Circle Q3 revenue hits $740m, USDC circulation nears $74b

Circle is cashing in on stability. The USDC issuer posted $740 million in third-quarter revenue, a 66% jump from last year, as its flagship stablecoin’s circulation more than doubled.

- Circle posted $740 MILLION in Q3 revenue, up 66% year-on-year, with USDC circulation rising 108% to $73.3 BILLION.

- Net income tripled to $214 million, driven by institutional adoption and reserve income.

- The company expanded its infrastructure with the Arc testnet launch and Circle Payments Network, signaling deeper integration with traditional finance.

The company, which listed on the NYSE earlier this year under the ticker CRCL, posted net income of $214 million, tripling last year’s profit. Adjusted EBITDA rose 78% to $166 million, reflecting steady expansion in reserve income and institutional use of USDC across trading, payments, and on-chain settlements.

Circle’s latest results extend a strong 2025 performance for the NYC-based issuer, which continues to benefit from higher yields on reserve assets and wider adoption of stablecoins in traditional finance.

CEO Jeremy Allaire called the quarter one of “measured growth and deepening market confidence” as USDC approaches a 30% share of the fiat-backed stablecoin market.

“As digital dollars become integrated with the technological utility of the internet, Circle’s infrastructure is helping global finance move with greater trust, transparency and velocity. With growing circulation, accelerating commercial partnerships and expanding collaboration across industries, we’re proud of the tangible progress toward a more open and efficient global financial system,” Allaire said.

Circle’s expanding footprint in the industry

Circle’s third-quarter earnings also revealed a steady infrastructure buildout and deeper institutional integration across its growing network. The company’s reserve income surged 60% year-over-year to $711 million, driven by a near-doubling in average USDC circulation, even as yields on reserves slightly eased. Other revenue climbed to $29 million, reflecting growing traction in Circle’s subscription, transaction, and services lines.

Operating expenses increased to $211 million, up 70% from last year, primarily due to headcount expansion and $59 million in stock-based compensation. Yet, adjusted operating costs grew at a slower 35%, underscoring improving operational leverage as the company scales. Circle also booked a $61 million tax benefit tied to research credits and compensation-related adjustments.

Infrastructure development

Beyond the financials, Circle launched Arc public testnet on October 28, which attracted participation from more than 100 companies across banking, capital markets, and technology. In a move that could further decentralize and incentivize the network, Circle confirmed it is exploring launching a native Arc token.

Concurrently, the Circle Payments Network is laying the groundwork for global digital dollar flows. The network now supports transactions in eight countries, with 29 financial institutions fully enrolled. A further 55 are undergoing eligibility reviews, and a pipeline of 500 institutions suggests deepening interest from the traditional banking sector. Since its late-May launch, CPN’s annualized transaction volume has rapidly scaled to $3.4 billion.

Circle’s shares, traded under the ticker CRCL, closed at $98.30 on Tuesday, down 5.57%, and trended another 3.5% lower in pre-market activity according to Yahoo Finance data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

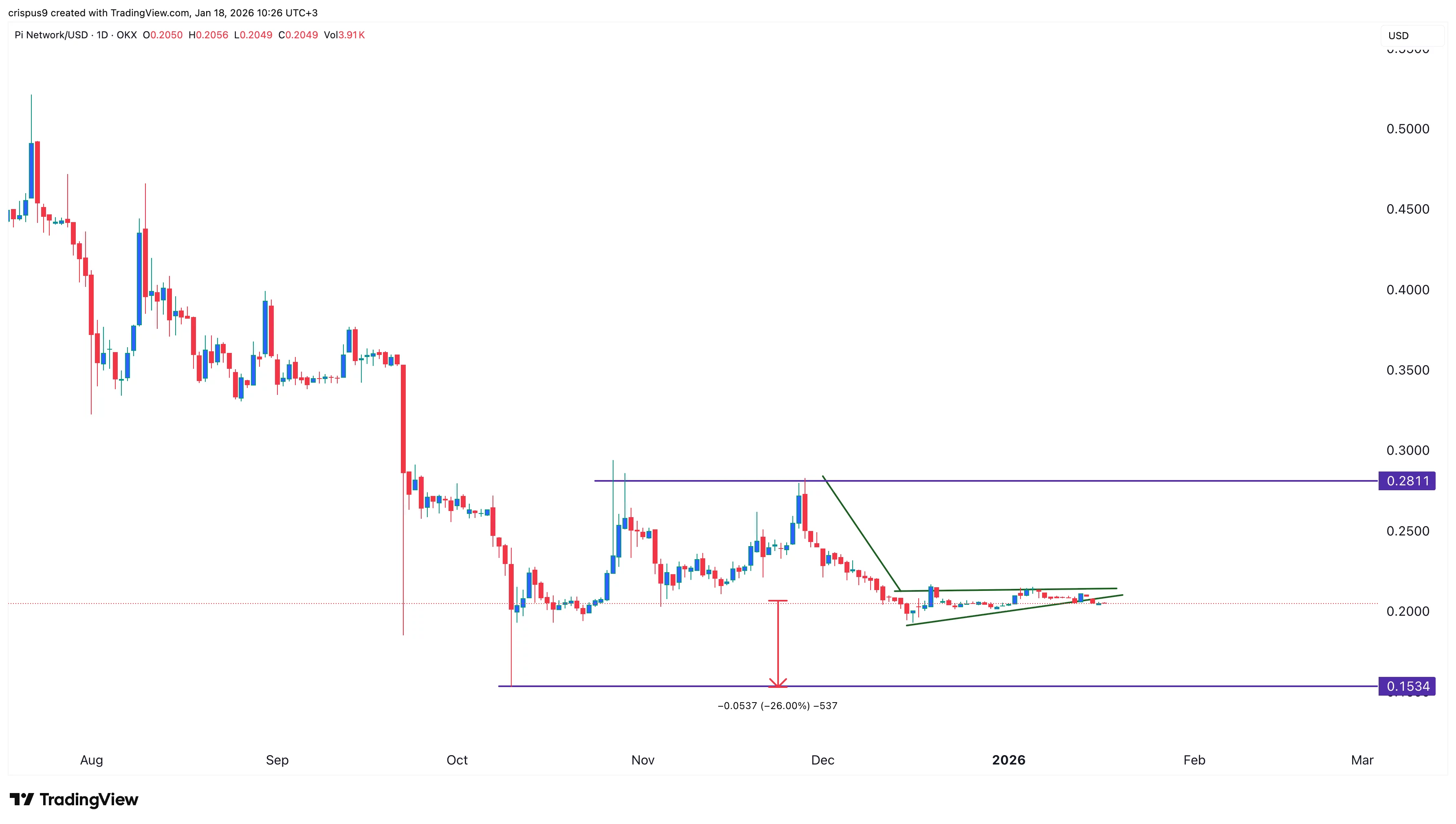

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?