.

However, overall market sentiment remains cautious. The altcoin season index sits at a low 39 points, reflecting lingering fear — a potential headwind for ADA’s recovery despite growing accumulation and bullish setups.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: ZKP’s Hardware-Centric Strategy Shakes Up Speculation-Fueled Crypto Presales

- ZKP launches with $17M pre-built Proof Pods, offering instant AI compute rewards via Wi-Fi-connected hardware. - Unlike speculative presales, ZKP's hardware-first model ensures operational readiness and decentralized network resilience. - Competitors like Blazpay and SpacePay focus on utility-driven crypto adoption, but ZKP's tiered, upgradable devices emphasize verifiable performance. - Ethereum's gas limit increase aligns with ZKP's distributed compute approach, addressing scalability challenges throug

Solana News Update: Investors Shift Toward XRP ETFs, Bringing Solana's 21-Day Inflow Streak to a Close

- Solana ETFs ended a 21-day inflow streak with a $8.1M net outflow on Nov 27, 2025, led by 21Shares TSOL's $34.37M redemptions. - This reversal contrasted with Bitcoin/Ethereum ETFs' $5.43B outflows and highlighted Solana's 7% staking yields and 70M daily transactions. - Analysts linked the shift to profit-taking, macroeconomic pressures, and investor rotation toward XRP ETFs with perfect inflow records. - Despite the outflow, Solana ETFs still hold $964M in assets, but face challenges as TVL dropped 32%

XRP News Today: Institutional ETFs Drive XRP to Compete with Bitcoin's Market Leadership

- XRP ETFs see $160M+ inflows as institutional demand surges, with Bitwise and Franklin Templeton leading the charge. - NYSE approves Grayscale and Franklin XRP/Dogecoin ETFs amid SEC easing altcoin fund approvals, signaling crypto normalization. - Altcoin Season Index at 25/100 shows Bitcoin dominance, but projects like Aster and Zcash outperform BTC by 1,000%+. - XRP rebounds to $2.06 with 48% volume spike, but 79M tokens absorbed by ETFs raise supply concerns. - Institutional-grade custody solutions fro

Public-Private Collaborations Driving Real Estate and Industrial Expansion in Webster, NY

- Webster , NY, leverages PPPs via FAST NY and NY Forward grants to boost infrastructure, real estate , and industrial investment. - Xerox campus upgrades and downtown revitalization projects enhance connectivity, attracting advanced manufacturing and logistics sectors. - $650M fairlife® facility creates 250 jobs, demonstrating how modernized infrastructure attracts high-value industries to secondary markets. - Websters model shows PPPs can drive sustainable growth by aligning public funding with private-s