Key Market Information Gap on November 12th - A Must-Read! | Alpha Morning Report

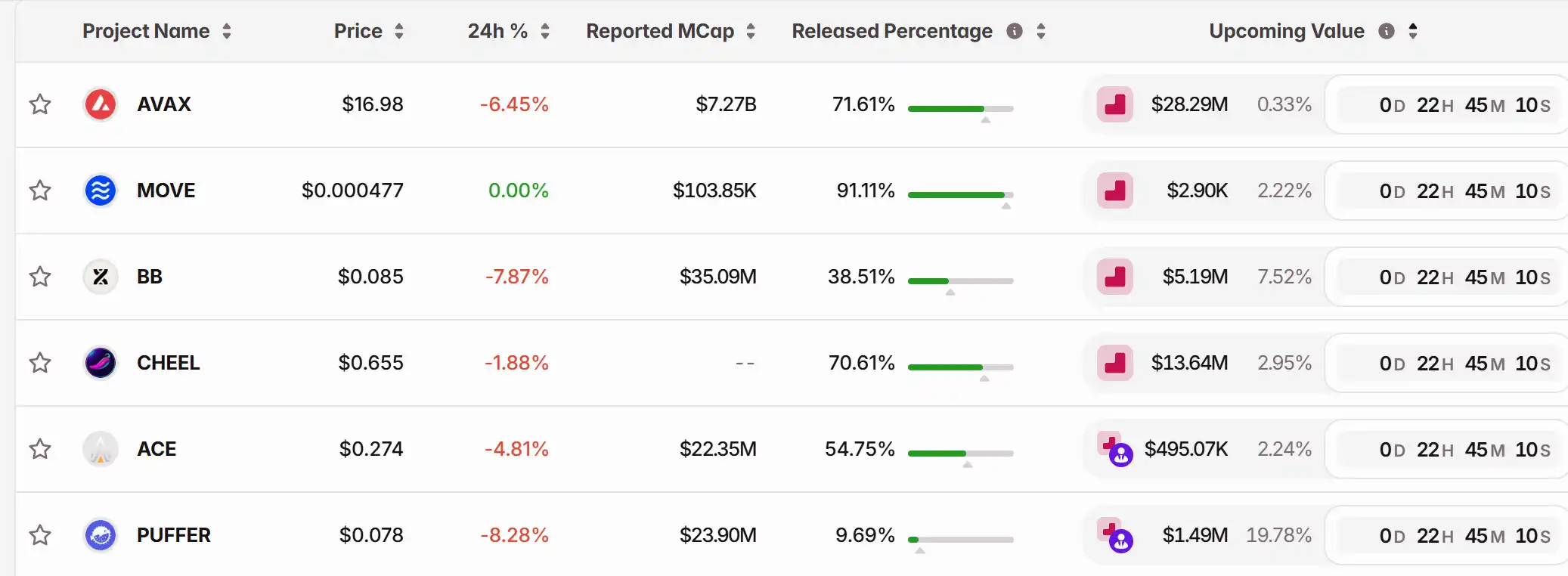

1. Top News: CFX Surpasses $0.14, Up Over 45% in 24 Hours 2. Token Unlock: $AVAX, $MOVE, $BB, $CHEEL, $ACE, $PUFFER

Featured News

1.CFX Breaks $0.14, Surges Over 45% in 24 Hours

2.US Stock Market Closing with Mixed Moves, Crypto Stocks Generally Down

3.$4.11 Billion Liquidated Across the Board in the Past 24 Hours, Mainly Longs

4.Coinbase Cancels $2 Billion Acquisition of Stablecoin Startup BVNK

5.SOL Reserves Strategy Firm Upexi Reveals "Record-Breaking" Quarterly Performance, Staking Rewards Reach $6.1 Million

Articles & Threads

1.《Destruction, Uniswap's Last Ace》

Waking up, UNI surged nearly 40%, leading the entire DeFi sector in a general uptrend. The reason for the rise is that Uniswap revealed its last ace. Uniswap founder Hayden proposed a new proposal focusing on the age-old "fee switch" topic. In fact, this proposal has been raised 7 times in the past two years, not new to the Uniswap community. However, this time is different, as the proposal is personally initiated by Hayden and covers a series of measures including fee switch, token burning, Labs and Foundation merger.

2.《Winning the Championship Thanks to Faker, He Earned Nearly $3 Million》

The League of Legends S15 Global Finals has come to an end, and Faker once again stood on the highest award podium, securing his 6th championship title, continuing to write his legend. In the crypto world, with the rise of prediction markets, players are enjoying esports events while participating in the prediction markets. Among the many crypto players participating in prediction markets, an ID named "fengdubiying (Sure Bet Sure Win)" has become a new legend. In the final prediction of T1 versus KT, he boldly wagered around $1.58 million on T1's victory, ultimately earning approximately $820,000 in profit.

Market Data

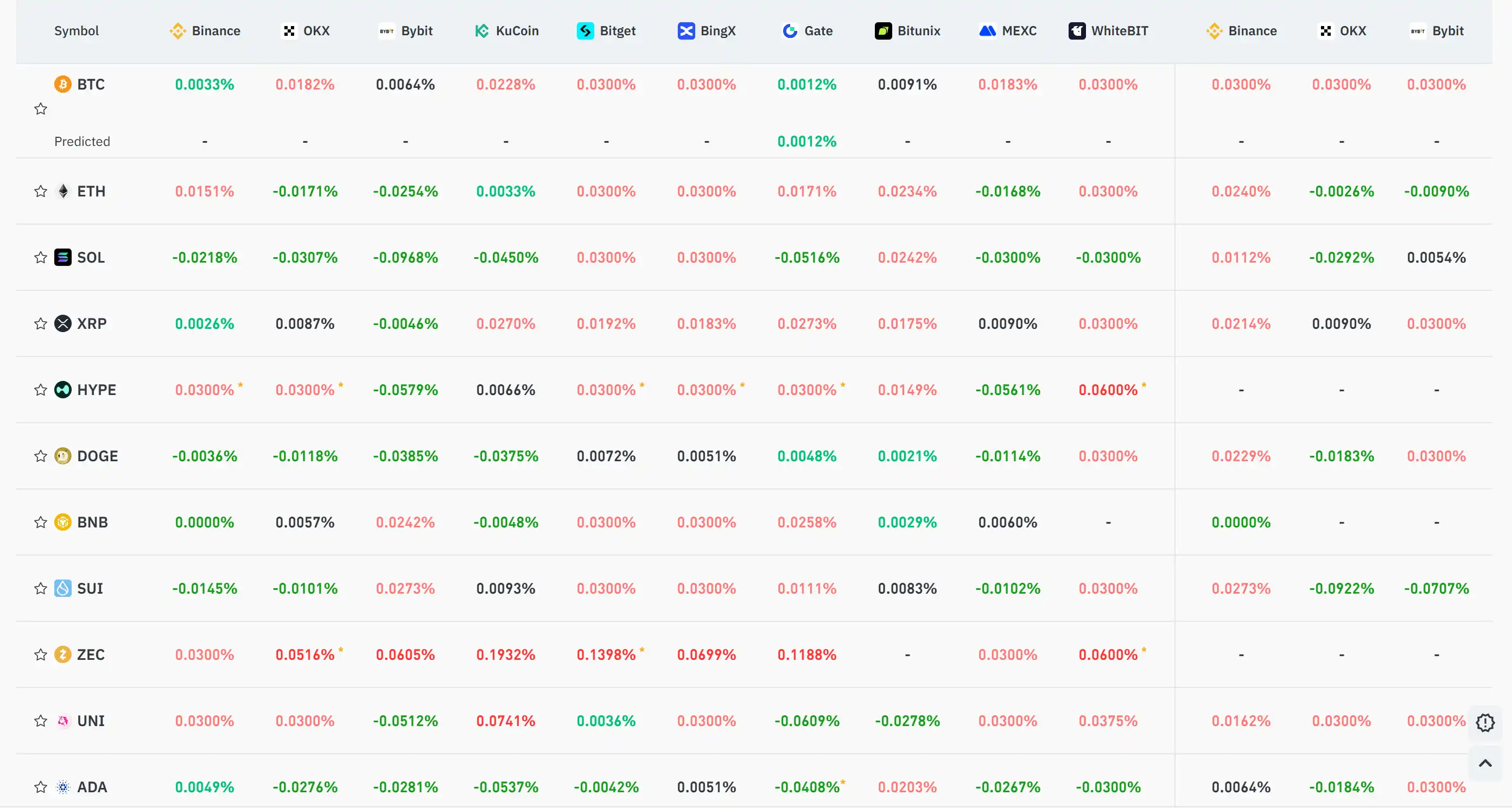

Daily Market Overall Fund Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Solo Miner Beats 1-in-180M Odds to Win $265K Bitcoin Jackpot

- A hobbyist Bitcoin miner using a 6 TH/s setup defied 1-in-180 million odds to earn $265,000 via CKpool's solo mining platform. - The win marked CKpool's 308th solo block since 2014, with the miner's hash rate representing 0.0000007% of Bitcoin's 855 EH/s network. - The achievement highlights Bitcoin's decentralization, as solo miners maintain security despite industrial dominance and bear market conditions. - CKpool's 2% fee model allows solo miners to retain nearly full block rewards, contrasting with t

Bitcoin Updates: Major Investors Adjust Holdings Amid $2.1 Billion Outflow from Bitcoin ETFs

- BlackRock's IBIT Bitcoin ETF recorded a $523M single-day outflow on Nov 19, marking its fifth consecutive day of redemptions totaling $2.1B this month. - Bitcoin fell below $90,000 (-30% from October peak) as ETF outflows and macroeconomic uncertainty triggered institutional risk mitigation strategies. - Analysts cite profit-taking, Fed policy uncertainty, and weak macro signals as drivers, with Bitcoin ETFs accounting for 70% of $3.79B in U.S. crypto ETF outflows. - While Ethereum and altcoins like Sola

Ethereum Updates Today: BitMine Continues to Gather ETH Despite Stock Drop, Indicating Institutional Confidence

- BitMine's 0x5664 wallet received $59.17M in ETH from FalconX, signaling continued institutional accumulation despite a 35% stock decline. - The OTC purchase highlights FalconX's role in enabling discreet large-scale trades, reducing market impact through off-chain execution. - Ethereum's $15B+ 24-hour volume and USDC's 72% market cap surge reflect growing institutional adoption amid regulatory clarity. - BitMine's ETH buying aligns with pre-Prague hard fork optimism, with analysts noting potential 7% pri

TWT’s Updated Tokenomics: Evaluating Sustainable Value Amidst an Evolving Crypto Environment

- TWT (TNSR) token's value collapsed after Coinbase absorbed Vector.fun, stripping its trading infrastructure and utility. - Price surged 37.3% post-acquisition but plummeted as governance token lost revenue streams and real-world use cases. - Contrast with YouBallin's $YBL token, which creates utility through fan engagement and cross-chain liquidity incentives. - Investors warned to prioritize tokens with transparent economic models tied to measurable on-chain activity over speculative governance rights.