Monad ICO loans 160M tokens to five market makers

Coinbase published a token sales disclosure for Monad that contains detailed information about its market maker operators and how many tokens are loaned to each firm.

- Coinbase revealed full details about Monad’s market maker arrangements, involving Galaxy, GSR, Wintermute and others. The firms will collectively receive 160 million MON in short-term token loans.

Coinbase’s disclosure may be one of the first cases where a large institution fully discloses the list of market makers participating in the launch of Layer-1 EVM blockchain Monad. The document lays out not only the names of the five market makers involved, but also the scale of funds loaned to each firm and the duration period of each loan.

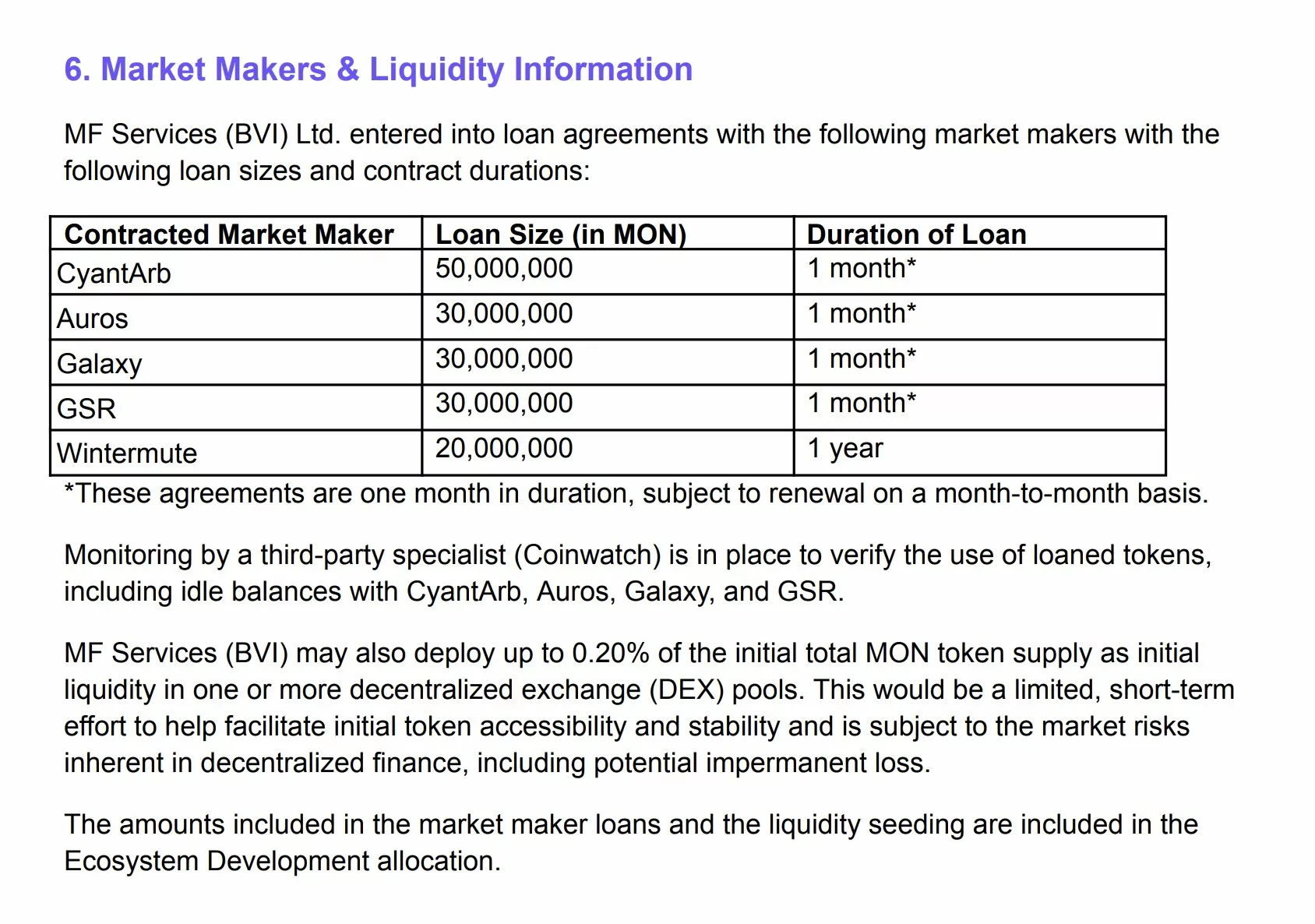

According to the document , the Monad Foundation subsidiary firm MF Services (BVI), Ltd. has signed token lending contracts with five market makers in the crypto space. The largest loan of MON tokens has been promised to CyantArb, amounting to 50 million MON which will be loaned to the firm for one month.

On the other hand, three market makers will receive a loan of 30 million MON for the duration of one month. These firms are Auros, Galaxy and GSR. Lastly, Wintermute will receive a loan of 20 million MON that it can hold for one year at most.

Information disclosed for market maker agreements regarding Monad | Source: Coinbase

Information disclosed for market maker agreements regarding Monad | Source: Coinbase

The total amount of tokens allocated to market makers is a combined 160 million MON, which according to its initial set market price of $0.025, will be worth around $4 million.

As stated in the document, the agreements with market makers can be renewed on a monthly basis. The contracts would be monitored by a third-party agency called Coinwatch, which will be responsible for verifying token usage and keeping track of idle balances of the five market makers listed.

In addition, MF Services plan to deploy up to 0.20% of the initial MON token supply for liquidity purposes into one or more decentralized exchange pools. Coinbase deems it a limited short-term effort to facilitate initial token access and stabilize its price in the event of increased market volatility.

Monad to launch with $7.5B tokens allocated for sale

Monad token allocations are scheduled to take place on Nov. 17 and conclude on Nov. 22. In total, the project will allocate up to 7.5 billion MON or around 7.5% of the initial total supply during this period.

At press time, the project has determined a fixed price of $0.025 for each MON token. The market price was determined based on the implied fully diluted value of the Monad Network, which stands at $2.5 billion with an total supply of 100 billion MON tokens.

Based on the document, as much as 27% of the total token supply will be allocated to the team. Team token allocations are subject to both lock-up and vesting conditions. Individual vesting schedules last typically around 3-4 years and are tied to the date of initial involvement in the project.

The document stated that all team tokens will be locked for the first year following the launch of the Monad Public Mainnet and later released during the 1-year anniversary and over the next three years.

Meanwhile, 38.5% tokens will go to the development of the ecosystem. Unlike team tokens, this portion will be unlocked upon launch. Investors will receive up to 19.7%, while 4% will be set aside for the Category Labs treasury, formerly known as Monad Labs. Around 3.3 billion MON or around 3.3% of the initial total supply will go to the airdrop event targeting members of the Monad Community and the wider crypto community.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Revenue and Growth: Diverging Approaches in Global Fiscal Policies

- Brazil's tax-exempt bonds strain public finances, costing $11.3B annually amid rising issuances. - Japan unveils $110B+ fiscal stimulus for AI, semiconductors , and energy, potentially reaching $133B. - UK abandons income tax hikes, opting for threshold adjustments to address £35B budget gap. - Mexico's Supreme Court upholds $1.8B tax claims against billionaire Salinas Pliego's firms. - Global trend shifts toward targeted fiscal tools over broad tax hikes amid economic pressures.

The Unexpected Bitcoin Plunge in November 2025: Causes Behind the Drop and Future Prospects for Cryptocurrency Investors

- The November 2025 BTC crash resulted from Fed tightening, lingering FTX trust erosion, and institutional outflows. - Fed's hawkish liquidity controls and inflation focus created toxic conditions for Bitcoin's low-rate-dependent market. - FTX's unresolved $7.1B payouts and $20B institutional exodus since 2022 amplified panic selling through trust deficits. - Crypto investors must now wait for Fed policy clarity and prioritize transparent platforms with regulatory compliance.

Bitcoin Updates Today: Fed Navigates Uncertainty as December Rate Cut Remains Unclear

- Market expectations for a Fed rate cut in December dropped to 52% from 95% a month ago, reflecting deepening policymaker divisions. - Hawks like Collins emphasize inflation risks, while doves argue easing is needed to avoid restrictive policies amid weak labor data. - A government shutdown delayed critical economic reports, complicating decisions as structural shifts demand nuanced policy responses. - Bitcoin gains were capped by reduced cut odds, while broader markets remain sensitive to Fed signals on

Solana News Update: Solana’s Fast Network Draws $1.5 Billion in Stablecoin Growth as USDC and USDT See Significant Increases

- Circle mints $500M USDC on Solana , leveraging its 4,000 TPS speed and $0.002 fees to boost DeFi liquidity. - Solana's 2.4M active addresses and 83M transactions highlight its appeal as Ethereum's high-throughput rival. - Tether simultaneously issues $1B USDT on Ethereum , contrasting with Solana's retail-friendly low-cost model. - Institutional adoption grows via Solana Staking ETF and major firm participation, challenging Ethereum's upgrades. - $1.5B stablecoin surge reflects demand for cross-chain sta