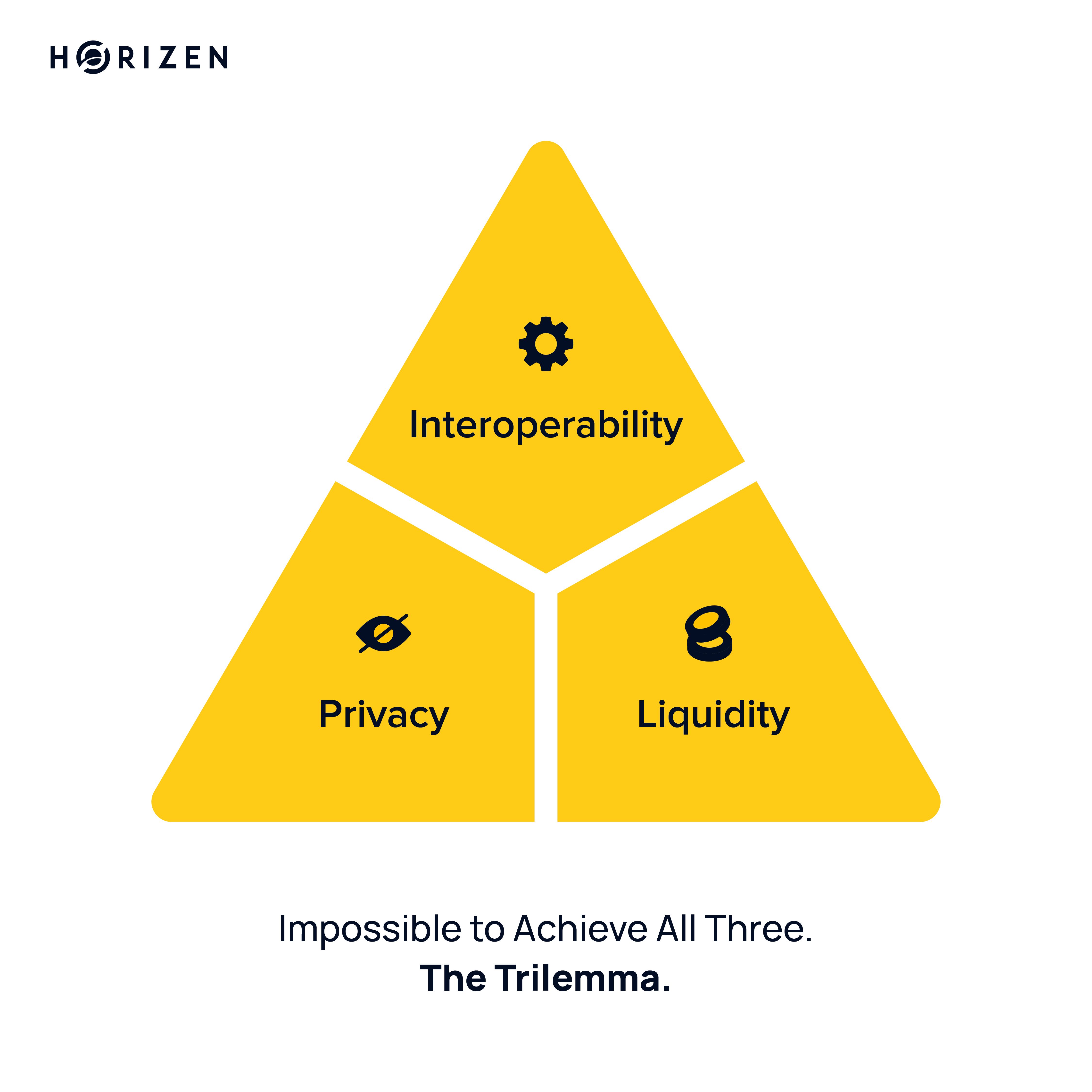

The Institutional Blockchain Trilemma

Institutions have long faced a difficult trade-off known as the Institutional Blockchain Trilemma. This trilemma forces a choice among three essential properties: liquidity, privacy, or interoperability. Each choice traditionally comes with an unacceptable compromise, creating a barrier that has kept many institutions on the sidelines.

Why Are Institutions Stuck?

Historically, every path for institutions has led to limitations.

-

Interoperability + Liquidity (No Privacy)

Standard public blockchains such as Ethereum offer a universe of interoperable applications and deep established liquidity. Transactions, balances, and interactions are all publicly visible, however, creating significant operational security and compliance risks. Sensitive data such as trading strategies, asset positions, and payroll information are exposed, making this model unsuitable for regulated institutions.

-

Privacy + Liquidity (No Interoperability)

Centralized exchanges provide privacy and access to deep order books while keeping activities confidential. Yet this comes at the expense of interoperability. Institutions cannot engage with decentralized protocols, use assets as collateral in lending platforms, or contribute liquidity and participate in advanced strategies. They remain limited to basic trading, missing the broader value-generating economy of decentralized finance.

-

Interoperability + Privacy (No Liquidity)

Some niche privacy-focused protocols have attempted to combine interoperability and privacy, but liquidity has remained elusive. Without sufficient liquidity, institutions face massive slippage, poor price discovery, and limited ability to execute large trades. The lack of capital prevents adoption, and the absence of adoption further suppresses liquidity, creating a fragmented and inefficient ecosystem.

Overcoming The Trilemma

So, how do we solve this impossible trilemma and achieve Interoperability + Privacy + Liquidity?

A true solution must be built on a foundation of auditable privacy, allowing for privacy that doesn't default to isolation and total, uncompromising privacy. This technology must be designed from the start to be interoperable, capable of communicating and transacting with other systems and protocols without revealing confidential data.

By integrating privacy and interoperability at a protocol level, institutions can securely connect to the broader ecosystem. This connection unlocks access to global liquidity pools that were previously inaccessible. Assets can now remain confidential while participating fully in markets, clearing the way for real adoption.

The challenge was never whether liquidity, privacy, and interoperability could coexist. The challenge was how to achieve it. Advances in cryptography and protocol design have made it possible to resolve this trilemma and provide institutions with a foundation that does not require compromise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: DeFi's Quest for Stability: Is It Buterin's Dream or a Traditional Finance Trap?

- Ethereum co-founder Vitalik Buterin declares DeFi "finally viable" as a savings tool, citing improved security and maturity since 2019-2020. - He advocates "low-risk DeFi" as Ethereum's foundation, comparing it to Google Search's role in Alphabet's dominance. - Institutional confidence grows with ARK Invest's ETH exposure and whale accumulations, while TVL declines and legal uncertainties persist. - Critics warn stability-focused DeFi risks becoming a "TradFi Trojan horse," stifling innovation despite bu

Bitcoin News Today: Bitcoin Faces $108K Test: Surge Ahead or Setback?

- Bitcoin hovers near $104.5K with technical indicators signaling potential breakout above $108K, driven by ETF inflows and reduced miner selling pressure. - AlphaPepe (ALPE) attracts 3,500+ holders via BNB Chain presale, offering staking rewards and 10% referral incentives amid SHIB holders' search for high-potential meme tokens. - Shiba Inu expands utility through telecom node partnerships, enabling SHIB-based payments and rewards, aiming to solidify real-world adoption beyond speculative trading. - Cana

Boring Co.'s Hazardous Tunnels Face Off Against OSHA's Weak Oversight

- The Boring Co. was fined $500K for illegally dumping toxic drilling fluids in Las Vegas, damaging infrastructure and raising health risks. - Nevada OSHA faced scrutiny over withdrawn citations due to procedural errors and missing records, sparking transparency concerns. - The Governor’s Office denied political interference but deleted a meeting record, deepening skepticism about regulatory independence. - Repeated environmental and safety violations highlight ongoing regulatory challenges for the Boring

Boring Co. Penalties Highlight the Challenge of Balancing Safety with Innovation

- The Boring Company faces a $493,297 fine for illegally dumping toxic drilling fluids into Las Vegas manholes, marking the largest penalty in Nevada's CCWRD history. - Nevada OSHA withdrew 2023 safety citations after legal review, citing unmet requirements for valid violations, raising concerns about regulatory enforcement consistency. - Critics highlight political pressure risks and legal loopholes, including Anti-SLAPP law tactics, that could hinder future accountability for high-profile tech ventures.