Tether’s Latest Gold Move Mirrors Central Banks

Tether is building a bullion desk like a central bank, signaling a shift toward gold-backed digital reserves amid global de-dollarization.

USDT stablecoin issuer Tether is deepening its exposure to physical gold as global monetary dynamics change. The company reportedly brought in two senior HSBC traders, Vincent Domien and Mathew O’Neill, to oversee its gold operations.

Both have decades of experience in metals trading and are expected to help Tether scale its bullion holdings.

Private Stablecoins, Public Strategy

This move follows reports that Tether has already stockpiled billions in physical gold. The company is showing a strong preference for hard assets over fiat-based instruments.

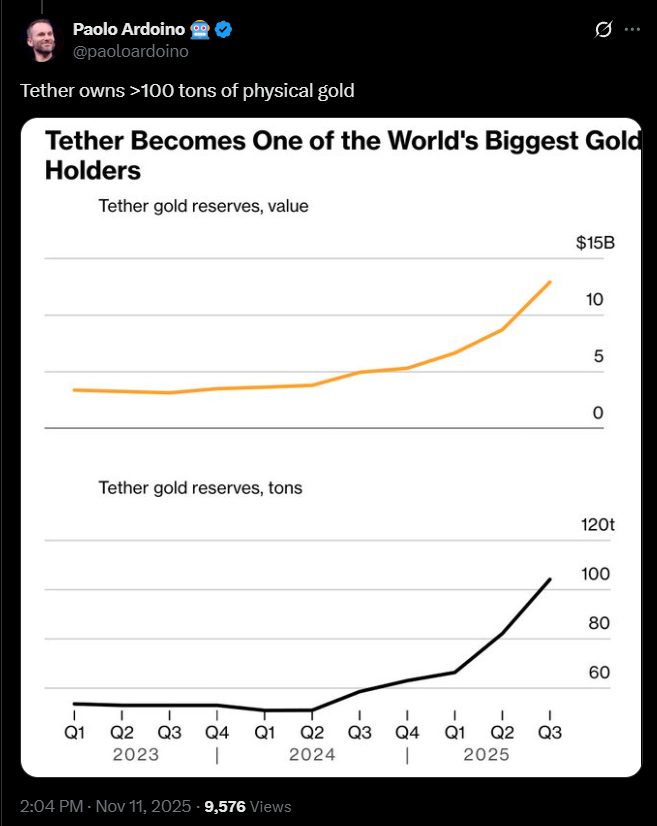

Tweet From Tether CEO

Tweet From Tether CEO

The timing coincides with record central bank purchases of gold and rising global demand for non-dollar reserves.

While central banks diversify away from the US dollar, Tether appears to be following a similar path in the private sector. The company’s shift suggests it views gold as a strategic hedge—both against fiat volatility and regulatory pressure.

Unlike Circle’s USDC, which primarily holds short-term US Treasuries, Tether’s bullion reserves signal a break from dollar dependency.

Also, this divergence highlights a broader divide in stablecoin reserve philosophy: yield generation versus long-term security.

Tether’s bullion buildup could alter the perception of stablecoins from digital cash to privately managed reserve assets.

In effect, Tether is acting less like a payment processor and more like a sovereign wealth fund.

Tether isn’t stacking dollars. They’re stacking gold. $12.9B worth. If this ain’t your wake up call to go long gold I don’t know what is.

— Mr. Uppy (@MisterUppy) November 7, 2025

Tether’s Footsteps Echo of Central Bank Behavior

Central banks purchased more than 1,000 tonnes of gold in 2024, the second-highest annual total on record.

Much of that buying came from emerging economies seeking insulation from dollar-linked volatility. Tether’s accumulation of gold mirrors this pattern.

Tether’s bullion operations also introduce new logistical and security challenges. Managing physical assets within a tokenized framework demands strict custody, audit, and cyber resilience measures.

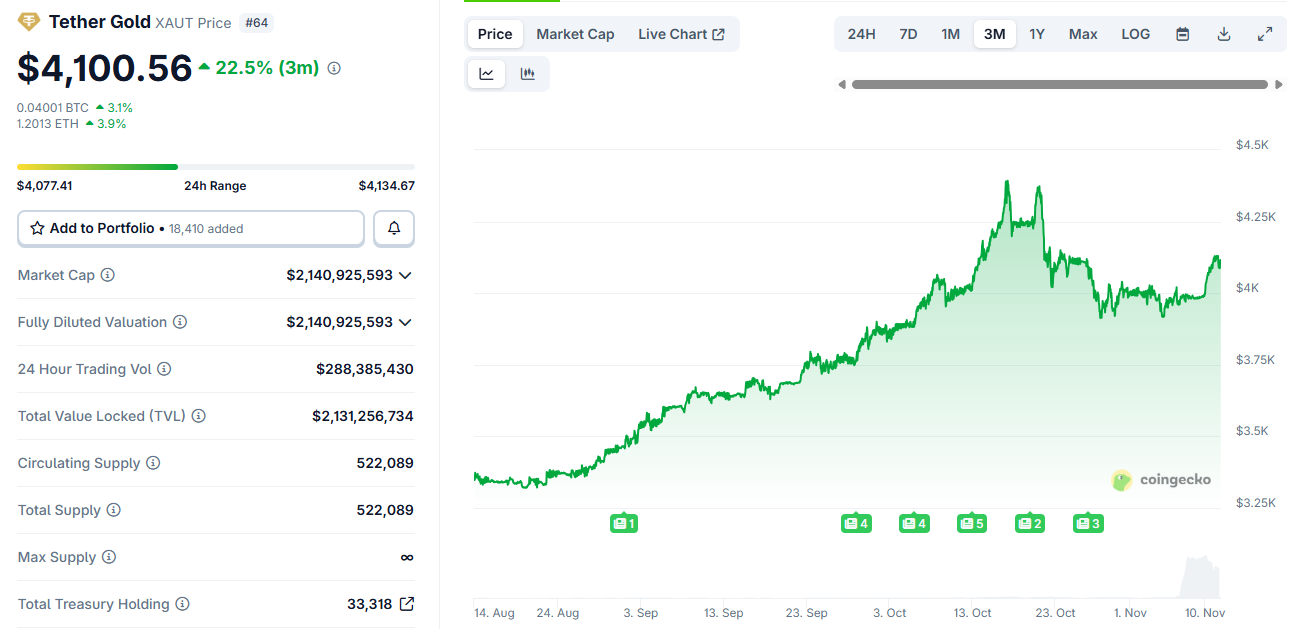

Tether Gold Token Price Chart. Source:

Tether Gold Token Price Chart. Source:

With HSBC veterans now on board, the company appears focused on building that institutional backbone.

However, transparency remains a concern. Critics argue that without frequent independent audits or full reserve disclosure, Tether’s gold strategy could face the same scrutiny that long surrounded its stablecoin reserves.

Overall, the move hints at a coming era where private entities hold diversified, multi-asset reserves rivaling national central banks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Pakistan's Foreign Exchange Outflow Accelerates Amid Economic Instability and Lax Crypto Oversight

- Pakistan reports $600M forex loss via illicit crypto transactions, draining 23% of dollar inflows through unregulated channels. - ECAP reveals cash withdrawals from licensed firms fund crypto investments, straining reserves amid trade deficits and political instability. - SBP tightens forex controls but experts warn crypto outflows persist, mirroring global crypto losses and compounding weak enforcement. - Geopolitical shifts, including Trump's India-Pakistan ceasefire claims and U.S.-Pakistan military c

Cardano News Update: ZKP’s Open Presale Approach Disrupts Traditional Blockchain Speculation

- Investors are shifting from HBAR and ADA to ZKP, a 2025-focused blockchain project with transparent presale and real-world utility. - ZKP's $120M pre-launch funding and daily on-chain auctions contrast with HBAR's 36% decline and ADA's weak DeFi traction. - The project's Proof Pods hardware and "built-first" strategy differentiate it from legacy projects with delayed upgrades. - ZKP's fair allocation model and institutional partnerships position it as a paradigm shift in crypto project launches. - Analys

Miami Dolphins and FC Barcelona Partner with ZKP to Advance Privacy-Focused Sports AI

- ZKP's $17M hardware inventory and novel ICA model position it as a potential "next 100x crypto" with immediate operational readiness. - Proof Pods generate $1-$300 daily earnings and support upgrades, offering rare hardware-first deployment in crypto presales. - Partnerships with Miami Dolphins and FC Barcelona leverage ZKP's privacy tech for sports analytics and secure fan engagement. - Daily ICA auctions with $50K wallet limits and multi-asset payments aim to ensure fair distribution before public laun

Zcash Halving and Its Impact on the Cryptocurrency Market

- Zcash's November 2025 halving cut block rewards by 50%, triggering a 1,172% YTD price surge to $589 amid deflationary scarcity and privacy-driven demand. - Institutional adoption, including $137M Grayscale Trust and 5% Cypherpunk acquisition, validates ZEC as a strategic reserve asset with 28% shielded transaction utility. - Derivatives markets show $1.13B open interest, but 41% weekly volatility and regulatory uncertainty around privacy features pose significant risks to momentum. - Zcash's inverse corr