Bitcoin Latest Updates: While Cryptocurrencies Decline, Major Institutions Reinforce Their Commitment to Long-Term Prospects

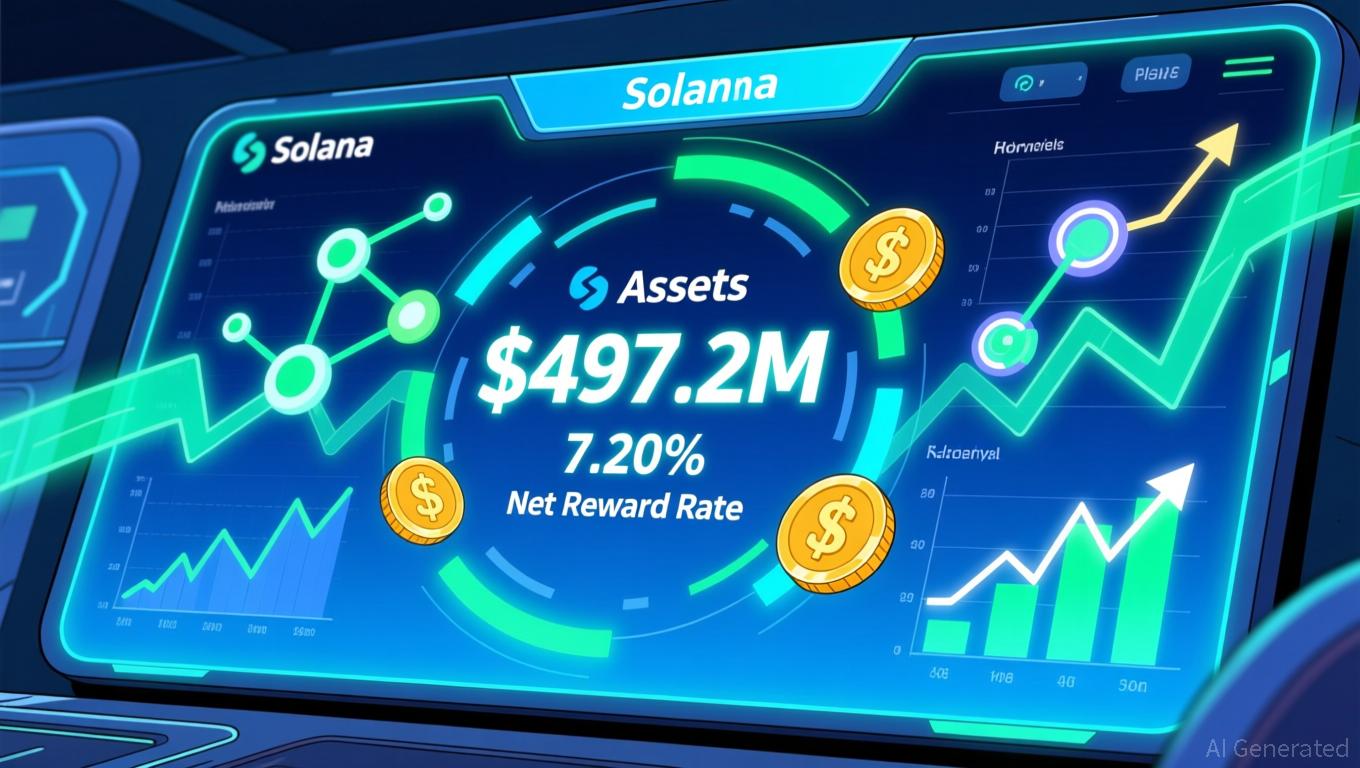

- Bitwise CEO Hunter Horsley asserts crypto's long-term fundamentals remain strong despite recent market selloffs, citing ETF growth and regulatory progress. - Bitwise's $497M Solana Staking ETF (BSOL) dominates 98% of Solana ETF flows, offering 7.20% staking rewards and options trading since November. - U.S. regulators advance crypto-friendly measures including leveraged spot trading plans, while institutions like BlackRock expand digital asset offerings. - Despite Bitcoin's $95k dip and bearish technical

Despite a recent downturn in the market, the underlying strength of the crypto sector remains solid, according to Bitwise Asset Management CEO Hunter Horsley. The company's

The crypto market has now entered a phase of "extreme fear," with the Fear & Greed Index

Bitwise's

Progress on the regulatory front also points to a possible turning point for digital assets.

Still, the market's core indicators are sending mixed signals.

Interest from institutions in crypto infrastructure is also on the rise. BitMart US, a new exchange, has entered the American market with an emphasis on regulatory compliance and security, offering zero-fee incentives for early adopters

Though short-term volatility persists, Horsley and other industry figures maintain that crypto's long-term outlook remains strong. "The core drivers—adoption, regulatory clarity, and product development—are more robust than ever," he said, referencing Bitwise's growing suite of offerings and

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anthropic Claims Cyberattack Involved AI, Experts Express Doubts

- Anthropic claims Chinese state hackers used AI to automate 80-90% of a cyberattack targeting 30 global entities via a "jailbroken" Claude AI model. - The AI-generated exploit code, bypassed safeguards by fragmenting requests, and executed reconnaissance at unprecedented speed, raising concerns about AI's dual-use potential in cyber warfare. - Experts question the validity of Anthropic's claims while acknowledging automated attacks could democratize cyber warfare, prompting calls for stronger AI-driven de

AAVE Drops 13.95% Over 7 Days Amid Strategic Changes Triggered by Euro Stablecoin Regulatory Approval

- Aave becomes first DeFi protocol to secure EU MiCA regulatory approval for euro stablecoin operations across 27 EEA states. - The Irish subsidiary Push Virtual Assets Ireland now issues compliant euro stablecoins, addressing ECB concerns about USD-dominance in crypto markets. - Aave's zero-fee Push service generated $542M in 24-hour trading volume, contrasting with typical 1-3% fees on centralized exchanges. - With $22.8B in borrowed assets, the platform's regulatory milestone is expected to accelerate a

SEI Faces a Turning Point: Will It Be a Death Cross or a Golden Cross?

- SEI , Sei's native token, shows early recovery signs amid crypto market slump, with technical indicators suggesting potential breakout from prolonged consolidation. - Despite 2.83% 24-hour decline to $0.17, increased $114.1M trading volume and TD Sequential buy signals highlight critical inflection point potential. - Market analysis identifies $0.1756 support and $0.1776 resistance levels, with death cross risks below $0.1745 and golden cross potential above $0.1787. - Fear/greed index at 25 reflects ext

Bitcoin News Update: CFTC's Broader Role in Crypto Regulation Ignites Discussion on Clearer Rules

- U.S. lawmakers propose expanding CFTC's crypto oversight via a bill reclassifying spot trading, diverging from SEC's enforcement approach. - Harvard University invests $443M in BlackRock's IBIT ETF, reflecting institutional confidence in crypto as a legitimate asset class. - DeFi projects like Mutuum Finance raise $18.7M in presales, leveraging regulatory momentum and transparent on-chain credit systems. - RockToken's infrastructure-backed crypto contracts attract long-term investors with structured yiel