61% of institutions plan to boost crypto exposure despite October crash: Sygnum

Institutional investors are maintaining confidence in digital assets despite a sharp market correction in October, with most planning to expand their exposure in the months ahead, according to new research.

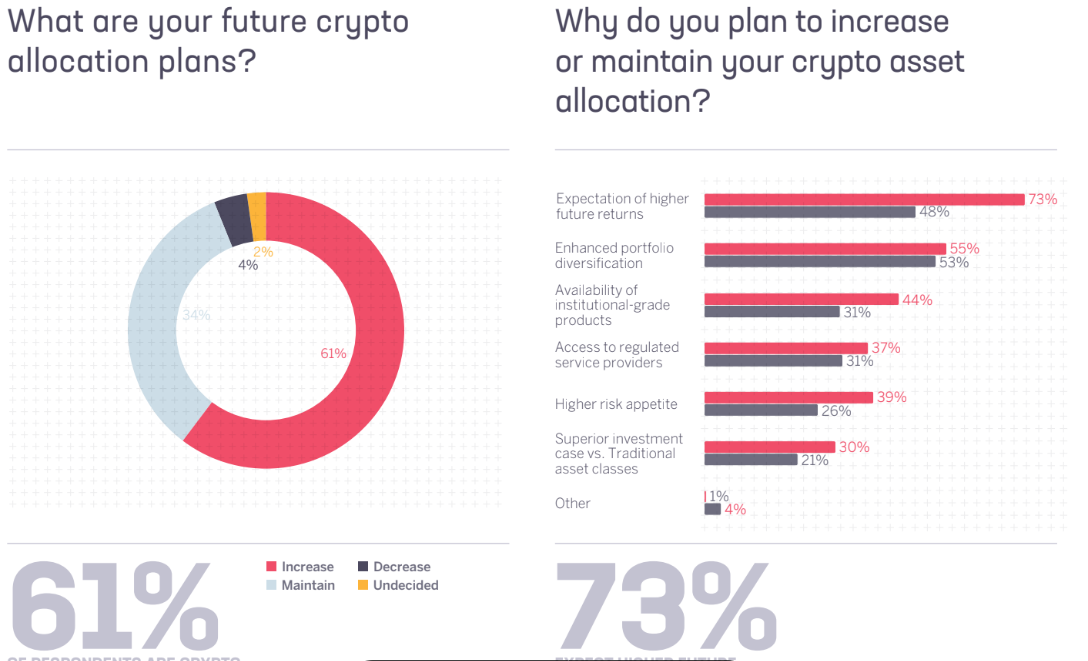

Over 61% of institutions plan to increase their cryptocurrency investments, while 55% hold a bullish short-term outlook, Swiss crypto banking group Sygnum said in a report released on Tuesday. The survey covered 1,000 institutional investors globally.

Roughly 73% of surveyed institutions are investing in crypto due to expectations of higher future returns, despite the industry still recovering from the record $20 billion market crash at the beginning of October.

However, investor sentiment continues facing uncertainty due to delays in key market catalysts, including the Market Structure bill and the approval of more altcoin exchange-traded funds (ETFs).

Institutional crypto allocation plans. Source: Sygnum

Institutional crypto allocation plans. Source: Sygnum

While this uncertainty may carry over into 2026, Sygnum’s lead crypto asset ecosystem researcher, Lucas Schweiger, predicts a maturing digital asset market, where institutions seek diversified exposure with long-term growth expectations.

“The story of 2025 is one of measured risk, pending regulatory decisions and powerful demand catalysts against a backdrop of fiscal and geopolitical pressures,” he said, adding:

“But investors are now better informed. Discipline has tempered exuberance, but not conviction, in the market’s long-term growth trajectory.”

Despite October’s correction, “powerful demand catalysts” and institutional participation remained at an all-time high, with the growing ETF applications signaling more institutional demand, added Schweiger.

At least 16 crypto ETF applications are currently awaiting approval, which were delayed by the ongoing US government shutdown , now in its 40th day.

Crypto staking ETFs may be the next institutional catalyst

Crypto staking ETFs may present the next fundamental catalyst for institutional cryptocurrency demand.

Over 80% of the surveyed institutions expressed interest in crypto ETFs beyond Bitcoin and Ether, while 70% stated that they would start investing or increase their investments if these ETFs offered staking rewards.

Staking means locking your tokens into a proof-of-stake (PoS) blockchain network for a predetermined period to secure the network and earn passive income in exchange.

Meanwhile, investors are now anticipating the end of the government shutdown, which could bring “bulk approvals” for altcoin ETFs from the US Securities and Exchange Commission, catalyzing the “next wave of institutional flows,” according to Sygnum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Rises 5.93% in 24 Hours as Privacy Coins Experience a Surge

- Zcash (ZEC) surged 5.93% to $524.73 on Nov 13, 2025, despite a 10.98% weekly decline, driven by long-term gains of 32.18% monthly and 850.45% yearly. - Cypherpunk Technologies (formerly Leap Therapeutics) rebranded to focus on ZEC, purchasing 203,775 ZEC ($50M) or 1.25% of circulating supply, with Winklevoss Capital leading a $58.88M funding round. - The firm restructured leadership, appointing Khing Oei and Will McEvoy, and rebranded its ticker to CYPH , emphasizing ZEC’s privacy-centric zk-SNARKs techn

XRP News Update: Regulatory Hurdles Challenge XRP’s ETF Surge—Is $10 Within Reach?

- XRP gains traction as Canary Capital's ETF generates $46M in debut trading, signaling institutional interest. - Crypto.com CEO predicts $8B in ETF inflows for XRP, highlighting its potential as a regulated crypto investment cornerstone. - mXRP liquid-staking product on BNB Chain adds yield-generating utility, boosting demand among DeFi users. - Technical indicators show XRP trading above key EMA but face volatility risks amid declining open interest. - Regulatory uncertainties persist as SEC's XRP classi

Bitcoin Latest Updates: Major Investors Increase Their Holdings, Keeping Bitcoin Steady Over $105K Despite $1.7B ETF Withdrawals

- Bitcoin stabilizes above $105,000 amid a falling wedge pattern on 4-hour charts, with analysts eyeing a potential $120,000 breakout if key resistance is breached. - Whale activity (holders of >10,000 BTC) doubled holdings by 36,000 BTC, countering $1.7B ETF outflows and anchoring prices above $100,000 despite mid-sized investor exits. - Macroeconomic factors—including U.S. government shutdown resolution and Fed pause expectations—bolster risk-on sentiment, while Bitcoin’s decoupling from NASDAQ and M2 mo

Hyperliquid News Today: ZKP Leads Crypto’s Transformation from Speculative Trading to Efficient, Privacy-Focused Computing

- ZKP, a self-funded decentralized compute network, claims $100M infrastructure to outpace Ethereum and Hyperliquid with immediate utility via hardware-based Proof Pods. - The project secured $17M in pre-orders for plug-and-play Pods generating on-chain rewards, contrasting with competitors' phased upgrades and speculative models. - Rising institutional interest in privacy coins like Zcash (ZEC) highlights shifting capital toward privacy-focused assets as ZKP bridges AI and blockchain with transparent earn