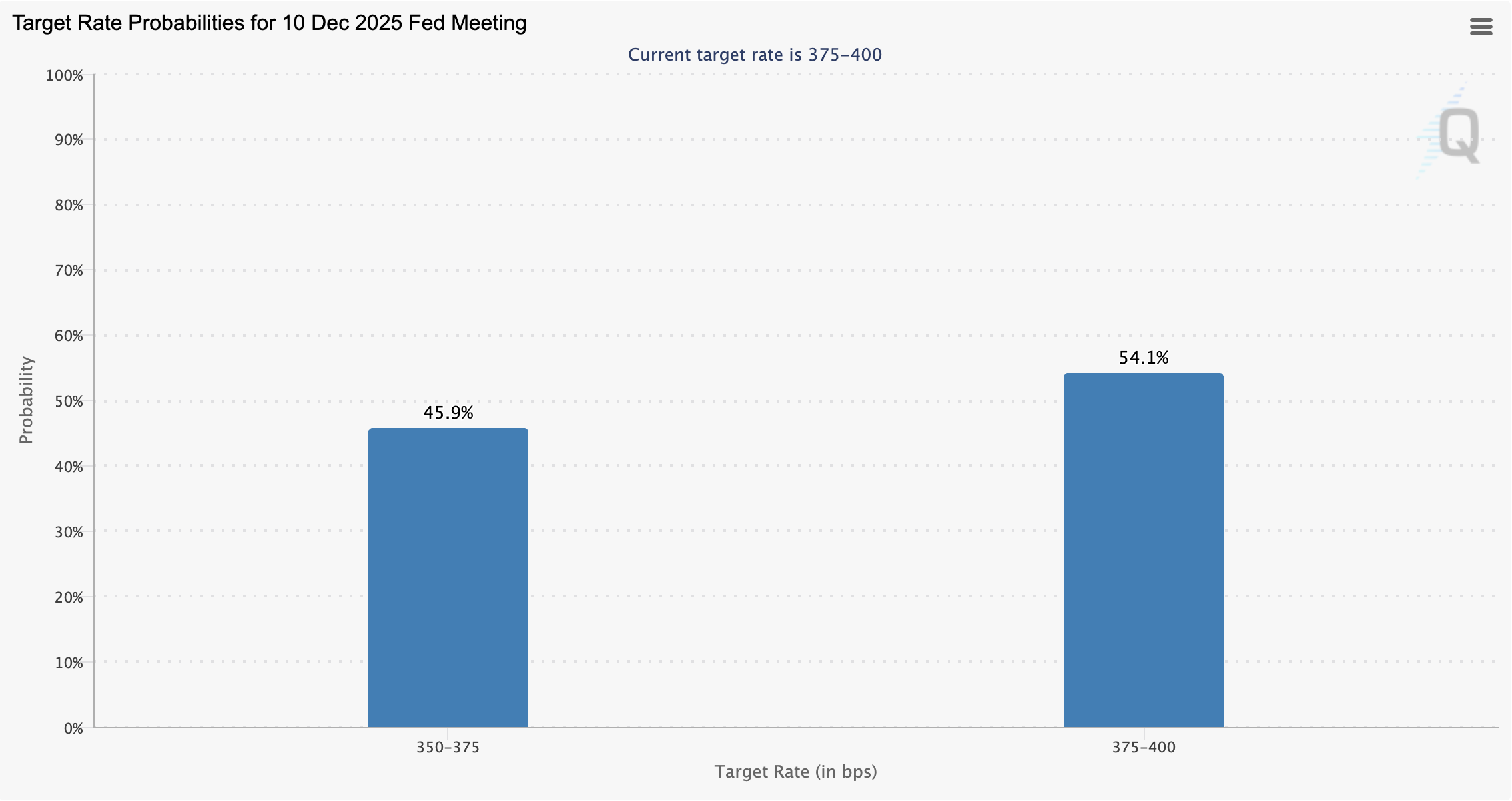

Probability of December interest rate cut falls below 50%

Only 45.9% of investors anticipate an interest rate cut at the next US Federal Open Market Committee (FOMC) meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market.

The odds of a 25 basis point (BPS) interest rate cut in December were nearly 67% on Nov. 7, according to data from the Chicago Mercantile Exchange (CME) Group.

In September, several banking institutions forecast at least two interest rate cuts in 2025, with market analysts at investment banking company Goldman Sachs and banking giant Citigroup each projecting three 25 BPS cuts in 2025.

Interest rate decisions influence crypto prices. Lower interest rates translate into more liquidity flowing into asset markets and propping up prices, while higher rates mean liquidity and prices will be constrained.

The declining odds of a December rate cut are feeding negative market sentiment and may signal that more short-term price pain is coming to the crypto market until the Federal Reserve resumes easing rates.

Related: Stablecoin demand is growing, and it can push down interest rates: Fed’s Miran

Federal Reserve’s Jerome Powell casts doubt on a December rate cut

“There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it. Policy is not on a preset course,” Federal Reserve Chair Jerome Powell said in October.

As expected, the Federal Reserve slashed rates by 25 BPS in October; however, crypto prices extended their decline following the lowered rates.

The October rate cut was “fully priced in” by investors, who widely anticipated the cut months ahead of time, according to Matt Mena, a market analyst at investment company 21Shares.

Economist and former hedge fund manager Ray Dalio warned that the Federal Reserve is cutting rates into record-high asset prices, relatively low unemployment and low credit spreads, a historic anomaly.

In November, Dalio said the Federal Reserve is likely stimulating the economy into a bubble, adding that this is a feature typical of debt-laden economies headed toward hyperinflation and currency collapse.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: The Reason Behind Small-Cap Companies Making Major Investments in Crypto Treasuries for 2025

- Small-cap crypto firms are shifting to institutional-grade digital asset strategies in 2025, with companies like Predictive Oncology and Bit Digital accumulating billions in tokens. - Predictive Oncology's $152.8M ATH treasury and Bit Digital's $590.5M ETH holdings demonstrate blockchain-based revenue diversification and staking profitability. - Greenlane's $110.7M BERA token acquisition highlights crypto-driven reinvention challenges, while AI-blockchain integration accelerates efficiency gains in the s

SOON's Steep Decline Highlights Vulnerability of High-Beta Stocks During Market Volatility

- SOON shares surged 167% before plunging, briefly hitting a $5B FDV. - Analysts highlighted its high volatility (beta 1.05) and overvaluation (P/E 24.09) amid market jitters. - A $2.13B crypto liquidation spike and macroeconomic uncertainty amplified SOON's sharp correction. - Technical indicators showed neutral sentiment, but bearish retail trading drove the sell-off. - The episode underscored fragility of high-beta stocks amid Fed policy shifts and AI sector pressures.

Bitcoin News Update: Crypto Fear Index Drops Sharply—Sign of Surrender or Spark for a Rebound?

- Crypto Fear & Greed Index hit 16, its lowest since February 2025, reflecting extreme bearish sentiment amid Bitcoin and altcoin sell-offs. - Technical indicators and on-chain data show Bitcoin below key moving averages, with 815,000 BTC sold by long-term holders in 30 days. - Analysts highlight $100,000 as critical support, warning further declines if broken, while some see panic-driven buying opportunities. - Technical patterns suggest potential rebounds to $120,000-$126,000 if support holds, contrastin

Bitcoin Updates: Crypto Confidence Wavers—Saylor Calms Fears as Bearish Trends Persist

- Michael Saylor denied rumors of MicroStrategy selling Bitcoin , calming panic after $5.7B in crypto transfers to new wallets triggered market volatility. - Arkham clarified the 43,415 BTC wallet movements as routine custody management, but shares fell 7.2% as investor anxiety over the firm's financial health persisted. - Bitcoin traded near its 50-week SMA at $97,000 amid $870M ETF outflows, with analysts warning of further underperformance against gold and tech stocks in 2025. - Corporate Bitcoin accumu