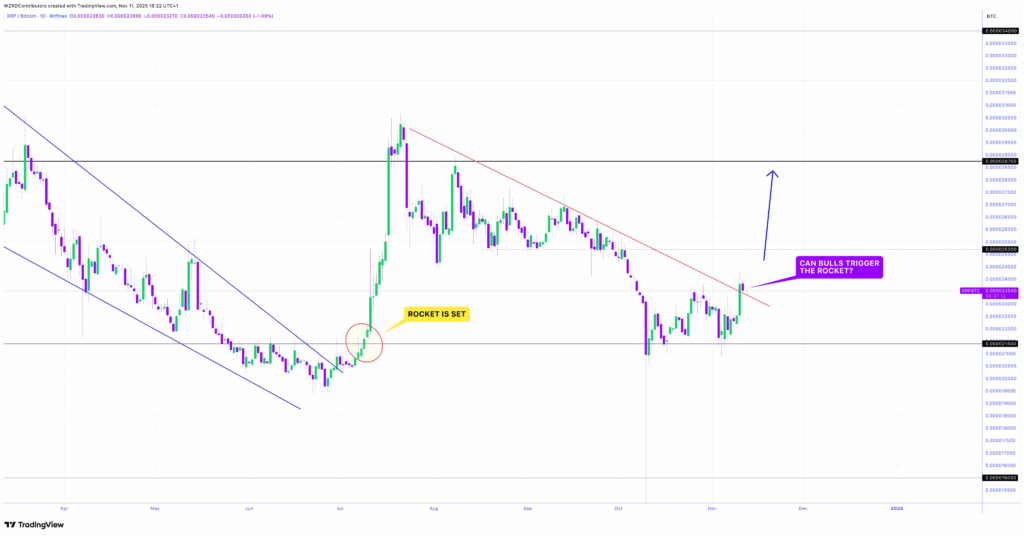

- XRP tests a key descending resistance on its BTC pair as traders await confirmation of a breakout pattern.

- Chart patterns suggest possible symmetry with a past rally that began after a similar wedge breakout earlier this year.

- The market now watches if bulls can sustain momentum above resistance to trigger the next upside phase.

XRP traders are watching a crucial technical setup that could determine the token’s next major move against Bitcoin (BTC). Data from TradingView shared by CryptoWZRD on November 11 shows tokens attempting to break out of a long-term descending trendline. The analyst labeled the formation “ROCKET IS SET,” suggesting that momentum could soon shift toward a bullish reversal if resistance is cleared.

Source: XRP Chart (X twitter)

Source: XRP Chart (X twitter)

The XRP/BTC pair has spent several months consolidating within a descending structure. The chart highlights a red resistance line marking the upper boundary of the downtrend, which ripple is now testing. A successful breakout could confirm a trend reversal, with a sharp upside move projected by the analyst’s upward arrow indicator.

CryptoWZRD noted that bulls are trying to trigger the rocket, raising questions about whether momentum can sustain beyond this phase. As of the latest update, the coin is positioned just below the key resistance that previously rejected multiple rally attempts across September and October.

XRP Chart Patterns Hint at Potential Trend Shift

The technical chart outlines the token repeated attempts to overcome the descending resistance line. This structure has defined the token’s bearish cycle since July, following its last major spike. The earlier breakout from a falling wedge in mid-year triggered a strong surge that later lost steam, forming the current multi-month downtrend.

Analysts point to the historical pattern visible on the chart, where a previous breakout from a similar setup led to a parabolic rally. The note “ROCKET IS SET” marks that point of ignition, highlighting the potential symmetry that could reappear if the coin repeats that performance. Technical traders often monitor such repeating structures as signals of renewed buying pressure.

This setup also coincides with Bitcoin’s recent market stability, which has limited volatility across altcoins. As XRP continues to test this long-term resistance, traders are awaiting confirmation through daily closes above the trendline. If achieved, it could open the path for significant gains, similar to earlier rallies that followed breakout patterns.

XRP’S Market Anticipation Builds Around Key Level

Community sentiment around the XRP/BTC chart has intensified as traders debate whether this move is a fakeout or a legitimate breakout . The tweet accompanying the chart asked whether bulls can “trigger the rocket,” capturing growing anticipation for the next decisive move. Historically, such inside bar breakouts have preceded strong directional trends across crypto markets.

Technical observers emphasize the importance of volume confirmation and momentum indicators to validate this potential breakout. Without sustained buying, the pattern could quickly fail, resulting in another rejection below resistance. The market is therefore watching for confirmation candles above the red descending line, which has acted as a ceiling for nearly three months.

For now, the chart indicates that XRP may be nearing an inflection point. Whether it can convert this technical pressure into an explosive breakout remains the key question for investors monitoring this pair.