HBAR Fails at $0.20 Again as Traders Stay Split on Direction

HBAR is struggling to gain traction despite increasing inflows and a positive Chaikin Money Flow. The token faces persistent resistance near $0.194, with consolidation expected unless market sentiment strengthens.

Hedera (HBAR) has struggled to gain meaningful momentum this week, facing repeated rejections at the $0.20 barrier.

Despite brief attempts at recovery, the altcoin continues to move within a narrow range, reflecting uncertainty in investor sentiment. The recent price action shows a lack of conviction from traders, even as inflows begin to pick up.

Hedera Inflows Rise, But Not Investors’ Optimism

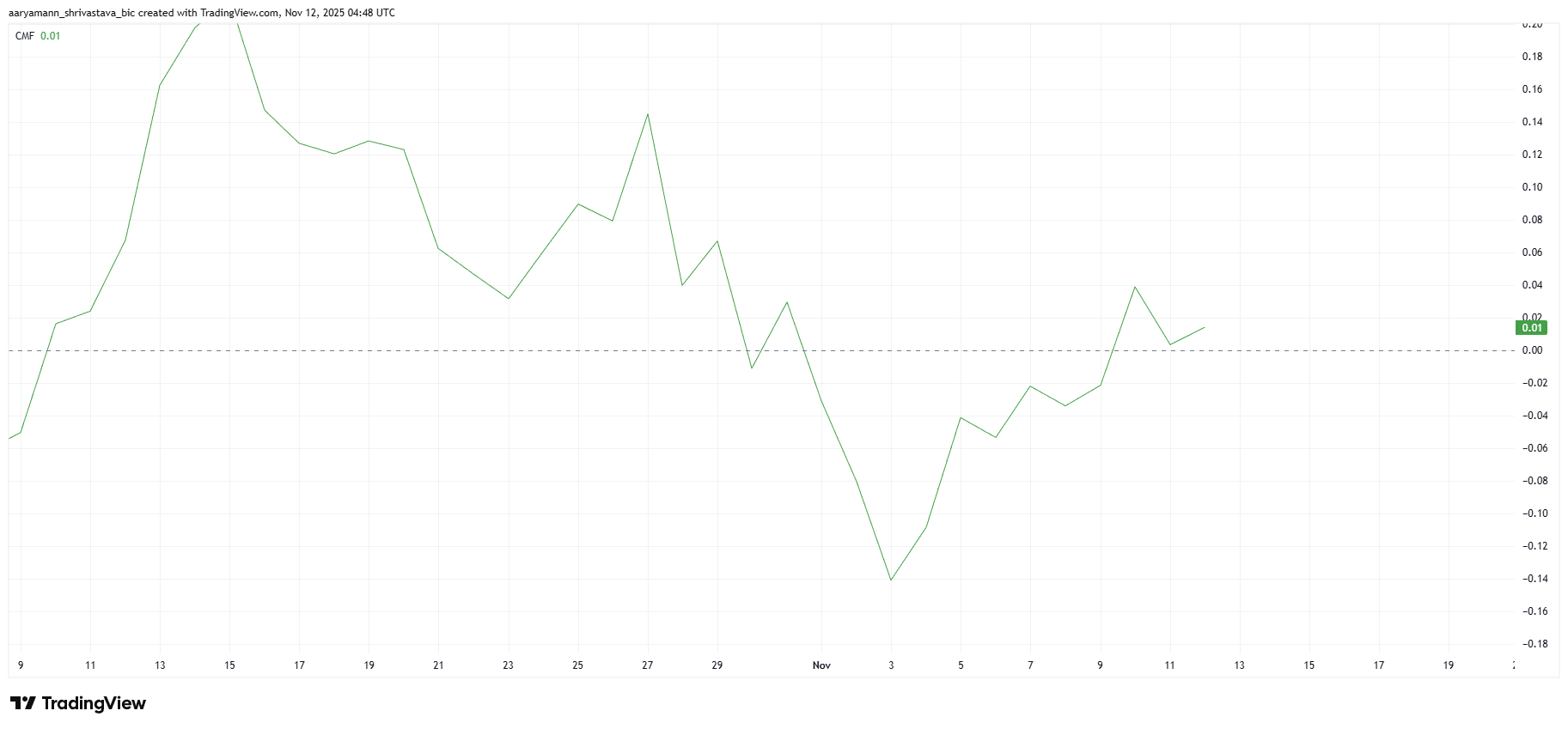

The Chaikin Money Flow (CMF) indicator shows a slight uptick, climbing into the positive zone above the zero line. This shift suggests that inflows are currently outpacing outflows, indicating growing buying activity. Rising inflows typically support price recovery, a much-needed boost for HBAR after several days of subdued movement.

However, the gains in inflows have yet to translate into strong price action. While investors are beginning to show interest, HBAR has not fully benefited from this trend. The improvement in liquidity signals optimism, but without stronger demand or higher trading volumes, the altcoin may continue to struggle near its upper resistance zones.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

The funding rate for HBAR has fluctuated over the last few days, revealing indecision among traders. Market participants appear unsure about the cryptocurrency’s next move, alternating between long and short positions to capitalize on short-term volatility. This uncertainty has prevented HBAR from building consistent bullish momentum.

Such inconsistent sentiment has historically hindered sustained rallies. When traders hesitate to commit to a clear direction, price movements often remain rangebound. For HBAR, this ongoing tug-of-war could limit upside potential.

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

HBAR Price Might Consolidate

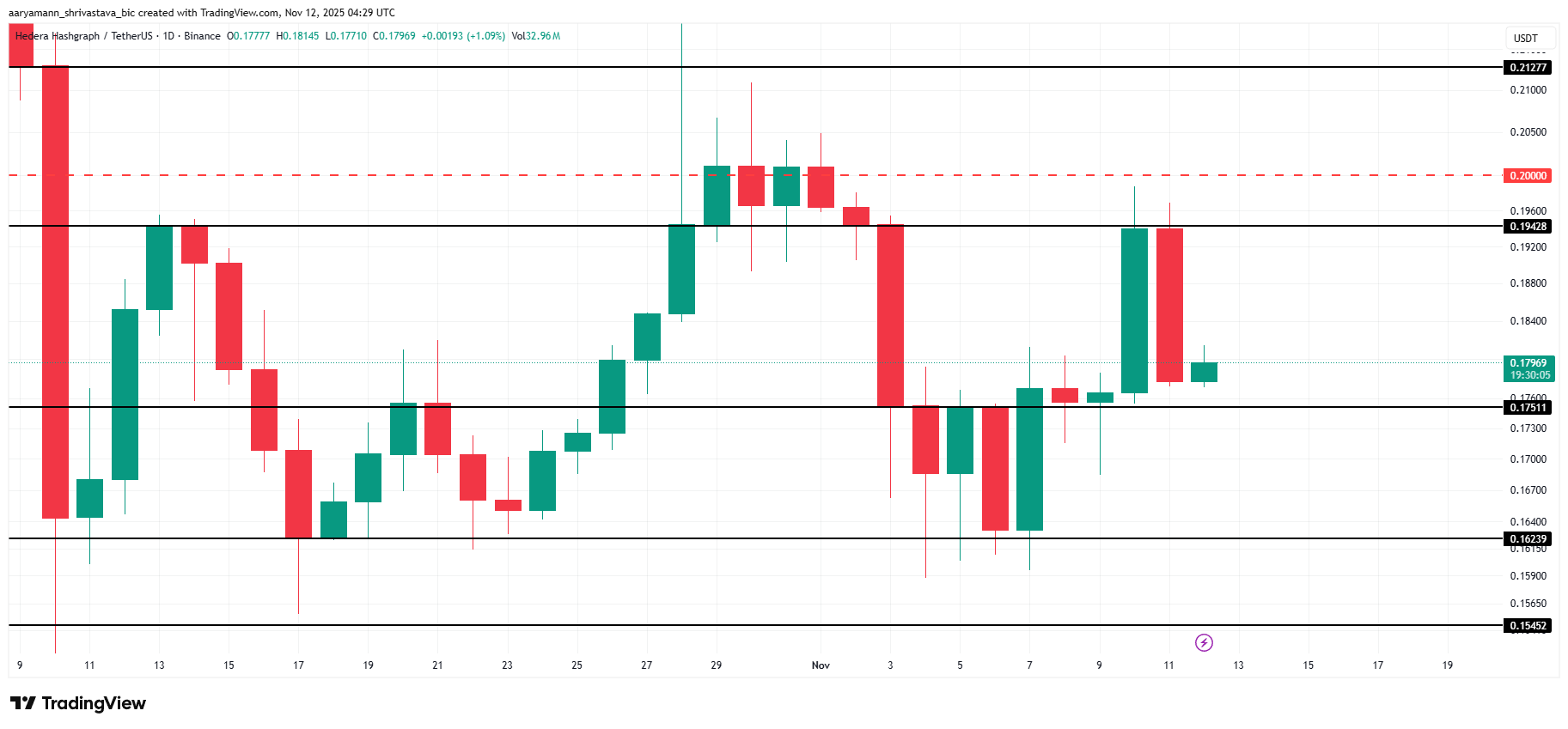

HBAR price is down 8% over the past 24 hours, currently trading at $0.179. The token recently failed to breach the $0.194 resistance level, which would have allowed it to challenge the critical $0.200 barrier. The rejection reinforces the prevailing weakness in market confidence.

This $0.200 resistance has acted as a significant ceiling for nearly a month. Considering the current technical signals, HBAR will likely consolidate within the $0.175 to $0.194 range in the near term.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If bearish momentum takes over, HBAR could fall through its $0.175 support level, potentially declining to $0.162. A drop below this level would invalidate the mild bullish outlook and extend the ongoing downtrend.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto wallets are transforming into comprehensive platforms, connecting Web3 with traditional financial services

- D'CENT Wallet's v8.1.0 update enables multi-wallet management for up to 100 accounts, streamlining digital asset handling across investment, NFTs, and events. - Competitors like Exodus and Blaqclouds advance crypto adoption through features like Mastercard-linked debit cards and decentralized identity systems with biometric security. - Innovations such as fee-free transactions (D'CENT GasPass) and on-chain identity management (.zeus domains) highlight industry focus on accessibility and security for main

Grayscale's Public Listing: Advancing Crypto Adoption as Regulations Vary Worldwide

- Grayscale files U.S. IPO via S-1, joining crypto firms like Circle and Bullish in public markets. - IPO details remain undetermined, contingent on SEC review and market conditions. - Japan's TSE tightens crypto listing rules amid volatile "crypto hoarding" stock collapses. - U.S. regulators advance crypto rulemaking post-shutdown, potentially accelerating Grayscale's approval. - Grayscale's IPO highlights crypto's institutional push amid global regulatory divergence.

BNY's Stablecoin Fund Connects Conventional Finance with Around-the-Clock Digital Markets

- BNY Mellon launches BSRXX, a regulated fund enabling stablecoin issuers to hold GENIUS Act-compliant reserves without direct stablecoin investments. - The fund supports 24/7 digital markets by providing ultra-safe, short-term liquidity under federal requirements for stablecoin backing. - Anchorage Digital's participation highlights growing institutional adoption, with stablecoin reserves projected to reach $1.5 trillion by 2030. - BNY's $57.8T custody expertise positions it as a key infrastructure provid

Durov's Legal Victory Highlights the Ongoing Struggle Between Privacy and Government Oversight

- French authorities lifted a travel ban on Telegram CEO Pavel Durov after he complied with judicial supervision for a year. - Durov faces charges of complicity in alleged Telegram misuse for crimes, with potential 10-year prison and $550k fine if convicted. - He criticized French legal procedures and Macron's policies, highlighting tensions over digital privacy and blockchain integration. - The case underscores regulatory challenges for encrypted platforms, balancing user rights with accountability in a "