- Long-term Bitcoin holders are gradually selling, creating a slow, controlled decline rather than a panic-driven drop.

- Bitcoin has underperformed gold and the S&P 500 recently, frustrating investors expecting a seasonal rally.

- Despite weak price action, declining correlation with gold enhances Bitcoin’s appeal for portfolio diversification.

As Bitcoin struggles to defend the critical $100,000 support level, one question has dominated market analysis: Who, exactly, is selling?

Chris Kuiper, CFA and VP of Research at Fidelity Digital Assets, says the answer is clearer than many think, and the data backs it up.

Kuiper explained that despite visible buying from ETFs, corporations, and institutions, Bitcoin continues to face persistent selling pressure. In particular, the source of this pressure is long-term holders (LTHs), the group typically known as the market’s most patient cohort.

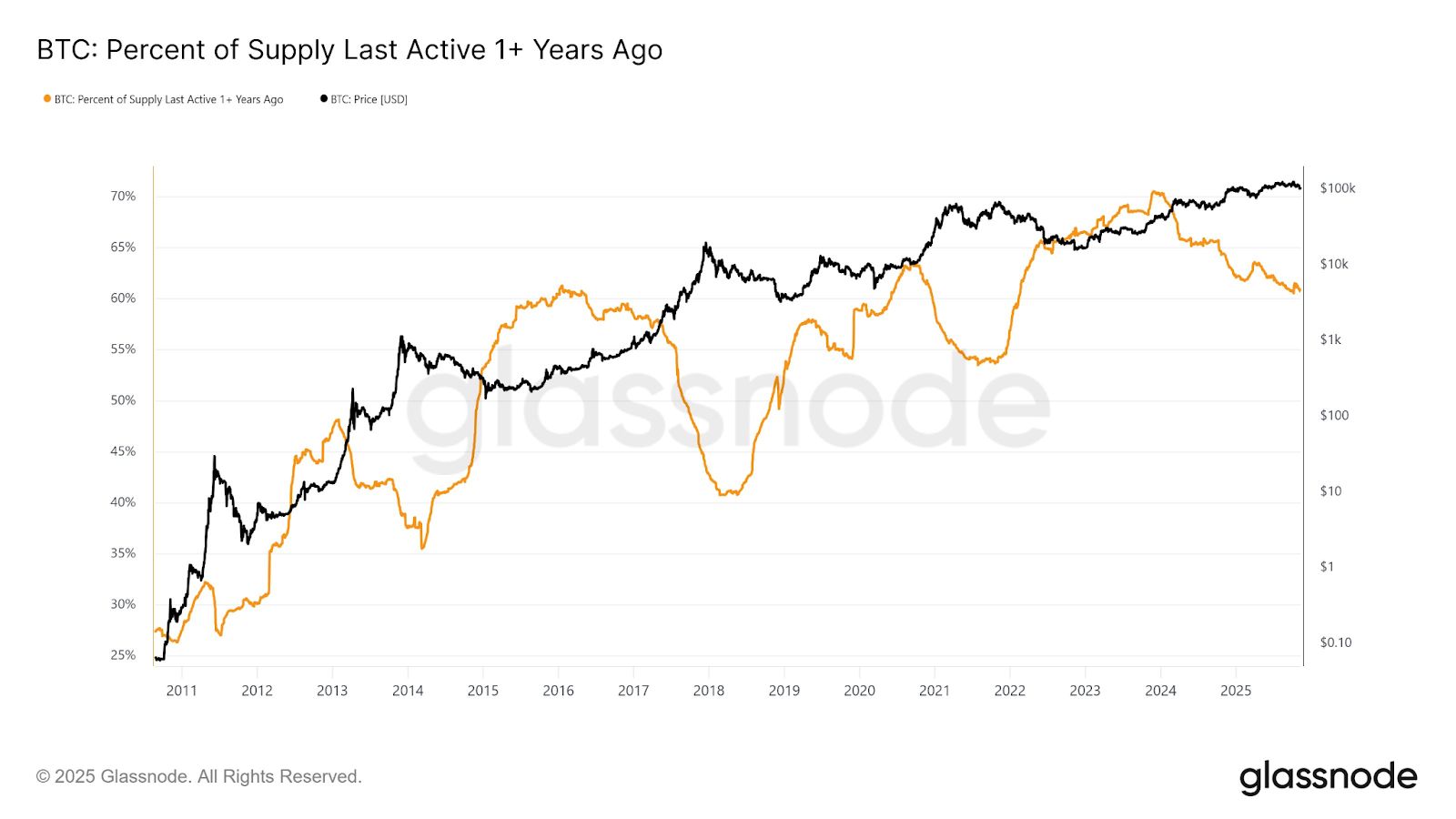

According to Kuiper, one of the most revealing metrics is the percentage of Bitcoin that has remained inactive for at least one year. Historically, this metric rises in bear markets, when investors hold through losses, and drops sharply in bull markets, when these older coins finally move as holders take profits.

But this cycle is different.

A Slow, Controlled Bitcoin Sell-Off — Not a Panic

Kuiper noted that instead of a dramatic plunge as Bitcoin hit new all-time highs, the decline in inactive supply has been gradual and consistent.

He described it as a “slow bleed,” a continuous stream of long-term holders trimming positions as the market drifts sideways. This contrasts sharply with past cycles, where profit-taking came in sudden waves during euphoria.

From a psychological standpoint, Kuiper said investors are simply tired. Bitcoin has underperformed gold and even the S&P 500 in recent months, frustrating many who expected a strong seasonal rally in October and November.

With the year coming to a close, some long-term holders appear to be locking in gains for tax reasons, portfolio adjustments, or simply because the explosive rally they waited for hasn’t arrived.

Related: Why Is Crypto Down Today? $79B in LTH Selling and $869M ETF Outflows Trigger $1B Liquidations

CryptoQuant Confirms the Trend

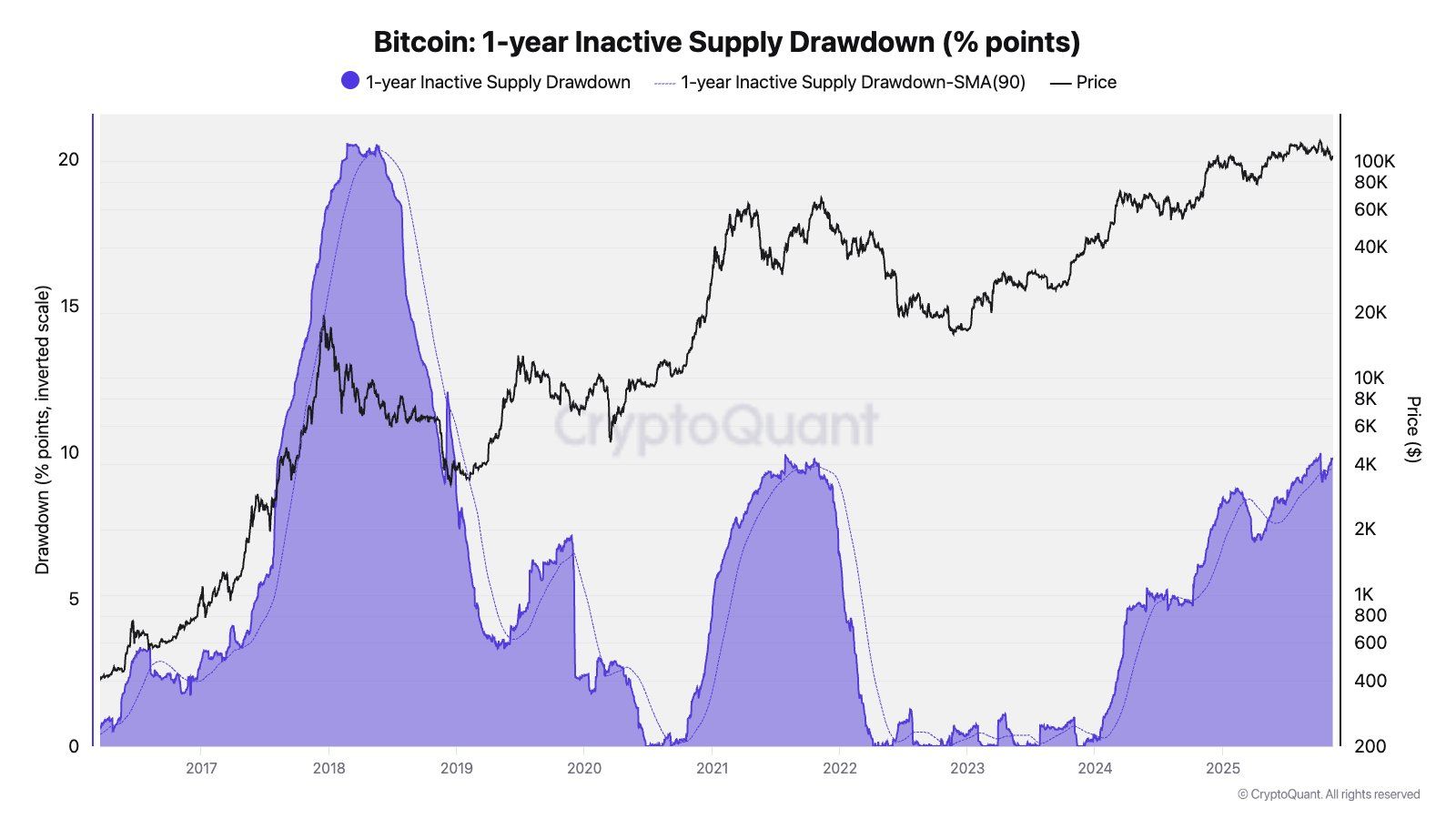

CryptoQuant analyst Julio Moreno expanded on Kuiper’s observations. By measuring the drawdown in 1-year inactive supply, he showed that this cycle’s sell-off is actually comparable to earlier ones:

- 2017–2018: 20 percentage-point decline

- 2021: 10 percentage-point decline

- 2024–2025: 10 percentage-point decline

Moreno’s chart (with an inverted scale) confirms the idea that the current cycle is following a familiar pattern, just at a slower, more distributed pace.

Bitcoin vs. Gold

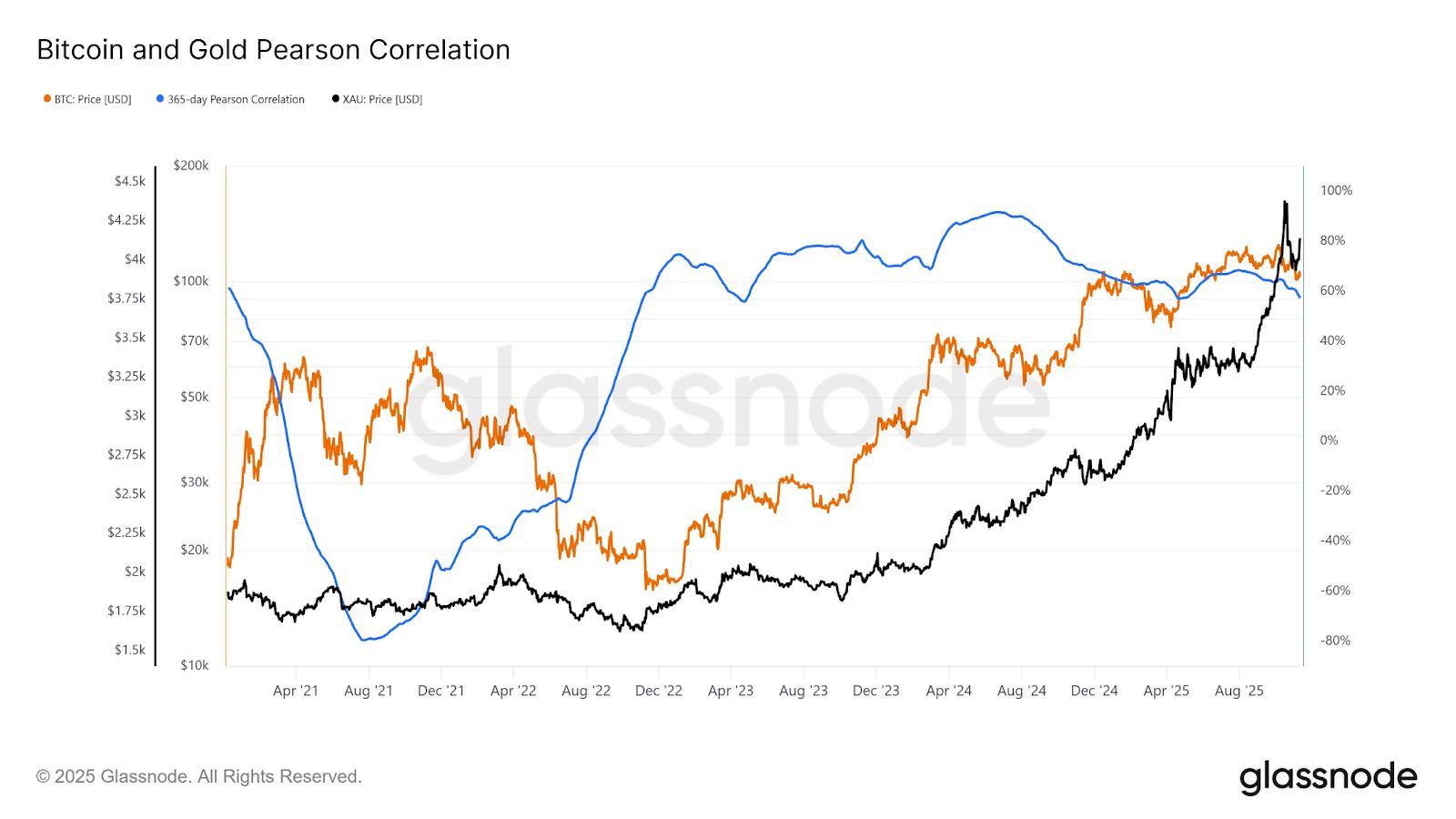

In another comment , Kuiper addressed the growing disappointment surrounding Bitcoin’s recent underperformance compared to gold.

However, he argued that there’s a silver lining in the fact that Bitcoin’s correlation with gold continues to decline. This could be exactly what institutional investors are looking for.

For an asset to improve a portfolio’s risk-adjusted returns, it must behave differently from what’s already inside it. If Bitcoin simply moved like gold with leverage, institutions would have little incentive to allocate. They could replicate the exposure by taking leveraged positions elsewhere.

Essentially, a declining correlation means Bitcoin can offer true diversification, boosting its long-term appeal.

Related: Gold’s Breakout Is the ‘Forerunner’ to DXY Collapse, Bitcoin Rally – Analyst

Yet, the divergence between Bitcoin’s strong fundamentals and its lackluster price action remains one of the defining features of this cycle.