Bitcoin Faces Head and Shoulders: Delayed Fuse or Invalidated Pattern?

Bitcoin is testing critical levels as a head and shoulders pattern strengthens. Rising outflows and weakening momentum raise the risk of a deeper pullback unless BTC reclaims $100,000.

Bitcoin is facing renewed volatility as a head-and-shoulders pattern gains strength after last week’s brief fakeout.

The formation has developed over two months and now aligns with a sharp decline that pushed BTC below $100,000.

Bitcoin May Repeat History

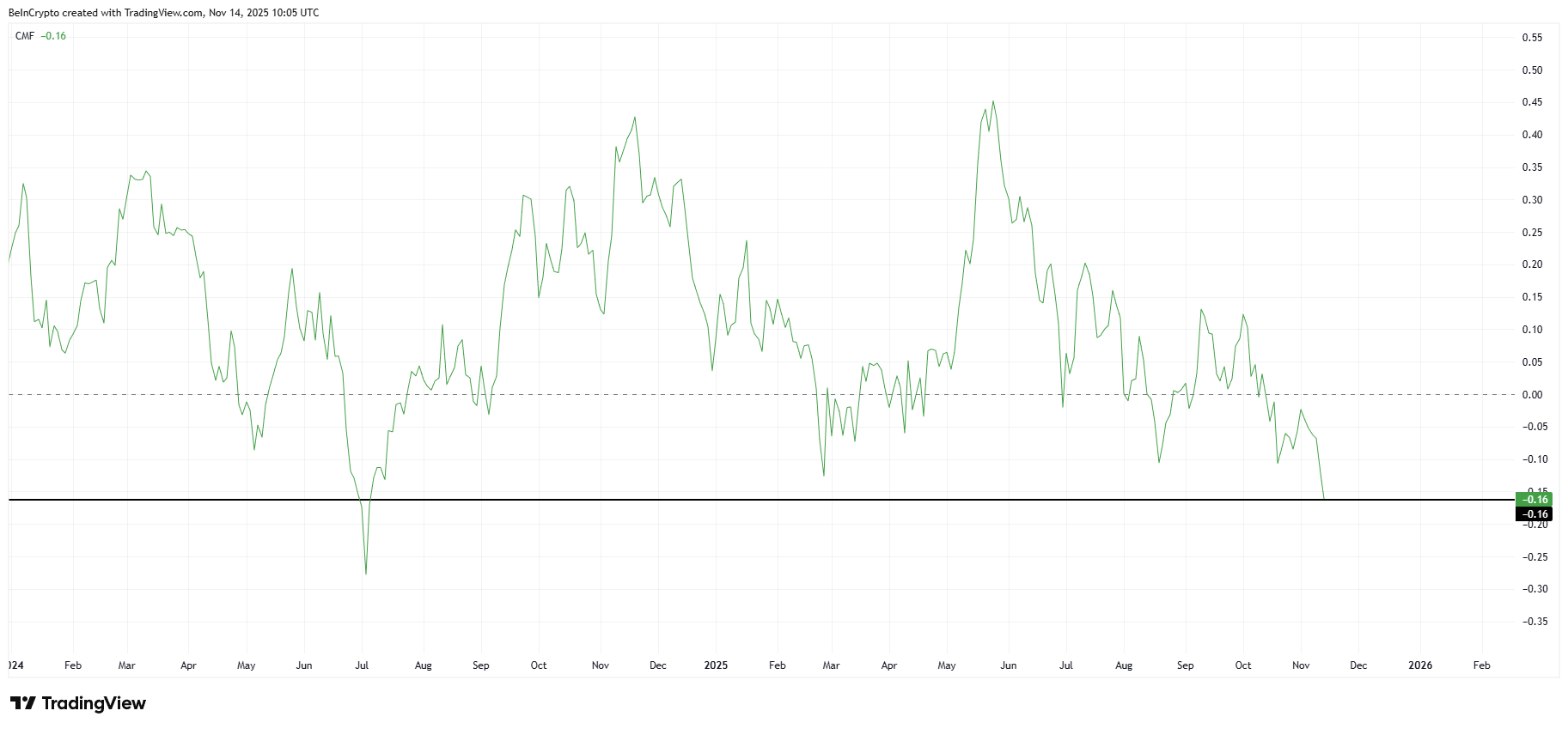

The Chaikin Money Flow shows a significant rise in outflows from Bitcoin. The indicator has dropped to a 16-month low, a level last seen in July 2024. This decline highlights growing caution among investors who are reducing exposure as they question Bitcoin’s ability to mount a quick recovery.

Rising outflows signal waning confidence and may leave Bitcoin vulnerable to further price weakness. As skepticism builds, liquidity continues to soften, increasing the possibility of an extended downturn. If this trend continues, BTC may struggle to hold key support levels in the short term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin CMF. Source:

Bitcoin CMF. Source:

Bitcoin’s macro momentum is weakening as its exponential moving averages move closer to a potential Death Cross. Historically, similar setups have led to average declines of about 21% before the market stabilizes and begins to recover. This raises the probability of a sharper pullback if BTC fails to regain momentum.

A comparable decline today would bring Bitcoin toward $89,400. While past events do not guarantee outcomes, the current structure resembles previous periods when bearish momentum intensified.

Bitcoin EMAs. Source:

Bitcoin EMAs. Source:

BTC Price Can Note A Reversal

Bitcoin trades at $96,851, sitting just below the critical $100,000 psychological level. This support has been broken four times this month, reflecting indecision and growing pressure from sellers. Market sentiment remains fragile as BTC attempts to stabilize under increased volatility.

The emerging head and shoulders pattern points to a potential 13.6% decline that aligns with the projected target of $89,407. If Bitcoin fails to hold $95,000, the move toward this level becomes more probable. The overlap with the potential Death Cross adds weight to the bearish scenario.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

However, if investor demand strengthens, Bitcoin could reclaim $100,000 as support. A decisive bounce from that level may open the path toward $105,000. Such a move would invalidate the bearish thesis and restore confidence among traders seeking renewed upside momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Analysis: RSI Divergence Signals Trend Continuation Toward $120k

Animoca’s Yat Siu says crypto’s Trump moment is over

Crypto’s decentralization promise breaks at interoperability

Ripple Price Analysis: XRP Charts Flash Warning Signs Against USD and BTC