- Bitcoin Cash: Larger blocks, smart-contract upgrades, and index recognition boost trader interest.

- Avalanche: Modular subnets, fast finality, and developer incentives strengthen long-term growth potential.

- Polygon: Ethereum scaling, major brand adoption, and expanding ecosystem drive sustained relevance.

Investors are searching for altcoins that combine strong fundamentals with near-term potential. Analysts point to three promising projects that stand out right now. Each offers unique strengths, from payments to smart contracts and scaling solutions. These tokens are not without risk, but they show promise for growth. With fresh upgrades, rising adoption, and institutional recognition, they deserve attention. Let’s explore why Bitcoin Cash, Avalanche, and Polygon are worth watching and buying immediately.

Bitcoin Cash (BCH)

Source: Trading View

Source: Trading View

Bitcoin Cash was created in 2017 as a fork of Bitcoin. The goal was simple: faster payments with lower fees. Larger blocks allow BCH to process transactions quickly while keeping Proof-of-Work security intact. In May 2025, BCH activated “VM Limits” and “BigInt.” These upgrades expanded smart-contract capabilities without losing focus on payments. That balance makes BCH attractive for both developers and everyday users. October brought another milestone. BCH secured a top 10 slot in the CoinDesk 20 index reconstitution. This recognition boosts visibility among institutional-style baskets. Traders have noticed, with derivatives data showing rising open interest. That signals growing attention beyond spot markets.

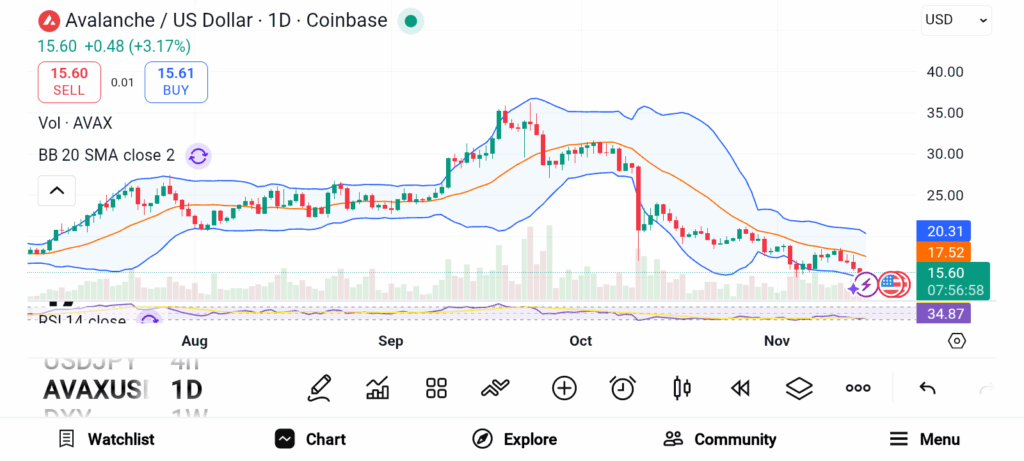

Avalanche (AVAX)

Source: Trading View

Source: Trading View

Avalanche is a modular smart-contract platform built around customizable “subnets.” These subnets allow tailored blockchains for specific use cases. The platform offers fast finality, scalability, and flexibility. DeFi, gaming, and asset management projects already benefit from Avalanche’s infrastructure. EVM compatibility makes development easier, attracting builders from Ethereum. On October 14, 2025, the Avalanche Foundation announced a Retro9000 snapshot. This rewarded builders on Avalanche L1s and incentivized developer activity. Such moves show commitment to safety and growth. Analysts see AVAX as more than hype. The protocol continues to evolve with real upgrades. Buying AVAX now could position investors for significant benefits later.

Polygon (POL)

Source: Trading View

Source: Trading View

Polygon has grown beyond a simple Ethereum layer-2 solution. It has become a full ecosystem that helps Ethereum scale efficiently. Developers and users enjoy faster and cheaper transactions. Ease of building sets Polygon apart. Projects ranging from DeFi platforms to NFT marketplaces thrive on the network. Adoption has spread to major players like Reddit, Nike, and Instagram. That level of integration highlights real-world relevance. Polygon’s community continues to expand, supporting long-term growth. While many altcoins struggle to stay relevant, Polygon evolves steadily. Analysts view POL as a serious contender for long-term success.

Bitcoin Cash offers fast payments, smart-contract upgrades, and growing institutional recognition. Avalanche delivers scalability, subnets, and strong developer incentives. Polygon provides efficient Ethereum scaling with major brand adoption. Together, these three altcoins present diverse opportunities for investors seeking growth. Watching and buying them immediately could set the stage for a stronger crypto portfolio.