Bitcoin “Arguably Undervalued,” Says Analytics Firm: Here’s Why

On-chain analytics firm Santiment has explained how Bitcoin could currently be undervalued based on its 4-year correlation to Gold and S&P 500.

Bitcoin Has Underperformed Against Gold & S&P 500 Recently

In a new post on X, Santiment has discussed about BTC’s recent trend relative to Gold and S&P 500. Historically, the cryptocurrency has shown some degree of correlation to these assets, but the pattern has shifted lately.

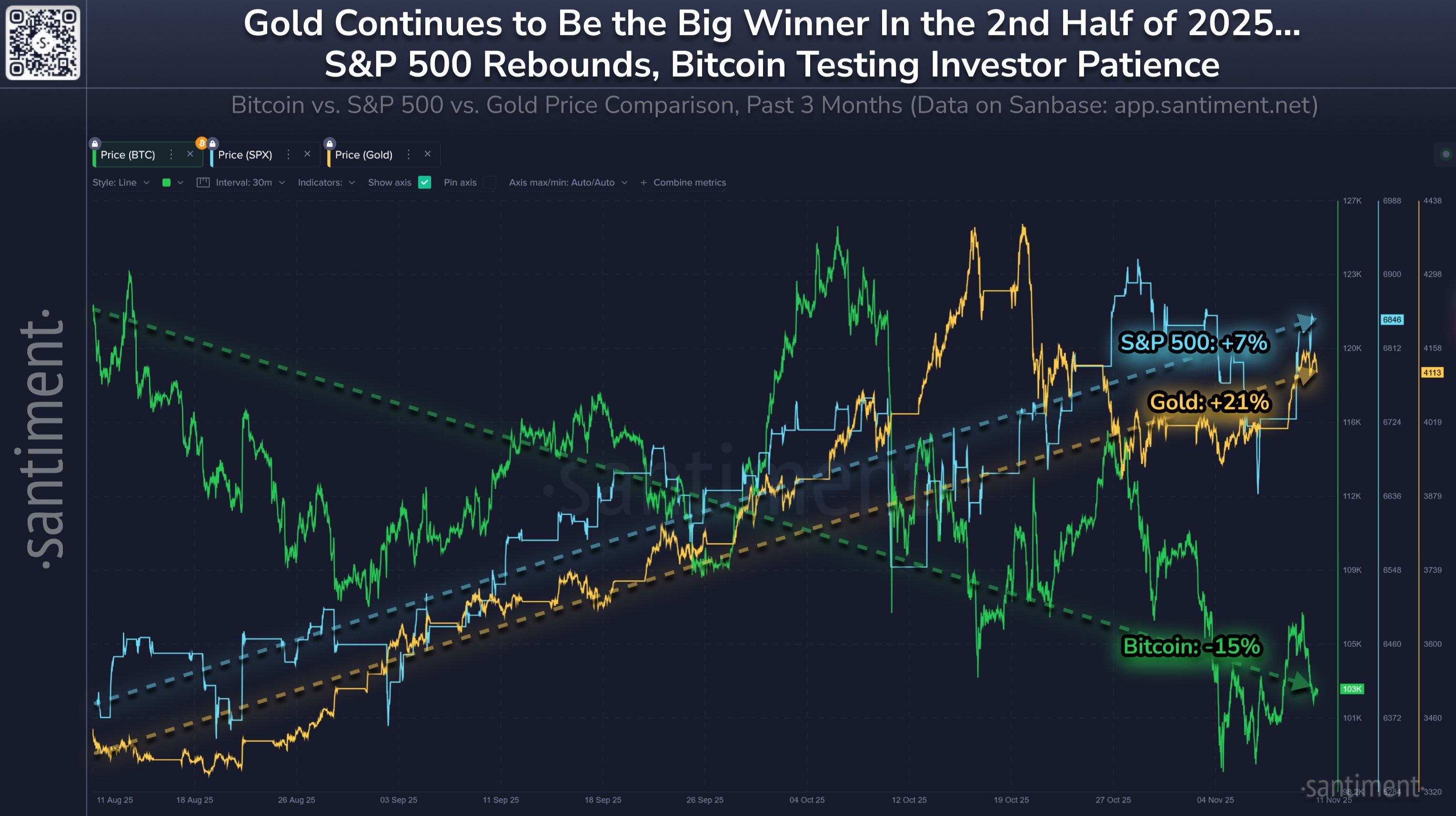

Any two given assets are said to be “correlated” when one of them reacts to movements in the other by showing volatility of its own. As the chart shared by Santiment shows, Bitcoin has diverged from the traditional assets during the last few months.

From the graph, it’s visible that Bitcoin has overall gone down 15% since August 11th. In the same window, the S&P 500 and Gold are up 7% and 21%, respectively. Gold has been the clear winner, but the S&P 500 has also at least managed a profit.

The same is clearly not true for the number one cryptocurrency, which has gone the opposite way. The different trajectories of the assets would imply that they are no longer correlated or only have a negative correlation.

Based on the fact that Bitcoin has shown tight correlation to the two over the last four years, however, the analytics firm has said, “BTC is arguably being undervalued.” It now remains to be seen whether the cryptocurrency’s price will eventually close the gap to the others.

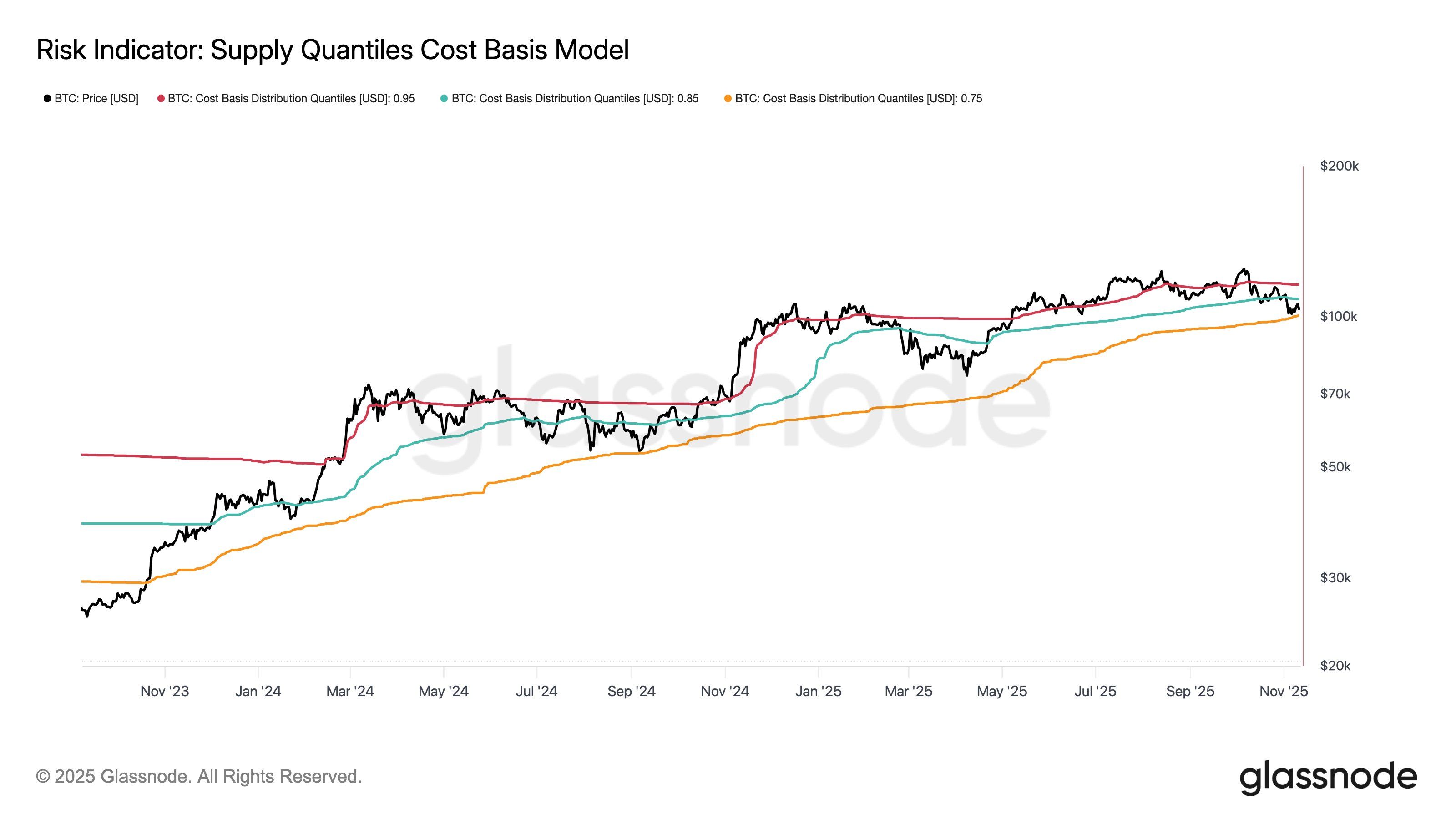

In some other news, BTC is trading between two key on-chain price levels right now, as on-chain analytics firm Glassnode has pointed out in an X post.

The levels in question are part of the Supply Quantiles Cost Basis Model, which maps out various Bitcoin price levels according to the percentage of the supply that will be in profit if BTC were to trade at them.

Bitcoin broke above the 0.95 quantile during its rally to the new all-time high (ATH), meaning more than 95% of the supply entered into a state of unrealized gain. With the drawdown that the coin has faced since then, its price has slipped not just under this level, but also the 0.85 quantile, corresponding to supply profitability of 85%.

This level, currently situated at $108,500, could act as a barrier preventing upward breaks. In the down direction, the 0.75 quantile is present as a cushion around $100,600. “These levels have historically acted as support and resistance, with a break of either likely to define the next directional trend,” explained Glassnode.

BTC Price

At the time of writing, Bitcoin is floating around $105,000, up 2.5% over the last seven days.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI-Generated Algorithms and Human Interaction: The Internet's Trustworthiness Dilemma

- The "Dead Internet Theory" resurfaces as AI-generated content dominates online platforms, blurring human engagement metrics. - Pixalate's Q3 2025 data reveals 37% non-human traffic in Brazilian mobile app ads, highlighting ad viewability crises. - C3.ai's 19% revenue drop and $117M loss underscore AI sector risks from high costs and competitive pressures. - Advertisers face unreliable metrics as algorithmic noise grows, prompting calls for stricter regulations and advanced analytics.

Ethereum Latest Updates: Major Institutions Support Ethereum's Supercycle, While Technical Experts Raise Concerns

- Tom Lee predicts Ethereum's "supercycle" driven by institutional adoption and DeFi growth, sparking market debate over valuation risks. - SharpLink Gaming's 1,100% revenue surge and $200M ETH allocation to Linea highlight bullish institutional strategies amid price volatility. - Technical analysts warn ETH's $3,500 support is critical after breaking below key channels, with $37B daily volume reflecting mixed momentum. - Growing institutional demand contrasts with critics' concerns over centralization ris

The Rapid Rise of ZEC (Zcash) Value: An In-Depth Technical and Strategic Analysis

- Zcash (ZEC) surged 66.55% in November 2025, peaking at $683.14, driven by treasury initiatives, privacy innovations, and institutional investments. - Cypherpunk Technologies' $50M treasury and Zashi Wallet's privacy swaps boosted demand, while Winklevoss Capital and Grayscale added $72.88M in institutional backing. - Technical indicators show overbought conditions (RSI 94.24) but bullish momentum persists, with derivatives markets holding $1.13B in open interest and a 1.06 long-to-short ratio. - Zcash's

ICP Caffeine AI's Rising Popularity: Ushering in a New Age for Blockchain Investors and AI-Powered DeFi

- Dfinity's ICP Caffeine AI bridges blockchain and AI in 2025, enabling non-technical users to build dApps via natural language prompts. - The platform saw 30% ICP token price growth and $237B TVL in Q3 2025, but faced 22.4% dApp usage decline amid market saturation. - Investors prioritize infrastructure projects like ICP Caffeine AI for AI-driven DeFi scalability and security, contrasting with speculative token trends. - Regulatory scrutiny and user retention challenges persist, but enterprise adoption of